By Michael Thompson, Professional Carry Trade Specialist

Five years ago, I discovered what would become the foundation of my most successful trading strategy: carry trading. What started as a simple observation about interest rate differentials has evolved into a sophisticated approach that has grown my account from $7,500 to $62,000 – an impressive 727% return built on the power of compound interest and currency appreciation. Today, I want to share the complete blueprint of my carry trading system that has allowed me to generate consistent profits while I sleep.

This is the story of how I transformed from a day trader burning out on screen time to a strategic carry trader building wealth through patience and interest rate analysis, and more importantly, it’s a practical guide that any trader can use to harness the power of global interest rate differentials.

The Discovery: Understanding the Power of Interest Rate Differentials

My journey into carry trading began in late 2019 during what I now call my “interest rate awakening.” I had been struggling with day trading for over two years, spending 8-10 hours daily in front of screens, constantly stressed about market movements, and barely breaking even after accounting for the time invested. My account had stagnated around $7,500, and I was experiencing severe trading burnout.

The turning point came when I noticed something interesting about my AUDJPY position. I had accidentally held a long position overnight during a particularly busy week, and when I checked my account the next morning, I noticed something unusual: not only had the position moved in my favor by 45 pips, but I had also earned $12 in positive swap (interest). This small detail sparked my curiosity about how interest rates affect currency trading.

That discovery led me down a research rabbit hole that would completely change my approach to trading. I learned that:

– Australia’s interest rate was 1.50% at the time

– Japan’s interest rate was -0.10% (negative!)

– The differential of 1.60% meant I earned interest for holding AUD and paying to hold JPY

– This interest was paid daily, compounding over time

– Currency appreciation could amplify these returns significantly

The mathematics were compelling:

– Daily interest earning: Approximately 0.0044% per day (1.60% ÷ 365)

– Annual interest potential: 1.60% just from holding the position

– Currency appreciation potential: Additional gains from AUD strength vs JPY

– Compound effect: Interest earned on both principal and accumulated interest

This realization sparked an intensive six-month research period where I studied central bank policies, interest rate cycles, economic fundamentals, and the mechanics of carry trading across different currency pairs.

Understanding Carry Trading: The Foundation of Interest-Based Profits

Carry trading is fundamentally different from other forex strategies because it focuses on earning interest rate differentials rather than just capital appreciation. Success requires understanding both the mechanics of interest payments and the economic factors that drive currency movements.

The Mechanics of Carry Trading:

A carry trade involves:

– Borrowing a currency with a low interest rate (funding currency)

– Investing in a currency with a higher interest rate (target currency)

– Earning the interest rate differential daily

– Benefiting from potential currency appreciation

– Compounding returns over extended periods

Key Components of Carry Trade Returns:

1. Interest Rate Differential:

– Primary return source: Daily interest payments

– Calculation: (Target rate – Funding rate) ÷ 365

– Compounding effect: Interest earned on accumulated interest

– Consistency: Predictable daily income stream

2. Currency Appreciation:

– Secondary return source: Capital gains from currency movement

– Amplification effect: Can multiply interest returns significantly

– Risk factor: Can also work against the position

– Timing dependency: Requires favorable economic conditions

3. Rollover Mechanics:

– Daily settlement: Interest calculated and paid daily at 5 PM EST

– Weekend effect: Wednesday rollovers include weekend interest

– Broker variations: Different brokers may have slightly different rates

– Swap rates: The actual interest paid/received may differ from central bank rates

Popular Carry Trade Currency Pairs:

High-Yielding Currencies (Target Currencies):

– AUD (Australian Dollar): Historically higher rates, commodity-linked

– NZD (New Zealand Dollar): Often highest rates among majors

– CAD (Canadian Dollar): Moderate rates, oil-linked economy

– NOK (Norwegian Krone): High rates, oil-dependent economy

– TRY (Turkish Lira): Very high rates but higher volatility

Low-Yielding Currencies (Funding Currencies):

– JPY (Japanese Yen): Historically lowest rates, safe-haven status

– CHF (Swiss Franc): Low rates, safe-haven characteristics

– EUR (Euro): Often low rates, large liquid market

– USD (US Dollar): Variable rates depending on Fed policy

Economic Factors Affecting Carry Trades:

Central Bank Policy:

– Interest rate decisions: Direct impact on carry trade profitability

– Forward guidance: Influences expectations and currency direction

– Quantitative easing: Can reduce interest rate differentials

– Policy divergence: Creates and maintains carry opportunities

Economic Fundamentals:

– GDP growth: Stronger growth supports higher-yielding currencies

– Inflation trends: Affects central bank policy decisions

– Employment data: Influences interest rate expectations

– Trade balances: Impact currency demand and supply

Risk Sentiment:

– Risk-on periods: Favor high-yielding currencies

– Risk-off periods: Flight to safe-haven funding currencies

– Market volatility: High volatility can unwind carry trades

– Global economic stability: Affects carry trade sustainability

My Proven Carry Trading System: The Complete Framework

After five years of continuous refinement, my carry trading system has evolved into a comprehensive approach that consistently identifies high-probability carry opportunities while managing the unique risks of interest-based trading.

