Whether you are a beginner who is still experimenting with many technical indicators on his charts or an experienced technical trader who wants to increase his success rate in the markets, this trading guide will help you come closer to the ultimate goal – becoming a consistently profitable trader.

In the following lines, we will cover the main characteristics of trading with oscillators and trend following indicators and show you some handy tips on how to trade them.

Should You Trade with Technical Indicators?

Technical indicators are based on simple (and sometimes complex) mathematical models and algorithms that take historic prices as their main input. As a result, they try to describe how historic prices have moved and offer traders a simple way to anticipate future price movements. In this regard, technical indicators are based on some of the basic premises of technical analysis, namely that history tends to repeat itself and that markets like to trend.

You’ve likely already encountered some types of technical indicators, such as moving averages, Bollinger bands, and the RSI index. All these indicators use previous prices to anticipate future movements in the market.

However, using historic prices for market predictions often means that technical indicators are inherently lagging in their nature. For example, the price will already be in an uptrend before a moving average starts to change its slope, and an RSI can remain overbought and oversold for a long period of time before the market changes its direction.

To overcome some of those obstacles, traders tend to combine several types of technical indicators and incorporate some sort of fundamental analysis in their trading. However, beginner traders tend to go overboard with the number of indicators on their charts. They add all types of indicators, often several indicators of the same type, and completely block their view on the price chart. As the saying goes, they don’t see the woods from the trees.

This approach is very counterproductive when it comes to trading with technical indicators. Different types of indicators will provide completely opposite trading signals, depending on whether the price goes up or down.

For example, a trend-following indicator like a moving average or the ADX indicator will give a buying signal when prices start to rise, but oscillators like the RSI and Stochastics will become overbought and send a selling signal. That’s why it’s so important to know the different types of indicators and understand how they behave in both trending and sideways moving markets.

Types of Technical Indicators

There are three main types of technical indicators: trend-following indicators, oscillators, and volume indicators. Other ways to group technical indicators include leading and lagging indicators, although even the so-called “leading” indicators are somewhat lagging in their nature.

Trend-following indicators are designed to follow the underlying trend of the markets and provide buying signals when the price moves up and selling signals when the price moves down. This type includes some of the most popular indicators, such as moving averages and ADX.

Oscillators are indicators that oscillate between the top and bottom values, typically between 100 and 0. They measure oscillations in buying and selling pressure and provide buying signals when their value becomes oversold (below 30 for the RSI) and selling signals when their value becomes overbought (above 70 for the RSI). Besides the RSI, popular oscillators include the Stochastics indicator and the MACD indicator.

Finally, volume indicators are used to determine the underlying trading volume of a specific financial instrument. They usually provide buying signals when the price rises along with higher (buying) volume, and selling signals when the price falls along with higher (selling) volume. Volume indicators are very popular among stock traders, but less so among Forex traders, given the decentralized nature of the currency markets. Still, some research has shown that tick volume (the number of ticks a currency pair moves within a time period) is pretty much an accurate representation of the actual trading volume.

In this article, we will focus on the most popular types of indicators: trend-following indicators and oscillators. We will also take a look at a specific indicator called the CR indicator, also known as the energy index, and its siblings the AR and BR indicators.

Most Popular Oscillators

Some of the most popular oscillating indicators include the RSI and Stochastics. The CR indicator (energy index), the AR indicator (popularity index), and the BR indicator (willingness index) are also oscillating indicators but are better suited for medium-term and long-term traders.

Markets tend to move in buy and sell cycles that can be measured and identified with oscillating indicators. Buy and sell cycles often reach a peak which is followed by profit-taking and mean-reversion, which is the point when oscillators also tend to reach their top or bottom.

The Relative Strength Index (RSI) is a popular indicator to measure those cycles. The RSI measures the magnitude of recent price changes to determine whether the current market is overbought or oversold. An overbought market is identified when the RSI reaches a value of 70 or above, and an oversold market is identified when the RSI reaches a value of 30 or below.

Similarly, when using the Stochastics indicator, which is another popular oscillator, overbought markets refer to values of 80 or above, and oversold markets refer to values of 20 or below.

