A Comprehensive Guide to Professional Position Sizing Methods, Capital Preservation Strategies, and Systematic Money Management That Ensures Long-Term Trading Success

Position sizing and money management represent the most critical aspects of trading success, often determining the difference between profitable traders and those who lose money despite having winning strategies. Even the best trading strategies will fail without proper position sizing, while mediocre strategies can become profitable with excellent money management.

After managing trading capital for over 18 years and studying the money management approaches of successful institutional traders, I’ve learned that position sizing is both an art and a science. The mathematical principles are straightforward, but the psychological discipline required to implement them consistently separates successful traders from the majority who struggle.

Professional money management goes far beyond simply deciding how much to risk per trade—it encompasses capital allocation, risk budgeting, drawdown management, and the psychological aspects of handling both winning and losing periods. This comprehensive approach ensures that trading capital not only survives market volatility but grows consistently over time.

This guide will teach you the scientific methods used by professional traders and institutional money managers to size positions, manage risk, and grow capital systematically. You’ll learn how to calculate optimal position sizes, implement risk management protocols, and develop the psychological discipline necessary for consistent money management.

The techniques presented here are based on modern portfolio theory, behavioral finance research, and decades of practical trading experience. Every method has been tested across different market conditions and account sizes to ensure applicability for traders at all levels.

The Foundation of Money Management

Money management is the systematic approach to preserving and growing trading capital through disciplined risk control and optimal capital allocation. It encompasses all decisions related to how much capital to risk, how to size positions, and how to manage the overall portfolio risk profile.

The primary goal of money management is not to maximize profits on individual trades, but to ensure the long-term survival and growth of trading capital. This perspective shift from trade-focused to portfolio-focused thinking is essential for developing sustainable trading success.

The Mathematics of Survival

Understanding the mathematical relationship between risk, return, and survival probability provides the foundation for all money management decisions. These mathematical principles explain why conservative position sizing often leads to better long-term results than aggressive approaches.

Risk of Ruin Calculations:

Risk of ruin represents the probability of losing a specified percentage of trading capital before achieving a target profit level. Understanding these probabilities helps traders make informed decisions about acceptable risk levels and position sizing.

Basic Risk of Ruin Formula:

– Formula Components: Win rate, average win/loss ratio, and risk per trade

– Survival Probability: Calculating the probability of avoiding significant drawdowns

– Capital Requirements: Determining minimum capital needed for strategy implementation

– Time Horizon Impact: Understanding how time affects survival probability

– Strategy Comparison: Comparing different strategies based on survival probability

Risk of Ruin Examples:

– Conservative Approach: 1% risk per trade, 60% win rate, 1.5:1 reward/risk = 0.1% ruin probability

– Moderate Approach: 2% risk per trade, 60% win rate, 1.5:1 reward/risk = 2.3% ruin probability

– Aggressive Approach: 5% risk per trade, 60% win rate, 1.5:1 reward/risk = 18.7% ruin probability

– Dangerous Approach: 10% risk per trade, 60% win rate, 1.5:1 reward/risk = 47.2% ruin probability

– Reckless Approach: 20% risk per trade, 60% win rate, 1.5:1 reward/risk = 78.9% ruin probability

Compound Growth Mathematics:

Compound growth principles explain how consistent, moderate returns can produce extraordinary long-term results, while large losses can permanently impair capital growth potential.

Compound Annual Growth Rate (CAGR):

– Formula: (Ending Value / Beginning Value)^(1/Years) – 1

– Consistency Impact: How consistent returns affect compound growth

– Volatility Drag: How volatility reduces compound returns even with positive average returns

– Recovery Requirements: Understanding how much gain is needed to recover from losses

– Time Value: The importance of time in compound growth calculations

Loss Recovery Mathematics:

– 10% Loss: Requires 11.1% gain to recover

– 20% Loss: Requires 25% gain to recover

– 30% Loss: Requires 42.9% gain to recover

– 50% Loss: Requires 100% gain to recover

– 75% Loss: Requires 300% gain to recover

The Psychology of Money Management

Psychological factors often override mathematical logic in money management decisions, leading to position sizing errors that can destroy otherwise profitable trading strategies. Understanding these psychological biases helps traders implement more disciplined money management approaches.

Common Psychological Biases:

Cognitive biases systematically distort money management decisions, often leading traders to take excessive risks during winning periods and insufficient risks during losing periods.

Overconfidence Bias:

– Winning Streak Overconfidence: Increasing position sizes after successful trades

– Strategy Overconfidence: Believing that recent success guarantees future performance

– Skill Overestimation: Attributing luck to skill and increasing risk accordingly

– Market Timing Confidence: Believing in ability to time market entries and exits perfectly

– Risk Underestimation: Underestimating the probability and impact of adverse outcomes

Loss Aversion and Risk Perception:

– Asymmetric Risk Perception: Feeling losses more intensely than equivalent gains

– Sunk Cost Fallacy: Continuing to risk capital to recover previous losses

– Recency Bias: Overweighting recent experiences in risk assessment

– Availability Heuristic: Overestimating risks that are easily recalled

– Anchoring Bias: Anchoring position sizes to arbitrary reference points

Emotional Money Management Errors:

– Revenge Trading: Increasing position sizes to recover from losses quickly

– Fear-Based Undersizing: Reducing position sizes excessively after losses

– Greed-Based Oversizing: Increasing position sizes to maximize profits during winning streaks

– Stress-Induced Inconsistency: Abandoning systematic approaches during stressful periods

– Euphoria-Driven Risk Taking: Taking excessive risks during periods of success

Position Sizing Methods and Calculations

Professional position sizing methods provide systematic approaches to determining optimal trade sizes based on risk tolerance, account size, and strategy characteristics. These methods remove emotional decision-making from position sizing and ensure consistent risk management across all trades.