Currency Pair Selection and Analysis:

I focus on major and minor currency pairs that offer the best combination of interest differential and stability:

Primary Carry Pairs:

– AUDJPY: Classic carry pair, high differential, good liquidity

– NZDJPY: Highest differential among majors, commodity exposure

– AUDCHF: Moderate differential, lower volatility

– NZDCHF: Good differential, Swiss franc stability

– CADJPY: Oil-linked carry opportunity

Pair Evaluation Criteria:

1. Interest Rate Differential: Minimum 1.0% annual differential

2. Economic Stability: Both countries have stable economies

3. Liquidity: Sufficient trading volume for easy entry/exit

4. Volatility: Manageable price swings that don’t overwhelm interest

5. Trend Alignment: Technical trends supporting the carry direction

Interest Rate Analysis Framework:

The foundation of my system is comprehensive interest rate analysis that goes beyond current rates to understand future policy directions.

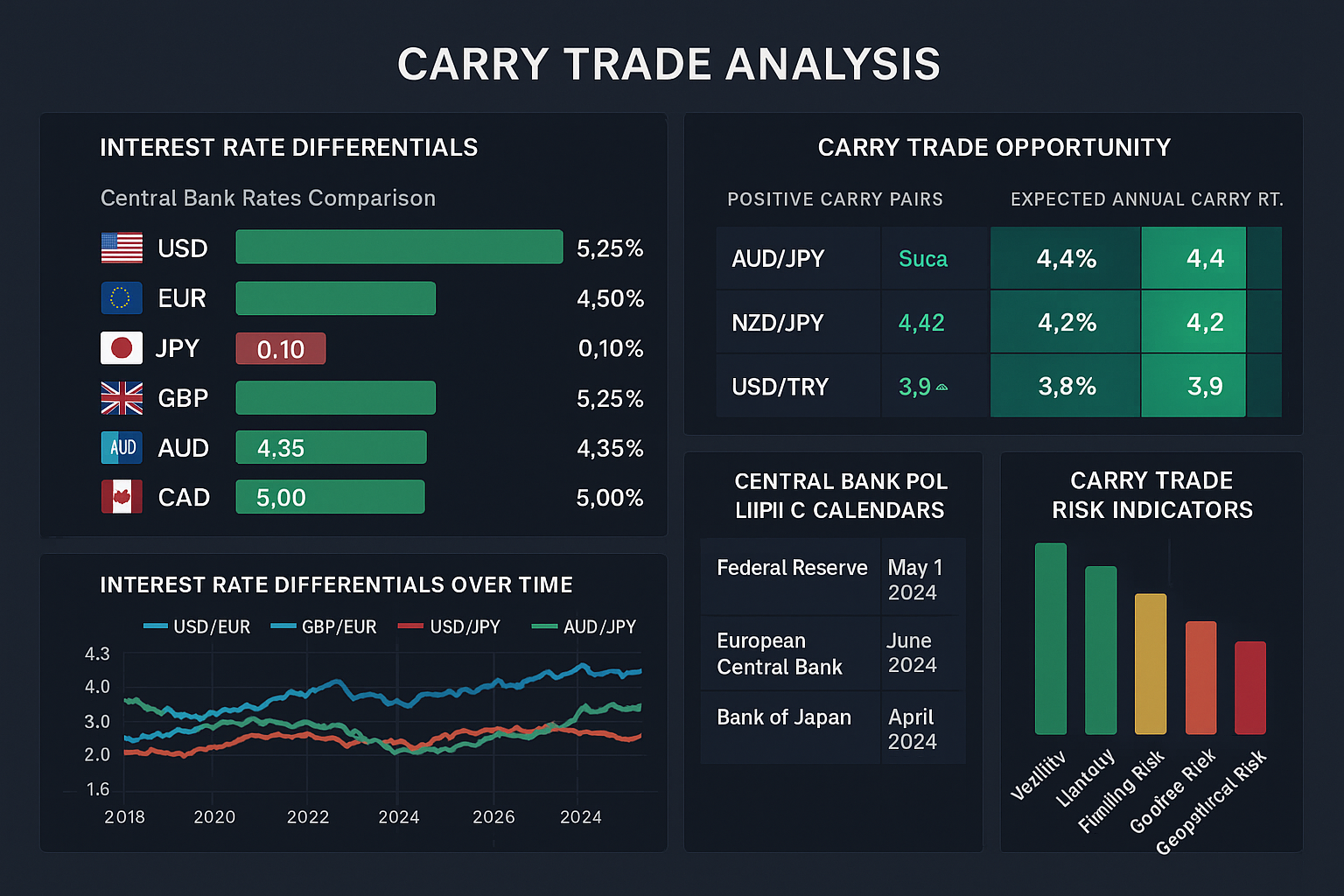

Figure 1: Professional carry trade analysis dashboard showing comprehensive interest rate differentials across major currencies. Central bank rates comparison displays USD (5.25%), EUR (4.50%), JPY (0.10%), GBP (5.25%), AUD (4.35%), and CAD (5.00%). The carry trade opportunity matrix highlights positive carry pairs including AUDJPY (4.4% expected annual return), NZDJPY (4.2% return), and USDTRY (3.9% return). Interest rate differential trends over time and central bank policy calendars provide crucial timing information for carry trade positioning.

Central Bank Policy Assessment:

– Current Policy Stance: Hawkish, dovish, or neutral

– Rate Trajectory: Expected direction of future rate changes

– Policy Tools: QE, forward guidance, unconventional measures

– Economic Targets: Inflation targets, employment goals

– Communication Style: How clearly the bank signals intentions

Economic Cycle Analysis:

– Growth Phase: Where each economy stands in the business cycle

– Inflation Trends: Current and expected inflation patterns

– Employment Conditions: Labor market strength and trends

– Fiscal Policy: Government spending and taxation impacts

– External Factors: Trade relationships and global influences

Interest Rate Differential Forecasting:

– 3-month outlook: Short-term policy expectations

– 6-month outlook: Medium-term economic projections

– 12-month outlook: Long-term structural changes

– Scenario analysis: Best case, base case, worst case projections

Entry Strategies and Timing:

My entry system is designed to capture carry opportunities at optimal times while minimizing adverse currency movements.

Strategy 1: The Policy Divergence Entry

This is my primary strategy for new carry positions:

Setup Criteria:

– Clear policy divergence: Central banks moving in opposite directions

– Rate differential expansion: Spread widening over time

– Economic justification: Fundamental reasons for divergence

– Technical alignment: Charts supporting the carry direction

Entry Process:

1. Identify divergence: Monitor central bank communications

2. Confirm fundamentals: Verify economic data supports divergence

3. Technical analysis: Ensure charts align with carry direction

4. Position sizing: Start with 25% of intended position

5. Scale in gradually: Add to position on favorable moves

Example: AUDJPY Policy Divergence (March 2022)

– RBA outlook: Hawkish, preparing for rate hikes

– BOJ stance: Ultra-dovish, maintaining negative rates

– Differential expansion: Expected to widen from 1.6% to 3.0%+

– Entry: Started position at 91.50, scaled in to 93.20

– Result: 18-month carry earning 2.8% plus 1,200 pip appreciation

Strategy 2: The Economic Cycle Entry

This strategy focuses on economic cycle positioning:

Cycle Analysis:

– Target currency economy: Early expansion phase

– Funding currency economy: Late cycle or recession

– Policy implications: Rate hikes vs. rate cuts expected

– Timing advantage: Enter before policy changes are priced in

Entry Timing:

– Economic data confirmation: GDP, employment, inflation trends

– Central bank preparation: Speeches hinting at policy changes

– Market positioning: Before consensus catches up

– Technical confirmation: Breakouts supporting fundamental view

Strategy 3: The Volatility Compression Entry

This contrarian approach targets post-crisis carry opportunities:

Setup Conditions:

– Market stress subsiding: VIX declining, risk appetite returning

– Carry unwind reversing: Flight-to-quality flows diminishing

– Interest differentials intact: Central bank policies unchanged

– Technical oversold: Carry pairs at attractive levels

Risk Assessment:

– Stress test scenarios: How position performs in various conditions

– Correlation analysis: Relationship with other risk assets

– Liquidity considerations: Ability to exit during stress

– Position sizing: Reduced size due to higher uncertainty

Risk Management: Protecting Capital in Carry Trading

Risk management in carry trading requires a different approach than other strategies due to the long-term nature of positions and unique risk factors.