However, bear in mind that strongly-trending markets tend to stay in overbought or oversold conditions for a long period of time before correcting to the downside or upside. This is why traders tend to combine oscillators with trend-following indicators to give them a more accurate picture of the underlying market dynamics. Usually, oscillators provide the best results when markets are ranging, and trend-following indicators should be used when markets start to trend.

Besides the RSI and Stochastics, some traders may also have heard of the CR index, also known as the energy index or price momentum index. The CR Index is a medium to long-term indicator that is used to measure the strength of buyers and sellers, most commonly in the stock market. Unlike the BR and AR indices, the CR index is based on the premise that the middle price is the most important price of a market.

The CR index consists of 5 lives: one CR line and four CR average lines. A buying signal is formed when the CR line crosses above all four average CR lines, and a selling signal is formed when the CR line crosses below all four average CR lines.

The AR index and BR index, also known as the popularity index and willingness index, are technical indicators that are often used in tandem with the CR index. A value of the BR index of around 100 indicates that the market is balanced, while values that range from 40 to 400 indicate an imbalance between buyers and sellers. The BR index is almost always used in conjunction with the AR index.

Typically, traders tend to buy when the BR index is below the AR index and when BR is below 100. On the opposite, traders tend to sell when the BR index is below the AR index and when the BR is above 100.

Most Popular Trend Following Indicators

Another popular type of technical indicators is the group of trend-following indicators. Unlike oscillators, trend-following indicators give a buying signal when prices rise, and a selling signal when prices fall.

This is exactly the opposite of what oscillators do, and beginner traders are often wondering why their indicators give opposing signals all the time. The answer is simple: They add a bunch of indicators to their screens without understanding what type of indicators they are and try to predict future price movements only with the help of historic prices. That’s why one indicator from every group is completely sufficient to analyze the market from a trend-following and oscillating standpoint.

Here are the most popular trend-following indicators used by traders: moving averages, Bollinger bands, the Average Directional Movement Index (ADX), and the Parabolic SAR.

Moving averages are arguably the most common technical indicator on any chart. They are based on the closing prices of a specific number of previous candles and simply plot that price on the chart. Common lookback periods include the 21-day MA, the 100-day MA, and the 200-day MA. However, traders can also use them on short-term timeframes, such as the 5-minute ones when day trading.

Among all the different types of MA, two types are especially popular: simple moving averages (SMAs) and exponential moving averages (EMAs). Simple moving averages take the last n-period closing prices and calculate the arithmetic average of those prices.

On the other hand, exponential moving averages use a geometric approach in their calculations, which makes them more sensitive to the most recent price changes and the obvious choice for many traders.

