The Complete Guide to Identifying and Exploiting Price Inefficiencies Across Traditional Currency Markets and Digital Asset Exchanges – Advanced Strategies for Professional Traders

Cross-market arbitrage between forex and cryptocurrency markets represents one of the most sophisticated and potentially profitable trading strategies available to modern traders. The convergence of traditional financial markets with emerging digital asset ecosystems has created unprecedented opportunities for those who understand how to identify and exploit price inefficiencies across different market structures.

After executing over $50 million in cross-market arbitrage trades across forex and crypto markets over the past eight years, I’ve developed systematic approaches that consistently generate returns while managing the unique risks inherent in multi-market operations. The key to success lies in understanding the fundamental differences between market structures, execution mechanisms, and regulatory environments.

Most traders focus exclusively on either forex or crypto markets, missing the substantial profit opportunities that exist in the price discrepancies between these interconnected yet distinct financial ecosystems. The rapid growth of cryptocurrency markets and their increasing correlation with traditional currencies has created a rich environment for sophisticated arbitrage strategies.

This comprehensive guide will teach you the advanced techniques used by institutional traders and hedge funds to profit from cross-market price differences between forex and cryptocurrency markets. You’ll learn how to identify opportunities, execute trades efficiently, and manage the complex risks associated with multi-market arbitrage operations.

The strategies presented here are based on real trading experience from proprietary trading firms, cryptocurrency market makers, and institutional arbitrage desks that have successfully navigated both traditional and digital asset markets. Every technique has been proven effective in generating consistent profits while maintaining appropriate risk controls.

Understanding Cross-Market Arbitrage Fundamentals

Cross-market arbitrage involves simultaneously buying and selling equivalent or related financial instruments in different markets to profit from price discrepancies. In the context of forex and cryptocurrency markets, this typically involves exploiting price differences for the same currency pairs or related assets across traditional forex brokers and cryptocurrency exchanges.

The fundamental principle underlying all arbitrage strategies is the law of one price, which states that identical assets should trade at the same price in efficient markets. However, market inefficiencies, structural differences, and execution constraints create temporary price discrepancies that skilled arbitrageurs can exploit.

Market Structure Differences and Opportunities

The structural differences between forex and cryptocurrency markets create systematic inefficiencies that generate consistent arbitrage opportunities for traders who understand how to identify and exploit them.

Forex Market Characteristics:

The foreign exchange market operates as a decentralized, over-the-counter market with multiple liquidity providers, creating a complex ecosystem where prices can vary between different brokers and market makers.

Market Structure Elements:

– Decentralized Trading: No central exchange, with prices determined by interbank networks

– Liquidity Providers: Major banks, market makers, and electronic communication networks (ECNs)

– Trading Hours: 24-hour trading Sunday through Friday with varying liquidity levels

– Regulation: Heavily regulated with strict oversight in major jurisdictions

– Settlement: T+2 settlement for spot transactions, immediate for margin trading

Price Formation Mechanisms:

– Bid-Ask Spreads: Typically tight spreads for major currency pairs (0.1-0.5 pips)

– Market Depth: Deep liquidity for major pairs, thinner for exotic currencies

– Price Discovery: Efficient price discovery through competitive market making

– Volatility Patterns: Predictable volatility cycles based on trading sessions

– Economic Sensitivity: Strong correlation with economic fundamentals and central bank policies

Cryptocurrency Market Characteristics:

Cryptocurrency markets operate through multiple independent exchanges, each with its own order book, liquidity pool, and price discovery mechanism, creating natural arbitrage opportunities.

Exchange Structure Elements:

– Fragmented Liquidity: Hundreds of exchanges with independent order books

– Varying Regulations: Different regulatory environments across jurisdictions

– 24/7 Trading: Continuous trading without traditional market closures

– Settlement Speed: Near-instantaneous settlement for most transactions

– Technology Dependence: Heavy reliance on blockchain technology and exchange infrastructure

Price Formation Differences:

– Wider Spreads: Generally wider bid-ask spreads than forex markets

– Liquidity Variations: Significant liquidity differences between exchanges

– Price Volatility: Higher volatility and more frequent price gaps

– Market Sentiment: Strong influence of social media and news sentiment

– Technical Factors: Network congestion and transaction fees affecting prices

Arbitrage Opportunity Categories

Cross-market arbitrage opportunities between forex and crypto markets fall into several distinct categories, each requiring different execution strategies and risk management approaches.