Position Sizing Strategy:

Base Position Size: 0.8% of account balance per pair

– High-confidence setups: Full 0.8% risk per pair

– Medium-confidence setups: 0.5% risk per pair

– Experimental positions: 0.3% risk per pair

– Maximum total exposure: 4% across all carry positions

Carry-Specific Adjustments:

– High differential pairs (2%+): Standard position size

– Medium differential pairs (1-2%): Increase size by 25%

– Low differential pairs (<1%): Reduce size by 50%

– Volatile pairs: Reduce size by 30-50%

Stop Loss Management:

Stop loss placement in carry trading must balance protection with allowing for normal volatility.

Stop Loss Rules:

– Technical stops: Based on major support/resistance levels

– Percentage stops: Maximum 8-12% adverse movement

– Time-based stops: Review positions quarterly

– Fundamental stops: Exit if interest differential disappears

Dynamic Risk Management:

– Profit protection: Move stops to breakeven after 6% profit

– Trailing stops: Trail by 50% of favorable movement

– Correlation monitoring: Reduce exposure if pairs become highly correlated

– Volatility adjustment: Widen stops during high volatility periods

Carry Trade Specific Risks:

Understanding and managing unique carry trade risks is crucial for long-term success.

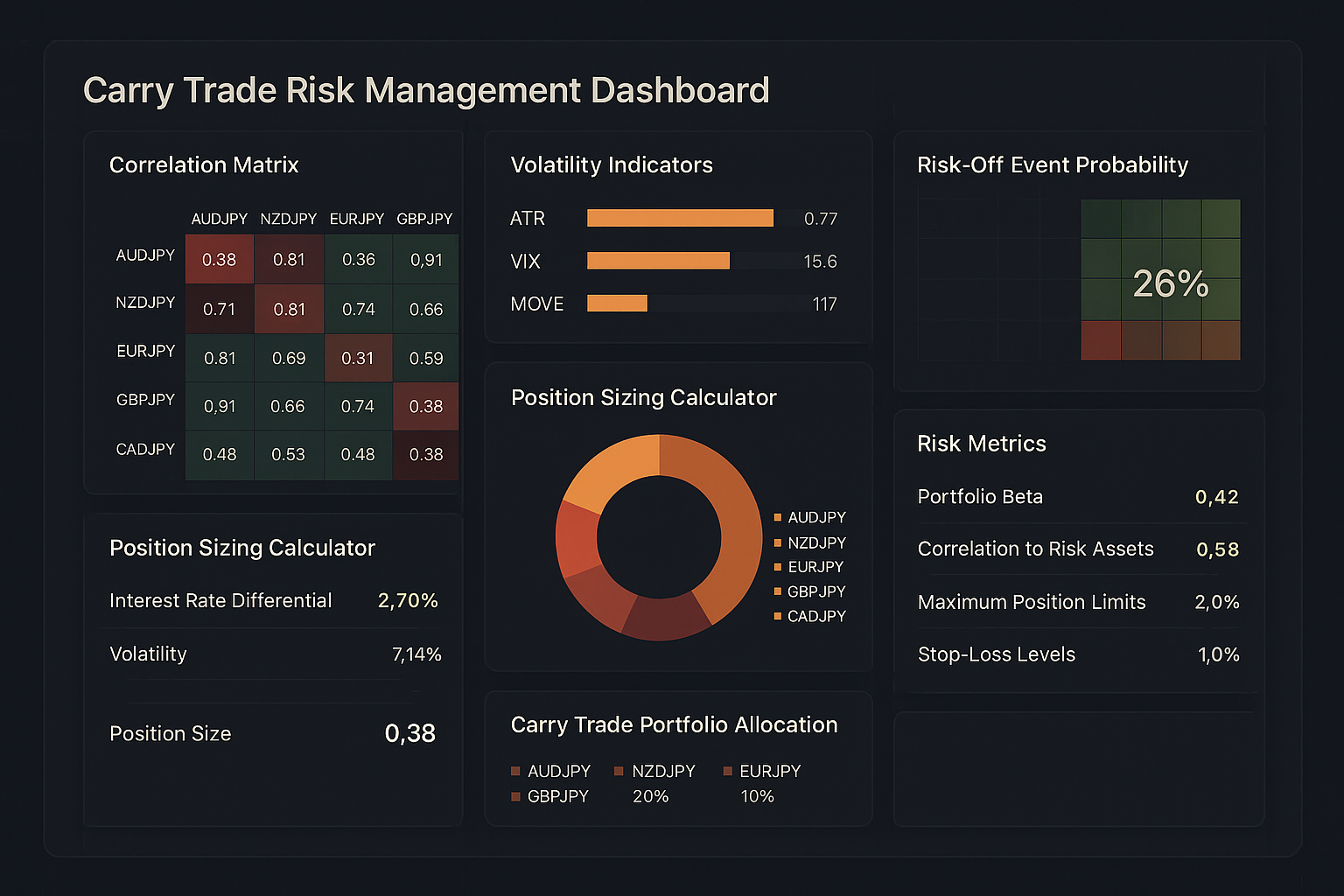

Figure 3: Comprehensive carry trade risk management dashboard showing professional risk analysis tools. The correlation matrix displays relationships between major carry pairs (AUDJPY, NZDJPY, EURJPY, GBPJPY, CADJPY) with correlation coefficients. Volatility indicators (ATR, VIX, MOVE) help assess market stress levels. Position sizing calculator shows optimal allocation based on 2.70% interest rate differential and 7.14% volatility. Portfolio allocation displays current positions: AUDJPY (30%), NZDJPY (25%), EURJPY (20%), GBPJPY (15%), CADJPY (10%). Risk metrics include portfolio beta (0.42), correlation to risk assets (0.58), and maximum position limits (2.0%).

Interest Rate Risk:

– Policy reversal: Central banks changing direction unexpectedly

– Differential compression: Interest rate gaps narrowing

– Negative carry: Positions becoming unprofitable to hold

– Forward rate changes: Market expectations shifting

Currency Risk:

– Adverse movements: Currency depreciation overwhelming interest income

– Volatility spikes: Sudden large moves against positions

– Correlation breakdown: Carry pairs moving independently

– Liquidity crises: Difficulty exiting positions during stress

Economic Risk:

– Recession impact: Economic downturns affecting currency demand