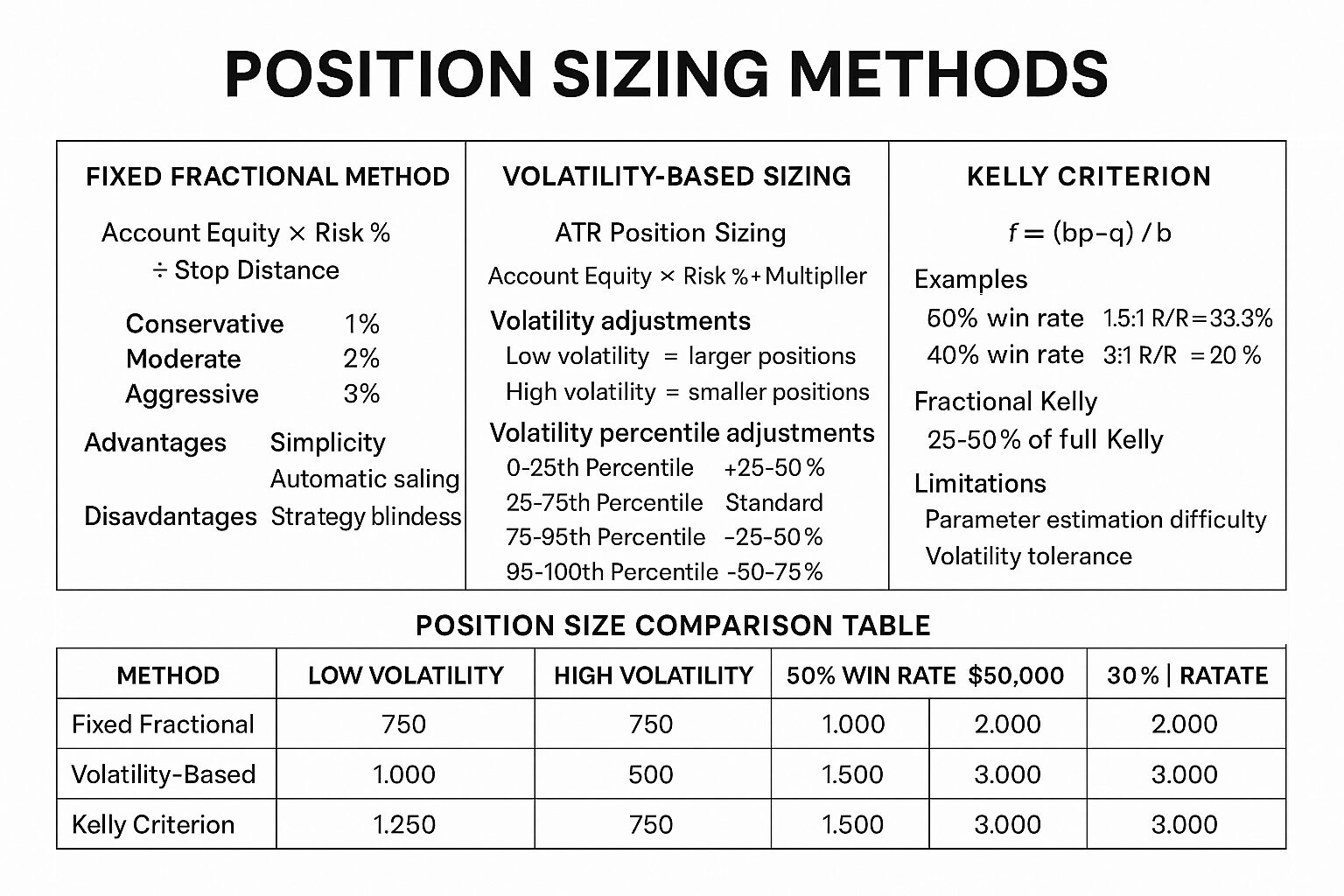

Figure 1: Position Sizing Methods Comparison – This comprehensive comparison demonstrates three primary position sizing approaches used by professional traders. The Fixed Fractional Method uses the formula (Account Equity × Risk % ÷ Stop Distance) with risk percentages ranging from Conservative (1%), Moderate (2%), to Aggressive (3%). Advantages include simplicity, automatic scaling, and consistent risk, while disadvantages include volatility ignorance and strategy blindness. Volatility-Based Sizing employs ATR Position Sizing (Account Equity × Risk % ÷ ATR × Multiplier) with volatility adjustments where low volatility periods allow larger positions and high volatility periods require smaller positions. Volatility percentile adjustments range from +25-50% for 0-25th percentile (low volatility) to -50-75% for 95-100th percentile (extreme volatility). The Kelly Criterion uses the formula f = (bp-q)/b with examples showing 60% win rate with 1.5:1 R/R = 33.3% Kelly, and 40% win rate with 3:1 R/R = 20% Kelly. Practical application typically uses 25-50% of full Kelly due to limitations including parameter estimation difficulty and volatility tolerance. The Position Size Comparison Table demonstrates how different methods perform across various scenarios including low/high volatility periods, different win rates, and account sizes.

