Every professional, successful, and the consistently profitable trader has strict risk management strategies in place. They know where to place their stop, how much risk to take, how to identify a realistic reward-to-risk set up, and cut their losing trades short – always.

Here, we’ll cover the best forex risk management strategies that you need to incorporate in your trading plan, today.

What are the risks involved in forex trading?

- Exchange rate risk is the risk associated with changes in the price of currencies that you can buy and sell. When you operate in the international currency market, this risk increases, although stocks also expose you to indirect risks.

- Interest rate risk is the risk associated with a sudden rise or fall in interest rates that affect volatility. Changes in interest rates affect currency exchange rates because the level of expenditure and investment in the economy will increase or decrease depending on the direction.

- Liquidity risk refers to the risk that you cannot buy or sell assets quickly enough to avoid loss. Although the foreign exchange market is usually a highly liquid market, there may be periods of insufficient liquidity depending on the currency and government policies.

- Leverage risk is the risk of increased losses in margin trading. Since the initial cost is lower than the cost of trading foreign exchange, it is important to consider the capital risk you bear.

The Most Important Part of Your Trading Plan

When talking about trading and developing a trading plan, many traders put too much emphasis on their trading strategy, technical analysis, or the markets they want to trade.

As the saying goes, 90% of traders lose 90% of their trading capital within 90 trading days. It’s no wonder that the majority of traders don’t pay attention to risk management taking into account those statistics.

If traders would focus more on how much they’re going to lose if a trade doesn’t play out as expected instead of how much profits they would make, the percentage of losing traders would be way below 90%.

When asked about the most important rules when investing in the stock market, Warren Buffet said “the first rule is don’t lose money, and the second rule is respecting the first one.” While there are major differences between trading and investing, those universal thoughts from one of the greatest investors of all time should be the first thing new traders learn.

Let’s face it, completely eliminating losses in trading is impossible. Managed and controlled losses are part of trading, and even professional traders need to cope with a losing trade here or there. But the key is, they manage their risks and don’t let their losing trades spiral out of control. This quickly leads to overtrading and overleveraging, which is a recipe for disaster.

Without risk management, you’ll blow your account sooner or later (most likely in the first 90 days of your trading.) So, to prevent this from happening, here are the best risk management strategies you need to follow if you want to become a consistently profitable trader.

Best Forex Risk Management Strategies You Need to Follow

-

Always use stop loss

If there is one thing I want you to learn from this article, it’s to always use a stop loss. Larger traders and hedge funds may have mental stop loss as they don’t want their broker to know where they want to exit, but for retail traders, this simply doesn’t make sense.

Stop-loss is an effective way to control your risk per trade and to stick to your risk management plan. Once you identify a stop loss level based on technical levels, such as horizontal support and resistance zones, you are not allowed to move your stop loss as the market approaches it.

-

The 2% Rule

The 2% rule states that the maximum amount you’re allowed to risk per trade is 2% of your available trading capital. For example, if you have a $10,000 account, then the maximum amount you can risk per any single trade is $200.

Some experienced traders use a slightly different approach. First, they may risk up to 5%, or even 10% per trade, if the trade setup they have identified looks like a high-probability one, based on their experience. Other traders like to start with a small position, such as 1%, and slowly add to their trade as it runs into profit.

All in all, the basic thing to understand here is that risking a small amount of capital allows you to stay in the game in the long term. Five consecutive losses won’t hurt much with a 2% risk-per-trade, but they would represent a whopping 50% loss if you had risked 10% per trade.

-

Size your trades appropriately

Risking 2% per trade should be easy to understand. With a $10,000 account, you’re risking $200 per trade. But where should you place your stop-loss, and how to calculate the ideal position size to stay within your risk-per-trade limits? After all, you could place a stop-loss 5 pips away from your entry price and trade $40 per pips, which still adds to a maximum loss of $200.

Of course, a 5-pip stop-loss is non-sense. You should always place your stop-loss around important technical levels (support and resistance, for example) or at least 2xATRs (Average True Ranges) away from your entry price, whatever is greater.