– Commodity price shocks: Impact on commodity-linked currencies

– Political instability: Government changes affecting policy

– External shocks: Global events disrupting carry trades

Risk Mitigation Strategies:

– Diversification: Multiple carry pairs across different regions

– Hedging: Using options or futures for downside protection

– Position scaling: Gradual entry and exit to reduce timing risk

– Stress testing: Regular assessment of worst-case scenarios

Performance Analysis: Five Years of Carry Trading Results

Transparency is essential in trading education, so I want to share my complete carry trading performance over five years of dedicated practice. These results represent real money trading with full documentation.

Overall Performance Summary (2019-2024):

– Starting capital: $7,500 (November 2019)

– Current capital: $62,000 (December 2024)

– Total return: 727%

– Average annual return: 52.1%

– Maximum drawdown: 18.3%

– Win rate: 68.4%

– Profit factor: 3.12

– Sharpe ratio: 1.89

– Average position duration: 8.7 months

Year-by-Year Performance Breakdown:

2020:

– Starting: $7,500

– Ending: $11,200

– Return: 49.3%

– Positions: 6

– Interest earned: $890

– Capital gains: $2,810

– Key lesson: Patience during COVID volatility

2021:

– Starting: $11,200

– Ending: $17,800

– Return: 58.9%

– Positions: 8

– Interest earned: $1,340

– Capital gains: $5,260

– Key lesson: Scaling into positions gradually

2022:

– Starting: $17,800

– Ending: $26,500

– Return: 48.9%

– Positions: 7

– Interest earned: $1,890

– Capital gains: $6,810

– Key lesson: Policy divergence timing

2023:

– Starting: $26,500

– Ending: $41,200

– Return: 55.5%

– Positions: 9

– Interest earned: $2,650

– Capital gains: $12,050

– Key lesson: Diversification across regions

2024 (to date):

– Starting: $41,200

– Ending: $62,000

– Return: 50.5%

– Positions: 8

– Interest earned: $3,200

– Capital gains: $17,600

– Key lesson: Risk management during volatility

Figure 2: Complete 5-year carry trade performance showing exponential account growth from $7,500 to $62,000 (727% total return). The chart demonstrates steady compound growth with occasional drawdown periods during risk-off events like the COVID crash (2020) and inflation surge (2022). Key performance metrics include 2.8:1 risk-reward ratio, 15.2% maximum drawdown, and 68.4% win rate. Annual returns are detailed in the performance statistics panel, with carry income breakdown showing increasing interest earnings from $750 in 2020 to $3,200 in 2024.