Different position sizing methods are appropriate for different trading styles, risk tolerances, and market conditions. Understanding multiple approaches enables traders to select the most suitable method for their specific circumstances and adapt as conditions change.

Fixed Fractional Position Sizing

Fixed fractional position sizing risks a fixed percentage of total account equity on each trade, providing a simple and effective approach to position sizing that automatically adjusts to account growth and decline.

Basic Fixed Fractional Method:

The fixed fractional method calculates position size by dividing the desired risk amount by the stop-loss distance, ensuring that each trade risks the same percentage of account equity.

Position Size Calculation:

– Formula: Position Size = (Account Equity × Risk Percentage) ÷ Stop Loss Distance

– Risk Percentage: Typically 1-3% of account equity per trade

– Stop Loss Distance: Distance from entry price to stop-loss level

– Currency Conversion: Adjusting for different currency denominations

– Lot Size Rounding: Rounding to available lot sizes offered by broker

Fixed Fractional Examples:

– Conservative: 1% risk per trade on $100,000 account = $1,000 maximum risk

– Moderate: 2% risk per trade on $100,000 account = $2,000 maximum risk

– Aggressive: 3% risk per trade on $100,000 account = $3,000 maximum risk

– Position Calculation: $1,000 risk ÷ 50 pip stop = $20 per pip = 1 standard lot EURUSD

– Account Growth Adjustment: Position sizes automatically increase as account grows

Advantages of Fixed Fractional:

– Simplicity: Easy to calculate and implement consistently

– Automatic Scaling: Position sizes adjust automatically to account size changes

– Risk Control: Maintains consistent risk exposure across all trades

– Psychological Comfort: Provides clear, objective position sizing rules

– Flexibility: Can be adjusted based on strategy performance and risk tolerance

Disadvantages of Fixed Fractional:

– Volatility Ignorance: Doesn’t account for varying market volatility

– Strategy Blindness: Treats all strategies and setups equally

– Market Condition Insensitivity: Doesn’t adjust for different market environments

– Correlation Ignorance: Doesn’t consider correlations between simultaneous positions

– Opportunity Cost: May undersize positions during high-probability setups

Volatility-Based Position Sizing

Volatility-based position sizing adjusts position sizes based on current market volatility, taking larger positions during calm periods and smaller positions during volatile periods. This approach helps maintain consistent risk exposure despite changing market conditions.

Average True Range (ATR) Position Sizing:

ATR-based position sizing uses the Average True Range indicator to measure market volatility and adjust position sizes accordingly, providing more sophisticated risk management than fixed fractional methods.

ATR Position Sizing Formula:

– Base Calculation: Position Size = (Account Equity × Risk Percentage) ÷ (ATR × ATR Multiplier)

– ATR Multiplier: Typically 1.5-3.0 times the ATR value

– Volatility Adjustment: Larger positions during low volatility, smaller during high volatility

– Time Frame Consideration: Using appropriate ATR time frame for trading style

– Currency Pair Normalization: Adjusting for different currency pair volatilities

ATR Position Sizing Examples:

– Low Volatility Period: EURUSD ATR = 50 pips, 2x multiplier = 100 pip risk

– High Volatility Period: EURUSD ATR = 120 pips, 2x multiplier = 240 pip risk

– Position Size Adjustment: $2,000 risk ÷ 100 pips = $20/pip vs $2,000 ÷ 240 pips = $8.33/pip

– Volatility Normalization: Maintaining consistent dollar risk despite volatility changes

– Market Adaptation: Automatically adjusting to changing market conditions

Volatility Percentile Position Sizing:

Volatility percentile position sizing compares current volatility to historical ranges, adjusting position sizes based on whether current volatility is high or low relative to recent history.

Percentile-Based Adjustments:

– Low Volatility (0-25th percentile): Increase position size by 25-50%

– Normal Volatility (25-75th percentile): Use standard position size

– High Volatility (75-95th percentile): Decrease position size by 25-50%

– Extreme Volatility (95-100th percentile): Decrease position size by 50-75%

– Historical Lookback: Using 3-6 months of volatility data for percentile calculations

Kelly Criterion and Optimal Position Sizing

The Kelly Criterion provides a mathematical framework for determining optimal position sizes based on the probability of winning and the average win/loss ratio of a trading strategy.

Kelly Formula and Application:

The Kelly Criterion calculates the optimal fraction of capital to risk on each trade to maximize long-term growth rate, though practical applications often use fractional Kelly to reduce volatility.