Once you identify your stop-loss size, simply divide your maximum allowed loss ($200 for a $10,000 account) with the stop-loss in pips, and you’ll get the maximum pip-value in dollar terms that you’re allowed to trade.

-

Understand reward-to-risk

Risk-per-trade is just one side of the coin. The other side is the reward-to-risk ratio. Also known as R/R, this ratio divides your potential profits with your potential losses.

For example, if you risk $200 per trade and have a profit target of $600, your R/R would be 3:1. This is considered a very good R/R, so try to stick to setups that provide a reward-to-risk of at least 2:1 or higher.

Another note here, you need to be realistic when setting your profit targets. It’s easy to get a 10:1 R/R set up by placing your profit target 10 times higher than your stop-loss, but does this make sense?

Just like your stop-losses, your profit targets need to be based on important technical levels, such as support and resistance levels. Don’t shoot for the moon, look for consistent profits instead.

-

Scale into winning trades

scaling into winning trades is what makes the difference between a good and a great trader. Scaling into trades means adding to positions that are already trading in profit. You can do this by adding a constant trade size to your winning trade, such as 1% of your account size for example.

Simultaneously, you should move your stop-losses with each added position, so that you’re not risking your initial trading account balance, but rather the unrealized profits from your existing profitable positions in that trade.

-

Managing Emotions

The exchange rate in the foreign exchange market is always in a state of fluctuation and occasionally fluctuates greatly under the influence of market policies and information. Traders’ account funds will also fluctuate accordingly, resulting in short-term and large profit and loss. Without good psychological quality and emotional management, traders will surely face fear, greed, and arrogance.

When the capital loss is worried that the exchange rate will continue to fall, stop losses, and then the market rebound, regret. I believe many traders have had similar psychological experiences. This is human nature. It’s a natural reaction.

But if you want to control the inner emotional fluctuations, firmly according to their own trading plan to execute the trade, these inner emotional fluctuations will be controlled in reverse. Yes, this is the key to controlling your emotions: you have to have one of your own trading systems or plan that you can trust.

-

Build your own trading systems

The key here is to create your own trading system, ideally suited to your personality, and you need to trust the trading system to execute firmly under any circumstances.

In addition to dealing with entry and exit times, prices and rules, the trading system also requires strict money management strategies. A good trading system should have a smooth upward capital return curve, not a volatile one.

A trusted trading system will not only bring stable capital gains but also make your trading emotions in good control, which will make your trading capital and status into a virtuous circle.

Establishing your own trading system requires a thorough understanding of the forex market, in addition to technical analysis indicators and money management strategies.

-

Understand The Forex Market

Nearly $6 trillion is traded in foreign exchange each day, but Forex is not a “market” in the traditional sense. It doesn’t have specific trading floors like stocks and futures. Foreign exchange transactions are carried out simultaneously among hundreds of banks around the world through telephone and computer terminals.

-

Trading Hours in the Forex Market

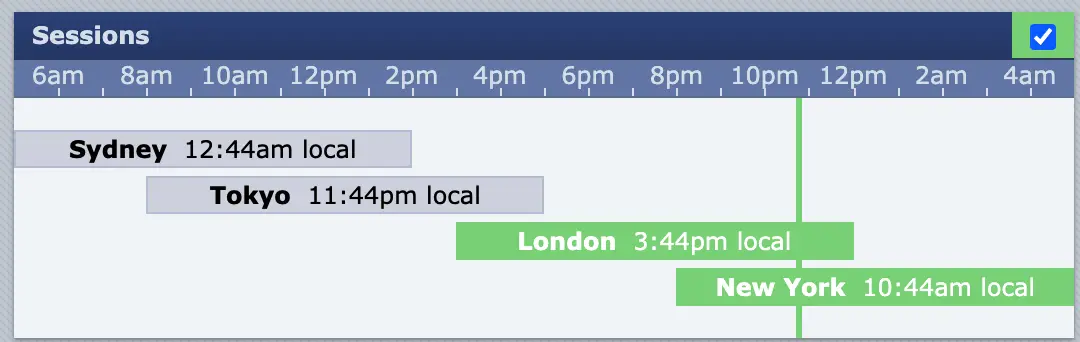

The forex market operates 24 hours a day and foreign currency trading continues throughout the week. There are traders in almost every time zone (London, New York, Tokyo, Hong Kong, Sydney, etc.) who are willing to quote on foreign exchange. There are four main trading hours each day, corresponding to the opening hours of banks in London, New York, Sydney, and Tokyo, and there is a large amount of trading in each trading hour, especially when the hours overlap.