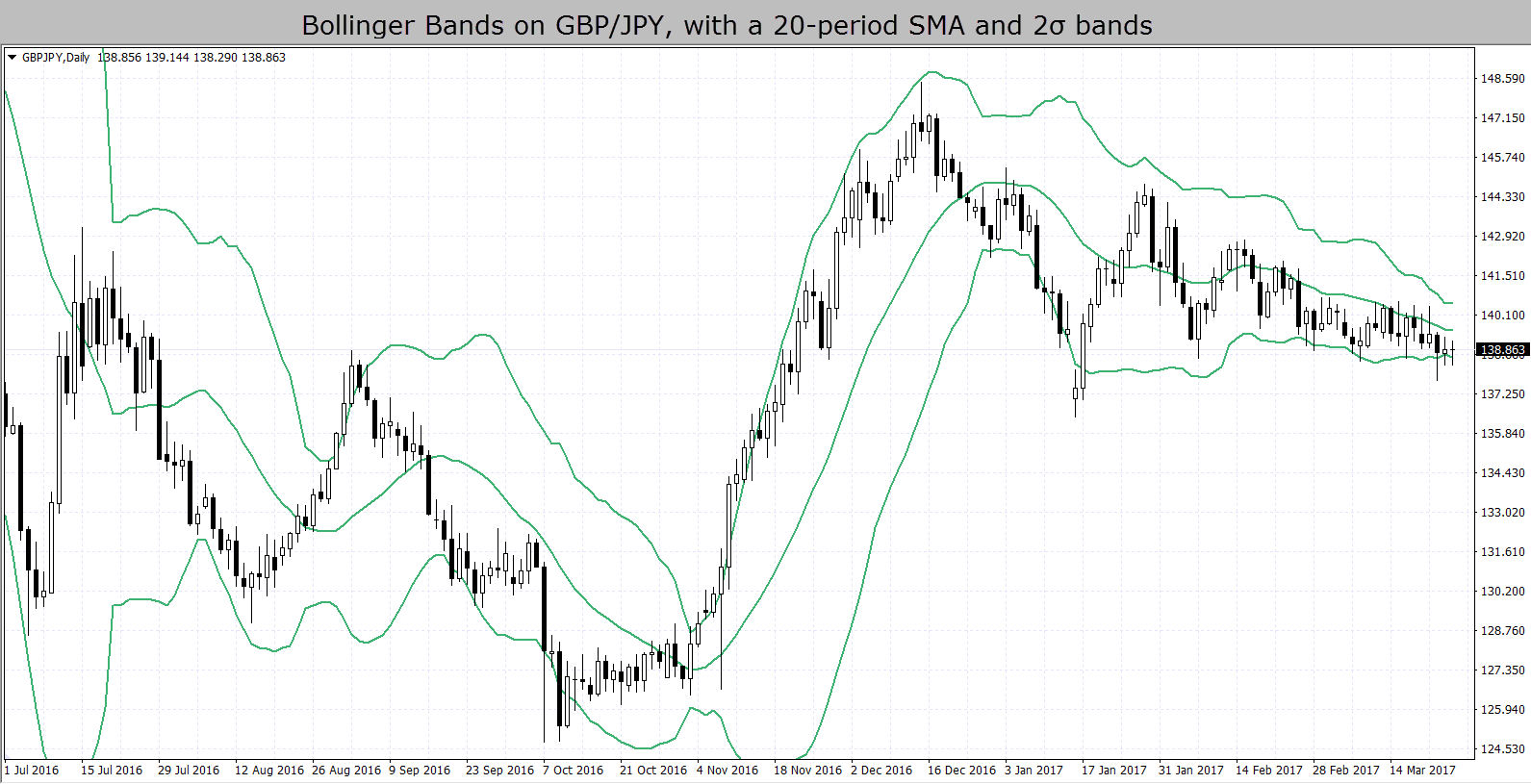

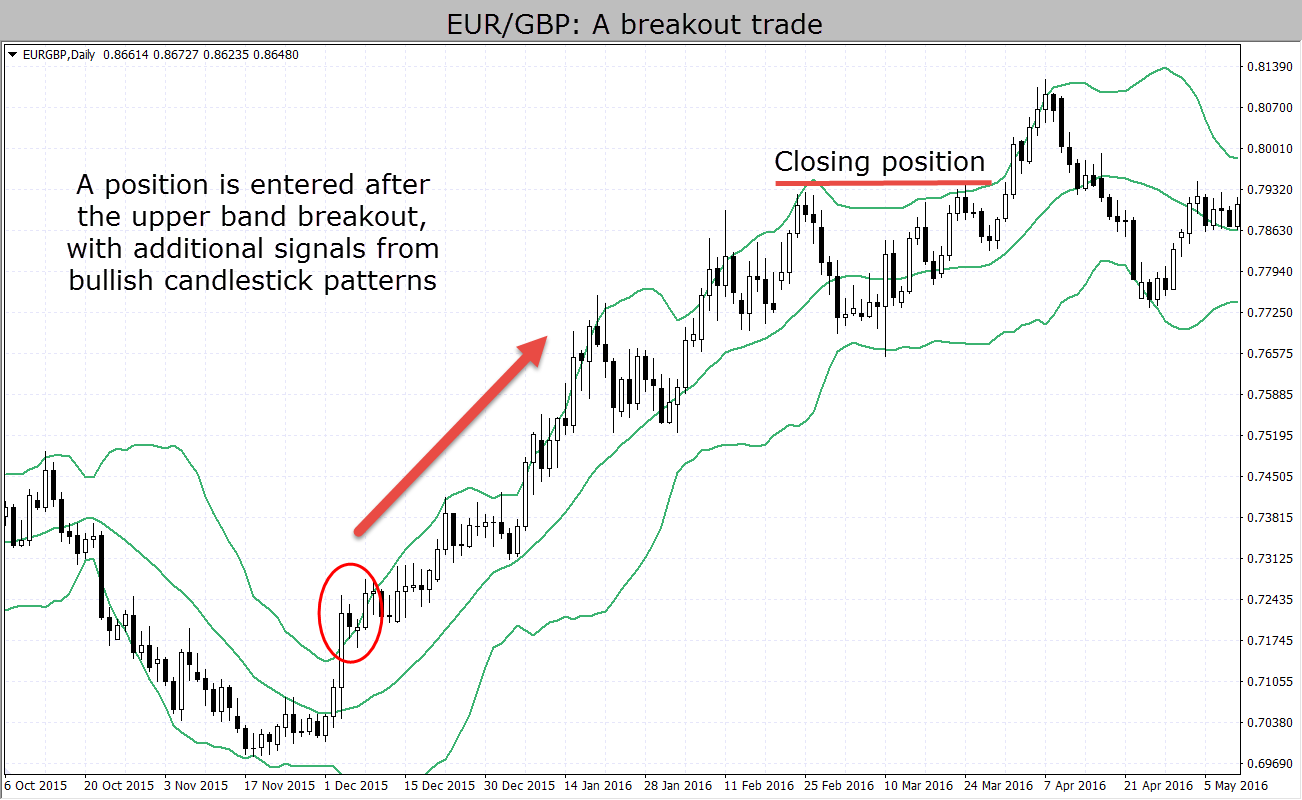

Bollinger bands are another indicator based on moving averages. Although Bollinger bands can also be considered a mean-reverting indicator, we group them as a trend-following indicator given their underlying calculations and sensitivity during trending markets.

Bollinger bands plot a band around a moving average that is two standard deviations away from the moving average. As markets start to trend, Bollinger bands widen and provide a buying signal. When markets are trading sideways and volatility is low, Bollinger bands squeeze and signal an upcoming rise in volatility. The Bollinger band squeeze is also the name of a popular trading strategy based on this indicator.