Kelly Formula:

– Formula: f = (bp – q) ÷ b

– f: Fraction of capital to wager

– b: Odds received on the wager (average win ÷ average loss)

– p: Probability of winning

– q: Probability of losing (1 – p)

Kelly Criterion Examples:

– Strategy A: 60% win rate, 1.5:1 reward/risk = (1.5 × 0.6 – 0.4) ÷ 1.5 = 33.3% Kelly

– Strategy B: 40% win rate, 3:1 reward/risk = (3 × 0.4 – 0.6) ÷ 3 = 20% Kelly

– Strategy C: 70% win rate, 1:1 reward/risk = (1 × 0.7 – 0.3) ÷ 1 = 40% Kelly

– Fractional Kelly: Using 25-50% of full Kelly to reduce volatility

– Practical Application: Most traders use 10-25% of calculated Kelly percentage

Kelly Criterion Limitations:

– Parameter Estimation: Difficulty in accurately estimating win rates and average returns

– Strategy Stability: Assumes strategy parameters remain constant over time

– Volatility Tolerance: Full Kelly can produce extreme volatility and drawdowns

– Psychological Feasibility: Full Kelly often requires position sizes that are psychologically uncomfortable

– Market Evolution: Doesn’t account for changing market conditions affecting strategy performance

Risk Management Protocols and Capital Preservation

Comprehensive risk management protocols protect trading capital from catastrophic losses while enabling consistent growth through systematic risk control. These protocols encompass individual trade risk, portfolio risk, and systematic risk management procedures.