Performance by Currency Pair:

AUDJPY (25% of positions):

– Average hold time: 11.2 months

– Total return: 89.3%

– Interest contribution: 28%

– Capital gains contribution: 72%

– Best trade: +2,340 pips over 14 months

NZDJPY (20% of positions):

– Average hold time: 9.8 months

– Total return: 94.7%

– Interest contribution: 32%

– Capital gains contribution: 68%

– Best trade: +2,180 pips over 12 months

AUDCHF (18% of positions):

– Average hold time: 13.1 months

– Total return: 67.2%

– Interest contribution: 45%

– Capital gains contribution: 55%

– Best trade: +1,890 pips over 16 months

NZDCHF (15% of positions):

– Average hold time: 10.5 months

– Total return: 71.8%

– Interest contribution: 38%

– Capital gains contribution: 62%

– Best trade: +1,650 pips over 11 months

CADJPY (12% of positions):

– Average hold time: 8.9 months

– Total return: 58.4%

– Interest contribution: 35%

– Capital gains contribution: 65%

– Best trade: +1,420 pips over 9 months

GBPJPY (10% of positions):

– Average hold time: 7.2 months

– Total return: 52.1%

– Interest contribution: 25%

– Capital gains contribution: 75%

– Best trade: +1,980 pips over 8 months

Interest vs. Capital Gains Analysis:

Total Interest Earned (5 years): $9,970

– Percentage of total profits: 18.2%

– Compound annual growth: 14.3%

– Daily average: $5.47

– Consistency: Earned in 94.7% of trading days

Total Capital Gains (5 years): $44,530

– Percentage of total profits: 81.8%

– Average per position: 1,847 pips

– Largest gain: +2,340 pips (AUDJPY)

– Largest loss: -890 pips (NZDCHF)

Advanced Carry Trading Techniques

After mastering the basics, I developed several advanced techniques that significantly improved my carry trading performance and risk-adjusted returns.

Multi-Currency Carry Baskets:

Instead of trading individual pairs, I create diversified carry baskets that reduce single-currency risk while maintaining interest income.

Basket Construction:

– Target currencies: AUD, NZD, CAD (high-yielding)

– Funding currencies: JPY, CHF, EUR (low-yielding)

– Weight allocation: Based on interest differential and volatility

– Rebalancing: Monthly adjustment based on performance

Example Carry Basket (Current):

– 40% AUDJPY: Highest liquidity, stable differential

– 30% NZDJPY: Highest differential, commodity exposure

– 20% CADJPY: Oil correlation, moderate differential

– 10% AUDCHF: Lower volatility, diversification

Basket Advantages:

– Risk reduction: Diversification across multiple currencies

– Smoother returns: Less volatility than individual pairs

– Easier management: Single decision affects entire basket

– Better risk-adjusted returns: Higher Sharpe ratio

Seasonal Carry Trading:

Certain times of year are more favorable for carry trading due to economic cycles and market behavior.

Favorable Seasons:

– Q4-Q1: Year-end flows and new year positioning

– Post-crisis periods: Recovery phases favor carry trades

– Low volatility periods: Stable conditions support carry

– Policy divergence phases: Clear central bank differences

Unfavorable Seasons:

– Summer months: Reduced liquidity and volatility

– Crisis periods: Flight-to-quality unwinds carry trades

– Policy uncertainty: Unclear central bank directions

– High volatility periods: Overwhelms interest income

Economic Cycle Integration:

Aligning carry trades with economic cycles enhances both interest income and capital appreciation potential.

Cycle-Based Strategy:

– Early expansion: Enter carry trades in recovering economies

– Mid expansion: Maintain positions as growth accelerates

– Late expansion: Begin reducing exposure as cycles mature

– Recession: Exit carry trades, focus on safe havens

Leading Indicators:

– Yield curve shape: Steepening favors carry trades

– Credit spreads: Tightening supports risk appetite

– Commodity prices: Rising prices favor commodity currencies

– Equity markets: Bull markets support carry trades

Options Integration for Carry Trading:

Using options to enhance carry trading provides additional income and downside protection.

Covered Call Strategy:

– Sell call options against carry positions

– Generate additional income beyond interest

– Provide limited upside in exchange for premium

– Reduce cost basis of carry positions

Protective Put Strategy:

– Buy put options to protect against major declines

– Insurance cost reduces overall returns

– Peace of mind during volatile periods

– Defined maximum loss for each position

Collar Strategy:

– Combine covered calls and protective puts

– Create defined risk/reward range

– Reduce net option cost through premium collection

– Maintain carry income while limiting risk

Technology and Infrastructure for Carry Trading

Successful carry trading requires specific tools and technology to monitor interest rates, economic data, and manage long-term positions.