-

Currency volatility

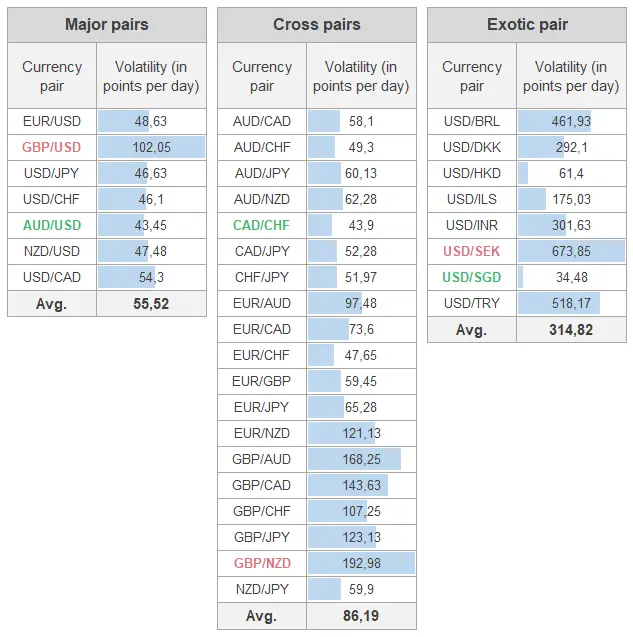

Exchange rate fluctuations create trading opportunities that allow us to make profits in the foreign exchange market.

The main cause of volatility is liquidity. A classic rule is that the more liquidity, the less volatility, and vice versa.

In fact, liquidity is the amount of supply and demand in the market. This means that the greater the supply and demand, the more difficult it is for prices to fluctuate.

Based on this rule, we can conclude that, since the less traded currencies tend to be less liquid in the market than the major currency pairs, the less traded currency pairs in the foreign exchange market are the most volatile.

Volatility also often occurs during major economic data releases. However, this volatility of the trading risk is relatively large, must have a corresponding trading market news strategy.

-

Correlation between currency pairs

In terms of managing risk, you can start to think about using correlations to diversify. Let’s take Eur/USD and AUD/USD as examples, as they tend to have weaker correlations.

For example, if you are bearish on the DOLLAR, you can take a different approach and go long in euro/USD and Aud/USD. You can spread your risk between the two positions, and since eurUSD and Aussie will have different monetary policies, they are likely to react differently to a USD rally.

-

Avoid important market news

The release of important forex market news may lead to drastic fluctuations in currency prices in a short period of time, and even change the original market direction, such as the release of Federal Reserve interest rate information and employment information of various countries, so it is better to avoid the release time of important information when making trading plans.

Of course, you can also tailor your trading strategy to these important news items.

-

Start with a demo or Small fund account

If you have created a trading system or strategy that needs to be tested, of course, use an account based on a live data presentation. But if you are a newbie to trading or have a tested trading system or strategy, we strongly recommend that you start your trading with a real small fund account. Whether it’s profit or loss, real money accounts can give you the feeling of real trading, and only on a real battlefield can you train a real general.

Final Words

Risk management is arguably the most important part of a trading plan. Traders who don’t manage their risk are doomed, they will blow their account once their emotions take over control over their decision-making process.

If you still don’t have any risk management rules in your trading plan, don’t place a new trade until you develop them! Risk-per-trade, reward-to-risk, and stop-loss levels need to be strictly defined if you want to be a successful trader in the long term.