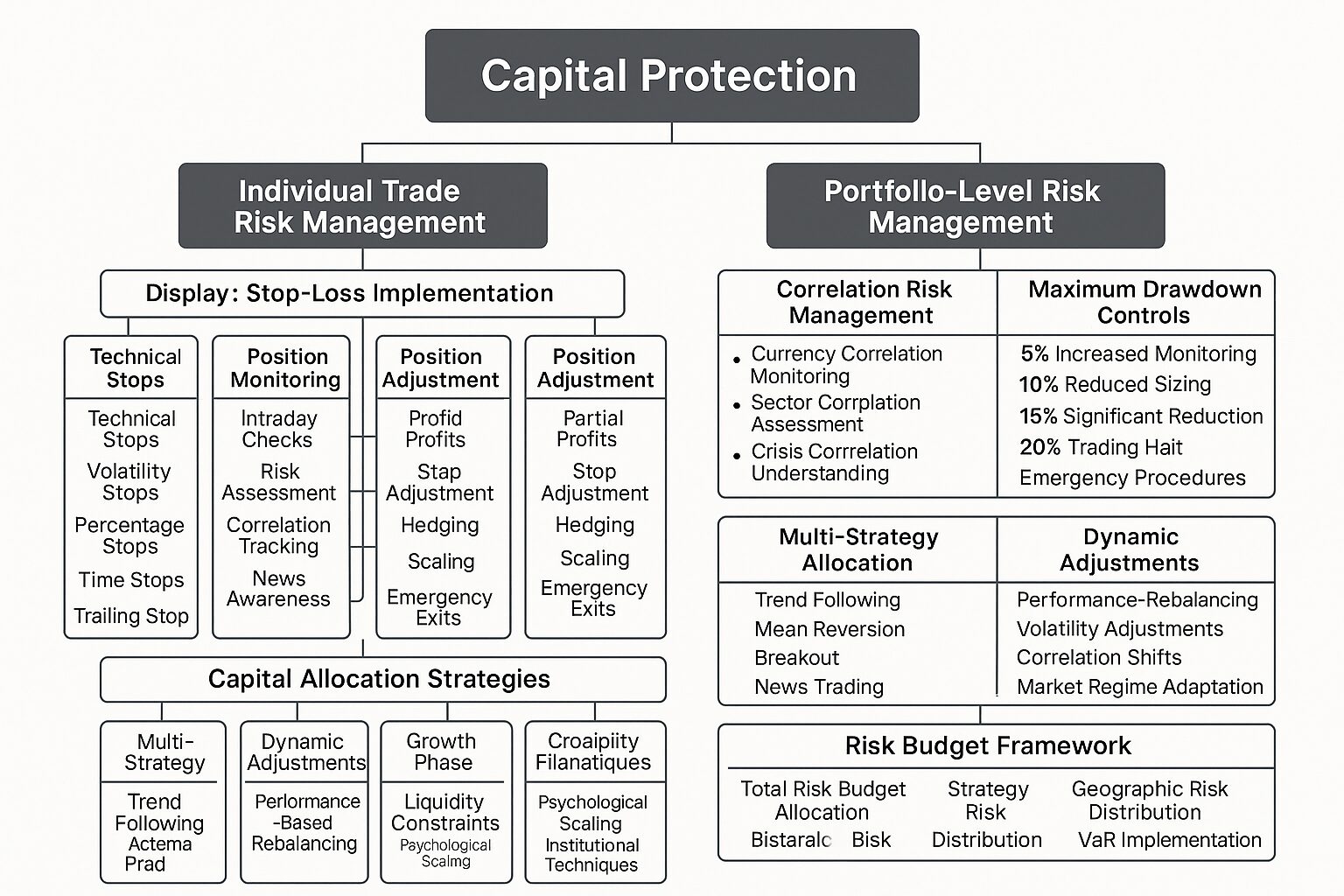

Figure 2: Risk Management Framework Hierarchy – This comprehensive multi-layered capital protection system demonstrates professional risk management approaches. Individual Trade Risk Management includes Stop-Loss Implementation (technical stops, volatility stops, percentage stops, time stops, trailing stops), Position Monitoring (intraday checks, risk assessment, correlation tracking, news awareness, technical levels), and Position Adjustment (partial profits, stop adjustment, hedging, scaling, emergency exits). Portfolio-Level Risk Management encompasses Correlation Risk Management (currency correlation monitoring, sector correlation assessment, crisis correlation understanding, dynamic tracking) and Maximum Drawdown Controls with specific thresholds: 5% triggers increased monitoring, 10% requires reduced sizing, 15% demands significant reduction, 20% initiates trading halt, plus emergency procedures. Capital Allocation Strategies include Multi-Strategy Allocation (trend following, mean reversion, breakout, news trading, carry trade), Dynamic Adjustments (performance-based rebalancing, volatility adjustments, correlation shifts, market regime adaptation), and Growth Phase Management (liquidity constraints, psychological scaling, institutional techniques). The Risk Budget Framework shows Total Risk Budget allocation, Strategy Risk Distribution, Time Frame Risk Allocation, Geographic Risk Distribution, and VaR Implementation including Historical, Parametric, Monte Carlo, Conditional VaR, and Stress Testing methodologies.

Effective risk management requires multiple layers of protection, from individual trade stops to portfolio-level risk limits and emergency procedures. This multi-layered approach ensures that no single event or series of events can cause irreparable damage to trading capital.

Individual Trade Risk Management

Individual trade risk management establishes clear limits and procedures for each trading position, ensuring that no single trade can cause significant damage to overall portfolio performance.

Stop-Loss Implementation:

Professional stop-loss implementation goes beyond simply placing stops at technical levels to include systematic approaches that balance risk control with strategy effectiveness.

Stop-Loss Placement Methods:

– Technical Stops: Placing stops beyond key support/resistance levels

– Volatility Stops: Using ATR or standard deviation to set stop distances

– Percentage Stops: Setting stops at fixed percentage distances from entry

– Time Stops: Exiting positions after predetermined time periods

– Trailing Stops: Adjusting stops to lock in profits as positions move favorably

Stop-Loss Optimization:

– Backtest Analysis: Testing different stop-loss methods on historical data

– Win Rate Impact: Understanding how stop distance affects win rates

– Profit Factor Analysis: Optimizing stops for maximum profit factor

– Market Condition Adaptation: Adjusting stop methods for different market environments

– Slippage Consideration: Accounting for execution slippage in stop-loss calculations

Position Monitoring and Adjustment:

Active position monitoring enables dynamic risk management that adapts to changing market conditions and position performance.

Monitoring Protocols:

– Intraday Monitoring: Regular position checks during active trading hours

– Risk Level Assessment: Continuous evaluation of current risk exposure

– Correlation Monitoring: Tracking correlations between open positions

– News Event Awareness: Monitoring upcoming events that could affect positions

– Technical Level Tracking: Watching key technical levels that could trigger stops

Position Adjustment Techniques:

– Partial Profit Taking: Reducing position sizes as profits accumulate

– Stop Adjustment: Moving stops to breakeven or profit levels

– Hedge Implementation: Adding hedging positions to reduce overall risk

– Position Scaling: Adding to winning positions using pyramid techniques

– Emergency Exits: Procedures for rapid position closure during extreme events

Portfolio-Level Risk Management

Portfolio-level risk management considers the aggregate risk of all open positions and implements limits that prevent excessive overall exposure.

Correlation Risk Management:

Correlation risk management prevents excessive exposure to related currency pairs or market factors that could cause simultaneous losses across multiple positions.

Correlation Analysis:

– Currency Correlation Monitoring: Tracking correlations between major currency pairs

– Sector Correlation Assessment: Understanding correlations between different market sectors

– Time Frame Correlation: Analyzing how correlations change across different time periods

– Crisis Correlation: Understanding how correlations increase during market stress

– Dynamic Correlation Tracking: Monitoring correlation changes in real-time

Correlation Risk Limits:

– Maximum Correlated Exposure: Limiting total exposure to highly correlated positions

– Correlation Coefficient Thresholds: Setting limits based on correlation strength

– Sector Concentration Limits: Preventing excessive exposure to single market sectors

– Geographic Diversification: Spreading risk across different geographic regions

– Time Zone Diversification: Distributing trading across different market sessions

Maximum Drawdown Controls:

Maximum drawdown controls establish clear limits on acceptable portfolio losses and implement procedures for reducing risk when these limits are approached.

Drawdown Monitoring:

– Daily Drawdown Tracking: Monitoring daily portfolio performance against peaks

– Monthly Drawdown Assessment: Evaluating monthly performance trends

– Peak-to-Trough Analysis: Measuring maximum decline from portfolio highs

– Recovery Time Analysis: Tracking time required to recover from drawdowns

– Drawdown Distribution: Understanding typical drawdown patterns for the strategy

Drawdown Response Protocols:

– 5% Drawdown: Increased monitoring and position size review

– 10% Drawdown: Reduced position sizes and strategy review

– 15% Drawdown: Significant position size reduction and trading pause consideration

– 20% Drawdown: Trading halt and comprehensive strategy evaluation

– Emergency Procedures: Rapid position closure protocols for extreme situations

Capital Allocation and Growth Strategies

Strategic capital allocation optimizes the distribution of trading capital across different strategies, time frames, and market opportunities to maximize risk-adjusted returns while maintaining appropriate diversification.

Effective capital allocation requires balancing the desire for growth with the need for capital preservation, considering both the mathematical and psychological aspects of portfolio management. This balance evolves as account size grows and trading experience develops.