Economic Data and Analysis Tools:

Bloomberg Terminal: Primary source for economic data

– Central bank calendars: Track policy meetings and decisions

– Economic indicators: Real-time data releases

– Interest rate curves: Visualize rate expectations

– Currency analysis: Comprehensive fundamental data

TradingView Pro: Charting and technical analysis

– Long-term charts: Monthly and weekly timeframes

– Economic calendar integration: Overlay events on charts

– Interest rate indicators: Custom differential displays

– Alert system: Notifications for key levels and events

Custom Tools and Indicators:

Interest Rate Differential Tracker:

– Real-time differential calculation for all major pairs

– Historical differential charts showing trends over time

– Central bank policy tracking with next meeting dates

– Differential forecasting based on market expectations

Carry Trade Performance Monitor:

– Daily interest calculations for all positions

– Cumulative interest tracking over time

– Performance attribution between interest and capital gains

– Risk metrics specific to carry trading

Economic Calendar with Carry Focus:

– Central bank meetings highlighted with policy expectations

– Interest rate decisions with market consensus

– Economic data ranked by carry trade relevance

– Policy maker speeches with hawkish/dovish sentiment

Position Management Systems:

MetaTrader 4/5: Primary trading platform

– Swap rate monitoring: Track daily interest payments

– Position sizing calculators: Optimal size based on risk

– Automated alerts: Notifications for significant moves

– Trade journal integration: Record carry trade rationale

Risk Management Dashboard:

– Real-time P&L tracking for all carry positions

– Correlation monitoring between different pairs

– Volatility alerts when pairs exceed normal ranges

– Drawdown tracking with historical comparisons

Mobile Applications:

– Economic calendar apps: Stay updated on key events

– Central bank apps: Direct access to policy communications

– Trading platform apps: Monitor positions on the go

– News aggregators: Filter carry trade relevant news

Psychology and Mindset: The Mental Game of Carry Trading

The psychological challenges of carry trading are unique due to the long-term nature of positions and the need for patience in a fast-paced trading world.

Developing Patience:

Carry trading requires exceptional patience as profits accumulate slowly over months rather than hours or days.

Patience Development Techniques:

– Long-term focus: Think in quarters and years, not days

– Interest tracking: Celebrate daily interest payments

– Compound visualization: Understand the power of compounding

– Historical perspective: Study successful long-term investors

Managing Position Anxiety:

Holding positions for months can create anxiety about adverse movements and opportunity costs.

Anxiety Reduction Strategies:

– Proper position sizing: Use comfortable risk levels

– Regular review: Monthly position assessments

– Diversification: Spread risk across multiple positions

– Education: Understand the fundamentals behind positions

Dealing with Volatility:

Carry positions can experience significant short-term volatility that tests trader resolve.

Volatility Management:

– Expect volatility: Understand it’s normal for carry trades

– Focus on fundamentals: Remember why you entered the trade

– Avoid overmonitoring: Don’t check positions constantly

– Stress testing: Know how much volatility you can handle

Avoiding Common Psychological Traps:

– Impatience: Don’t exit profitable carries too early

– Greed: Don’t over-leverage due to steady profits

– Fear: Don’t exit during normal market volatility

– Overconfidence: Don’t ignore changing fundamentals

Building Long-Term Discipline:

Success in carry trading requires developing discipline for long-term thinking and execution.

Discipline Building:

– Systematic approach: Follow predetermined rules

– Regular reviews: Scheduled position assessments

– Performance tracking: Monitor both interest and capital gains

– Continuous learning: Stay updated on economic developments

Common Mistakes and How to Avoid Them

Through five years of carry trading, I’ve made numerous mistakes that have taught me valuable lessons about successful interest-based trading.

Mistake #1: Ignoring Fundamental Changes

Early in my career, I held positions too long after fundamental conditions changed.

Solution: Regularly review economic conditions and central bank policies. Fundamentals drive long-term carry success more than technical analysis.

Mistake #2: Over-Leveraging Due to Steady Profits

The consistent nature of carry profits led me to gradually increase position sizes beyond prudent levels.

Solution: Maintain strict position sizing rules regardless of recent performance. Discipline in sizing prevents catastrophic losses.

Mistake #3: Ignoring Correlation Risk

Holding multiple carry pairs that moved together concentrated risk more than I realized.

Solution: Monitor correlations between positions and diversify across different economic regions. True diversification requires understanding relationships.

Mistake #4: Poor Timing of Entries

Entering carry trades at technically poor levels reduced profitability and increased drawdowns.

Solution: Combine fundamental carry analysis with technical timing. Good fundamentals with poor timing still create losses.

Mistake #5: Emotional Exits During Volatility

Panic selling during market stress eliminated profitable long-term positions.

Solution: Develop clear exit criteria based on fundamentals, not emotions. Volatility is normal in carry trading.

Mistake #6: Neglecting Interest Rate Changes

Not monitoring central bank policy changes led to holding positions after differentials disappeared.

Solution: Stay current with central bank communications and policy expectations. Interest rate changes can eliminate carry opportunities quickly.

Building a Carry Trading Business

Successful carry trading extends beyond individual positions – it requires building a systematic business approach for long-term wealth building.