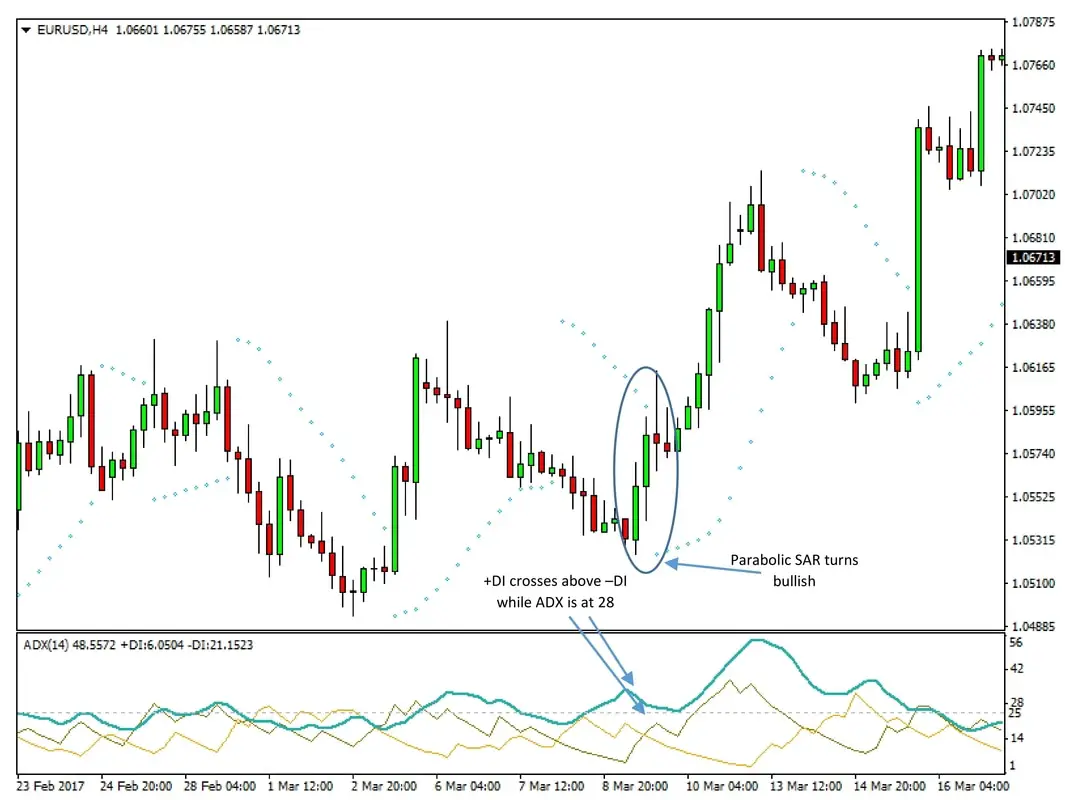

The Average Directional Movement Index, or ADX, is a non-directional trend-following indicator that consists of three lines: the ADX line, the DI+ line, and the DI- line. The ADX line measures the strength of the underlying trend in the market and rises when price movements pick up. It’s called a non-directional indicator because the ADX line measures only the strength of the indicator, but not its direction.

However, the DI+ and DI- lines can be used to determine the direction: when the DI+ line crosses above the DI- line, we have a possible bull trend around the corner, and when the DI- line crosses above the DI+ line, a possible bear trend is ahead.

The Parabolic SAR, or Parabolic stop-and-reverse, is a popular technical indicator that tries to identify potential reversal points in the markets. The indicator is also often used to provide entry and exit points.

The Parabolic SAR works best when the markets are trending, which is why the developer of the indicator, J. Welles Wilder, recommends using the indicator to establish the direction of the underlying market and to use other indicators to measure the strength of the trend, such as the ADX index. The Parabolic SAR plots a series of dots on the charts, with a dot below the price signaling a possible buying opportunity, and a dot above the price a possible selling opportunity.

Trading with Oscillators and Trend Following Indicators

Here are some well-documented and handy tips on how to use each of the above-mentioned indicators.

- Relative Strength Index (RSI) – As an oscillator, the RSI provides a buying signal when the market becomes oversold (typically an RSI value of below 30) and a selling signal when the market becomes overbought (typically an RSI value of above 70). However, since oscillators work best in ranging markets, try to incorporate the ADX index to identify a non-trending market before applying the RSI.

- Stochastics – Just like the RSI, the Stochastics indicator is an oscillator that provides buying and selling signals depending on whether the market is oversold or overbought. Typical thresholds used with the Stochastics indicator include 20 and below for oversold markets, and 80 and above for overbought markets. Use the ADX index to identify a ranging market before applying Stochastics.

- CR, AR, and BR Indices – CR, AR, and BR indices work best in the medium and long-term by measuring the strength and balance between buyers and sellers. The CR index provides a buying signal when the CR line crosses the four CR average lines to the upside, and a selling signal when it crosses to the downside. AR and BR indices are often used in tandem to measure the sentiment of buyers and sellers and provide a trading signal when the BR index is above the AR index, and the BR dips below 100.

- Moving Averages – Moving averages are popularly used as dynamic support and resistance levels in the markets. In this regard, the 100-period and 200-period MAs are especially popular as a large number of traders are following them on a daily basis. Buy when the price shows to respect the 100-period or 200-period MA from the upside and sell when the MAs hold from the downside.

- Bollinger Bands – Popular Bollinger band strategies include Riding the Band and the Bollinger Squeeze. In Riding the Band, a trader would buy when the price touches one of the Bollinger bands and closes above the band on high volatility. The opposite is true for selling signals.

In a Bollinger Squeeze, anticipate an upcoming surge in volatility – and potential trading opportunities, when the Bollinger bands squeeze to form a tight channel.

- Average Directional Movement Index (ADX) – The ADX line measures the strength of the underlying trend, with a reading above 30 typically signaling a weak trend. Values between 50 and 70 signal strong trends, and values above 70 signal very strong trends. You should never sell when the market shows a strong uptrend or buy when the market shows a strong downtrend. Use the DI+ and DI- lines to determine whether the market is entering into a bull trend or a bear trend.

- Parabolic SAR – The Parabolic SAR aims to catch reversal points in the market by printing small dots above or below the price. A selling signal is formed when the dots appear above the price, and a buying signal is formed when the dots appear below the price.

Final Words

Technical indicators are a great tool to measure market sentiment, trends, and reversal points based on historic prices. In this article, we have covered the most popular oscillating and trend-following indicators and provided a straightforward way of how to trade them. However, bear in mind that technical indicators are not the holy grail of trading and that you should also use other types of analyses before placing your trades.