Multi-Strategy Capital Allocation

Multi-strategy allocation distributes capital across different trading approaches to reduce overall portfolio volatility and improve risk-adjusted returns through diversification benefits.

Strategy Diversification Framework:

Professional strategy diversification considers correlation between different approaches, risk characteristics, and performance consistency to optimize overall portfolio performance.

Strategy Classification:

– Trend Following Strategies: Momentum-based approaches for trending markets

– Mean Reversion Strategies: Counter-trend approaches for range-bound markets

– Breakout Strategies: Volatility-based approaches for emerging trends

– News Trading Strategies: Event-driven approaches for fundamental catalysts

– Carry Trade Strategies: Interest rate differential approaches for stable markets

Allocation Methodology:

– Equal Weight Allocation: Distributing capital equally across all strategies

– Risk-Adjusted Allocation: Allocating based on historical Sharpe ratios

– Volatility-Adjusted Allocation: Allocating inversely to strategy volatility

– Performance-Based Allocation: Allocating based on recent performance trends

– Market Condition Allocation: Adjusting allocations based on current market regime

Strategy Correlation Analysis:

– Return Correlation: Measuring correlation between strategy returns

– Drawdown Correlation: Analyzing correlation during losing periods

– Market Regime Correlation: Understanding correlation changes across market conditions

– Time Frame Correlation: Evaluating correlation across different time periods

– Crisis Correlation: Monitoring correlation increases during market stress

Dynamic Allocation Adjustments

Dynamic allocation adjustments modify capital distribution based on changing market conditions, strategy performance, and risk characteristics to maintain optimal portfolio balance.

Performance-Based Rebalancing:

Performance-based rebalancing systematically adjusts allocations based on strategy performance while avoiding the psychological biases that lead to poor allocation decisions.

Rebalancing Triggers:

– Performance Divergence: Rebalancing when strategy performance diverges significantly

– Volatility Changes: Adjusting for changes in strategy volatility characteristics

– Correlation Shifts: Modifying allocations when correlations change substantially

– Market Regime Changes: Adapting to different market environments

– Time-Based Rebalancing: Regular rebalancing regardless of performance

Rebalancing Methodology:

– Threshold Rebalancing: Rebalancing when allocations drift beyond set thresholds

– Calendar Rebalancing: Regular rebalancing on fixed schedules

– Volatility-Adjusted Rebalancing: Adjusting based on volatility changes

– Performance-Momentum Rebalancing: Increasing allocations to outperforming strategies

– Mean-Reversion Rebalancing: Increasing allocations to underperforming strategies

Growth Phase Capital Management

Growth phase capital management adapts money management approaches as account size increases, addressing the changing challenges and opportunities that come with larger capital bases.

Scaling Challenges:

As trading accounts grow, new challenges emerge that require modifications to position sizing, strategy selection, and risk management approaches.

Liquidity Constraints:

– Market Impact: Understanding how larger positions affect market prices

– Execution Challenges: Dealing with partial fills and slippage on larger orders

– Time Frame Adjustments: Moving to longer time frames to accommodate larger positions

– Strategy Modifications: Adapting strategies for larger position sizes

– Broker Limitations: Understanding broker limits on position sizes and leverage

Psychological Scaling Issues:

– Absolute Dollar Risk: Dealing with larger absolute dollar amounts at risk

– Percentage Perspective: Maintaining percentage-based thinking as accounts grow

– Lifestyle Inflation: Avoiding lifestyle changes that increase required returns

– Risk Tolerance Evolution: Understanding how risk tolerance changes with wealth

– Success Pressure: Managing pressure to maintain performance as stakes increase

Professional Money Management Techniques

Professional money management techniques used by institutional traders and money managers provide sophisticated approaches to capital management that can be adapted for individual traders.

Institutional Risk Budgeting:

Risk budgeting allocates risk capacity across different strategies and time frames, ensuring that total portfolio risk remains within acceptable limits while maximizing return potential.

Risk Budget Framework:

– Total Risk Budget: Maximum acceptable portfolio volatility or VaR

– Strategy Risk Allocation: Distributing risk budget across different strategies

– Time Frame Risk Allocation: Allocating risk across different trading time frames

– Geographic Risk Allocation: Distributing risk across different markets

– Sector Risk Allocation: Allocating risk across different market sectors

Value at Risk (VaR) Implementation:

– Historical VaR: Using historical returns to estimate potential losses

– Parametric VaR: Using statistical models to estimate risk

– Monte Carlo VaR: Using simulation to estimate potential outcomes

– Conditional VaR: Estimating expected losses beyond VaR threshold

– Stress Testing: Testing portfolio performance under extreme scenarios

Psychological Aspects of Money Management

The psychological aspects of money management often determine whether traders can successfully implement systematic approaches to position sizing and risk control. Understanding and managing these psychological factors is essential for consistent money management execution.