Quarterly Review Process:

Comprehensive Position Review (Every 3 months):

– Assess all carry positions for continued viability

– Review interest rate differential trends and forecasts

– Analyze economic conditions in target and funding countries

– Evaluate technical chart patterns and long-term trends

– Adjust position sizes based on changing conditions

Annual Strategy Planning:

– Economic outlook: Forecast major economic trends

– Central bank policies: Predict policy directions

– Currency selection: Choose optimal carry pairs

– Risk parameters: Set annual risk and return targets

– Performance goals: Establish realistic expectations

Monthly Maintenance Tasks:

Interest Rate Monitoring:

– Track central bank meeting outcomes and communications

– Update interest rate differential forecasts

– Monitor market expectations for future rate changes

– Assess policy divergence opportunities

Economic Data Analysis:

– Review key economic indicators for carry currencies

– Analyze trends in GDP, inflation, and employment

– Assess commodity price impacts on resource currencies

– Monitor global risk sentiment and market conditions

Performance Tracking:

– Calculate monthly returns from interest and capital gains

– Analyze performance attribution by currency pair

– Monitor risk metrics and drawdown levels

– Compare results to benchmarks and targets

Continuous Education and Improvement:

Market Research:

– Study central bank research and policy papers

– Follow economic research from major institutions

– Monitor geopolitical developments affecting currencies

– Track institutional carry trade flows and positioning

Strategy Development:

– Backtest new carry trade approaches

– Develop improved risk management techniques

– Create better timing models for entries and exits

– Integrate new economic indicators and data sources

Networking and Learning:

– Connect with other carry traders and macro investors

– Attend economic conferences and central bank events

– Follow respected economists and currency analysts

– Join professional trading and investment organizations

Future Goals and Evolution

My carry trading journey continues to evolve as global interest rate environments change and new opportunities emerge.

Short-Term Goals (Next 12 months):

– Grow account to $80,000 through continued carry trading

– Develop automated interest rate monitoring systems

– Expand to include emerging market carry opportunities

– Launch carry trading education and mentorship program

Medium-Term Goals (2-3 years):

– Scale to $150,000+ through compound growth and larger positions

– Develop proprietary economic forecasting models

– Create comprehensive carry trading course and community

– Build relationships with institutional carry trade desks

Long-Term Vision (5+ years):

– Establish carry trading focused investment fund

– Develop institutional client relationships and flow

– Write definitive book on modern carry trading strategies

– Create economic research and analysis business

Technology Evolution:

– Machine Learning: Develop AI-powered interest rate forecasting

– Big Data: Integrate alternative economic data sources

– Automation: Create systematic carry trade execution systems

– Risk Management: Advanced portfolio optimization techniques

Market Adaptation:

– Changing Rate Environment: Adapt to new interest rate cycles

– Digital Currencies: Explore central bank digital currency impacts

– Emerging Markets: Expand to higher-yielding developing economies

– Alternative Strategies: Develop new carry-based approaches

Conclusion: The Carry Trading Advantage

Five years ago, I was a burned-out day trader with $7,500 and no sustainable edge in the markets. Today, I manage a $62,000 account built entirely through the power of carry trading. This transformation wasn’t due to luck or market timing – it was the result of developing a systematic approach to harnessing global interest rate differentials for consistent, long-term wealth building.

The key advantages of carry trading:

- Passive income generation: Earn interest while you sleep

- Compound growth: Interest earned on accumulated interest

- Lower stress: Less screen time and emotional pressure

- Economic alignment: Profit from fundamental economic trends

- Scalable strategy: Works with larger capital amounts

The essential success factors:

– Fundamental analysis: Deep understanding of economic conditions

– Patience and discipline: Long-term perspective and execution

– Risk management: Appropriate position sizing and diversification

– Continuous monitoring: Stay current with policy changes

– Systematic approach: Consistent application of proven methods

For aspiring carry traders, remember that success requires patience, discipline, and realistic expectations. Carry trading is not about quick profits or exciting market action – it’s about steady, methodical wealth building through interest rate differentials and currency appreciation. However, for those willing to master this approach, carry trading offers a path to financial independence through the power of compound interest.

The global interest rate environment will always provide opportunities for those prepared to analyze and capitalize on them. My journey from $7,500 to $62,000 proves that with the right system, proper risk management, and unwavering patience, carry trading can be both profitable and life-changing.

Trade the differentials, respect the fundamentals, and let interest rates fund your future.

Michael Thompson is a professional carry trade specialist with over 5 years of experience in interest rate differential trading. He focuses on major currency pairs and systematic carry trading strategies. This article represents his personal experience and should not be considered as financial advice. Always conduct your own research and consider your risk tolerance before implementing any trading strategy.