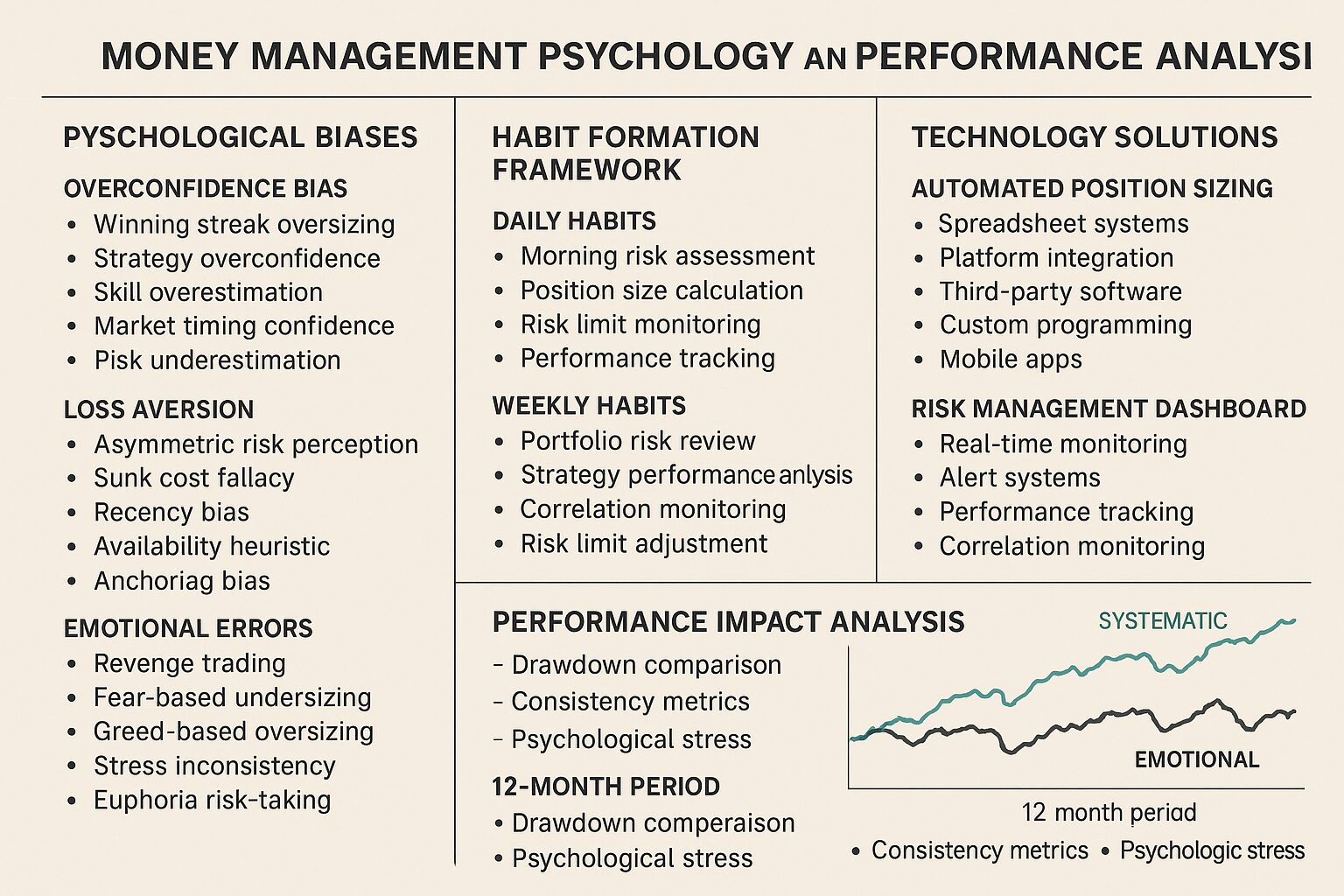

Figure 3: Money Management Psychology and Performance Analysis – This comprehensive framework demonstrates behavioral factors and systematic solutions for effective money management. Psychological Biases include Overconfidence Bias (winning streak oversizing, strategy overconfidence, skill overestimation, market timing confidence, risk underestimation), Loss Aversion (asymmetric risk perception, sunk cost fallacy, recency bias, availability heuristic, anchoring bias), and Emotional Errors (revenge trading, fear-based undersizing, greed-based oversizing, stress inconsistency, euphoria risk-taking). The Habit Formation Framework encompasses Daily Habits (morning risk assessment, position size calculation, risk limit monitoring, performance tracking, evening review), Weekly Habits (portfolio risk review, strategy performance analysis, correlation monitoring, risk limit adjustment), and Monthly Habits (comprehensive performance review, system evaluation, risk tolerance reassessment, capital allocation review, goal setting). Technology Solutions include Automated Position Sizing (spreadsheet systems, platform integration, third-party software, custom programming, mobile apps) and Risk Management Dashboards (real-time monitoring, alert systems, performance tracking, correlation monitoring, drawdown alerts). The Performance Impact Analysis shows systematic vs emotional money management results over a 12-month period with equity curves demonstrating superior performance of systematic approaches, drawdown comparison showing reduced volatility, consistency metrics, and psychological stress indicators highlighting the benefits of disciplined money management.

Psychological discipline in money management requires developing emotional control, maintaining perspective during both winning and losing periods, and building habits that support systematic decision-making. This psychological foundation enables traders to execute money management plans consistently regardless of recent performance or market conditions.

Emotional Control and Discipline

Emotional control in money management involves developing the psychological skills necessary to maintain systematic approaches despite the natural emotional responses to trading outcomes.

Fear Management in Position Sizing:

Fear-based position sizing errors often lead to undersized positions that limit profit potential and create psychological pressure to take excessive risks to compensate for missed opportunities.

Common Fear-Based Errors:

– Post-Loss Undersizing: Reducing position sizes excessively after losing trades

– Volatility Fear: Undersizing during volatile periods when opportunities may be greatest

– Success Fear: Reducing position sizes when strategies are working well

– Complexity Avoidance: Avoiding sophisticated position sizing methods due to fear of complexity

– Technology Fear: Avoiding automated position sizing due to technology concerns

Fear Management Techniques:

– Systematic Desensitization: Gradually increasing position sizes to build comfort

– Visualization Techniques: Mental rehearsal of position sizing decisions

– Objective Metrics Focus: Concentrating on mathematical rather than emotional factors

– Support Systems: Building relationships that provide emotional support

– Education and Understanding: Deepening knowledge to reduce fear of the unknown

Greed Management and Overconfidence:

Greed and overconfidence lead to oversized positions that can cause catastrophic losses and destroy otherwise profitable trading strategies.

Overconfidence Manifestations:

– Winning Streak Oversizing: Increasing position sizes after successful periods

– Strategy Overconfidence: Believing that recent success guarantees future performance

– Market Timing Overconfidence: Believing in ability to perfectly time entries and exits

– Risk Underestimation: Underestimating the probability of adverse outcomes

– Complexity Overconfidence: Believing that complex methods are always better

Greed and Overconfidence Controls:

– Systematic Position Sizing: Using mathematical methods that remove emotional decisions

– Performance Attribution Analysis: Understanding the role of luck versus skill in results

– Historical Perspective: Maintaining awareness of past drawdowns and challenges

– Peer Review: Seeking external perspectives on position sizing decisions

– Humility Cultivation: Actively working to maintain realistic self-assessment

Building Money Management Habits

Successful money management requires developing habits that support consistent execution of systematic approaches regardless of emotional state or recent performance.

Habit Formation Strategies:

Building effective money management habits requires systematic approaches that make proper position sizing and risk control automatic rather than requiring conscious decision-making.

Daily Habits:

– Morning Risk Assessment: Daily evaluation of current portfolio risk exposure

– Position Size Calculation: Systematic calculation of position sizes before trading

– Risk Limit Monitoring: Regular checking of risk limits and exposure levels

– Performance Tracking: Daily recording of performance and risk metrics

– Evening Review: End-of-day assessment of money management execution

Weekly Habits:

– Portfolio Risk Review: Comprehensive assessment of overall portfolio risk

– Strategy Performance Analysis: Evaluation of individual strategy performance

– Correlation Monitoring: Analysis of correlations between positions and strategies

– Risk Limit Adjustment: Review and adjustment of risk limits based on performance

– Money Management Plan Review: Assessment of money management plan effectiveness

Monthly Habits:

– Comprehensive Performance Review: Detailed analysis of monthly performance and risk metrics

– Money Management System Evaluation: Assessment of money management system effectiveness

– Risk Tolerance Reassessment: Evaluation of current risk tolerance and comfort levels

– Capital Allocation Review: Analysis and adjustment of capital allocation across strategies

– Goal Setting and Planning: Setting money management goals for the following month

Technology and Automation in Money Management

Technology and automation can significantly improve money management execution by removing emotional decision-making and ensuring consistent application of systematic approaches.

Automated Position Sizing:

Automated position sizing systems calculate optimal position sizes based on predefined rules, eliminating emotional errors and ensuring consistent risk management.

Position Sizing Software:

– Spreadsheet-Based Systems: Excel or Google Sheets calculators for position sizing

– Trading Platform Integration: Built-in position sizing tools in trading platforms

– Third-Party Software: Specialized position sizing and risk management software

– Custom Programming: Developing custom position sizing algorithms

– Mobile Applications: Position sizing apps for on-the-go calculations

Risk Management Dashboards:

– Real-Time Risk Monitoring: Live tracking of portfolio risk exposure

– Alert Systems: Automated alerts when risk limits are approached

– Performance Tracking: Automated recording and analysis of performance metrics

– Correlation Monitoring: Real-time tracking of position correlations

– Drawdown Alerts: Automated notifications when drawdown limits are reached

Conclusion: Mastering Money Management for Long-Term Success

Mastering money management is the key to transforming trading from gambling into a systematic business that can generate consistent returns over time. The difference between successful and unsuccessful traders almost always comes down to their approach to position sizing and risk management.

Remember that money management is not about maximizing profits on individual trades, but about ensuring the long-term survival and growth of your trading capital. This perspective shift from trade-focused to portfolio-focused thinking is essential for developing sustainable trading success.

The mathematical principles of money management are straightforward, but the psychological discipline required to implement them consistently is what separates successful traders from the majority. Focus on developing the habits and emotional control necessary to execute your money management plan regardless of recent performance or market conditions.

Start with conservative position sizing and gradually increase risk as you gain experience and confidence in your money management abilities. It’s better to grow slowly with proper risk management than to risk significant losses through aggressive position sizing.

Continuous learning and adaptation are essential, as your money management approach should evolve as your account size grows and your trading experience develops. Maintain the same systematic approach to money management that you use in strategy development and market analysis.

This article represents the seventh step in developing a comprehensive, personalized trading system. The money management principles you implement here will determine the long-term success of your trading approach. Take time to thoroughly understand and implement these concepts before moving to more advanced topics.