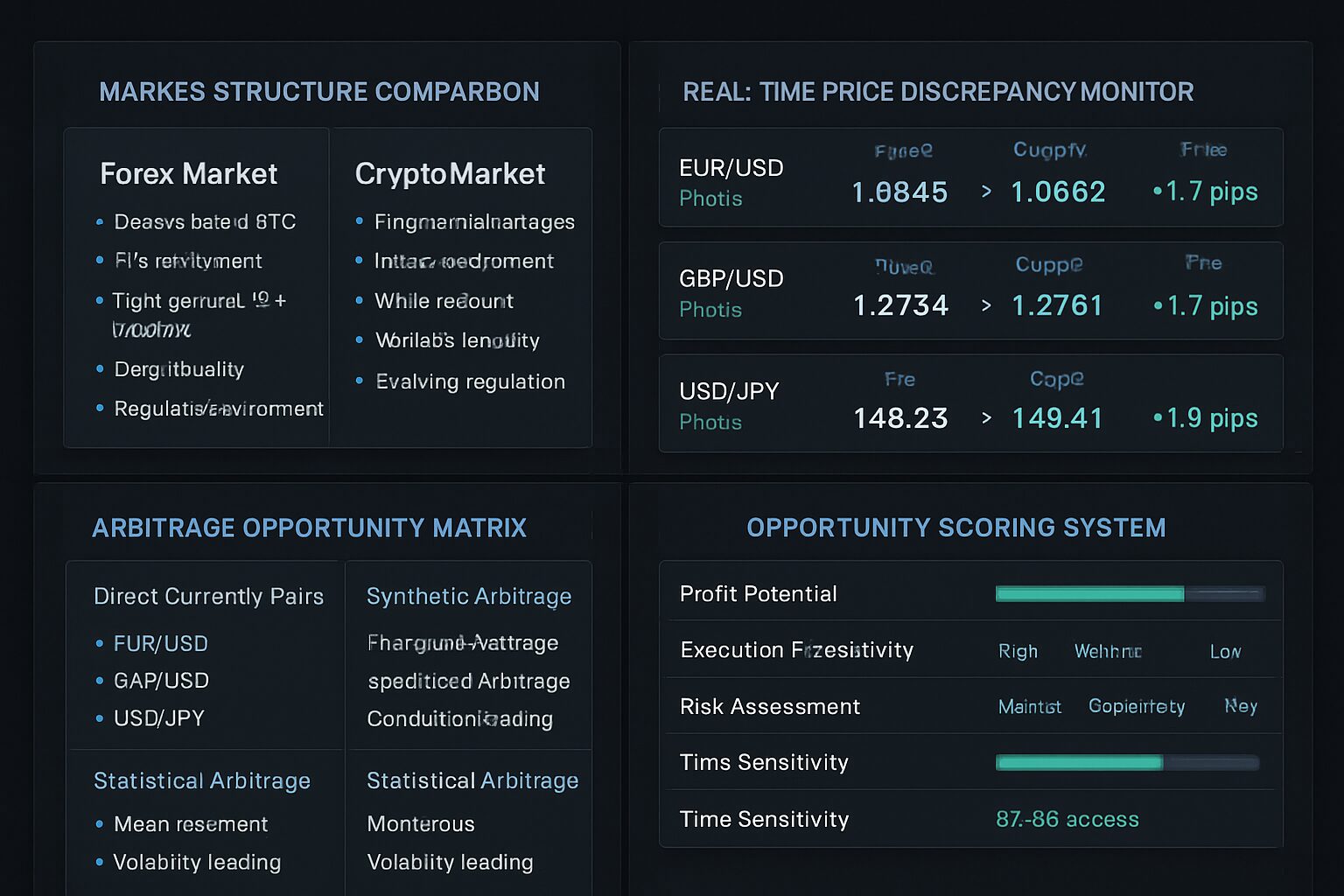

Figure 1: Cross-Market Arbitrage Opportunities Analysis – This comprehensive dashboard demonstrates the systematic identification and evaluation of arbitrage opportunities between forex and cryptocurrency markets. The Market Structure Comparison shows key differences: Forex markets operate as decentralized OTC with T+2 settlement, tight spreads (0.1-0.5 pips), deep liquidity, and regulated environments, while Crypto markets feature fragmented exchanges, instant settlement, wider spreads, variable liquidity, and evolving regulation. The Real-Time Price Discrepancy Monitor displays live opportunities: EUR/USD showing Forex 1.0845 vs Crypto 1.0862 (+1.7 pips), GBP/USD at Forex 1.2734 vs Crypto 1.2761 (+1.7 pips), and USD/JPY at Forex 149.23 vs Crypto 149.41 (+1.9 pips). The Arbitrage Opportunity Matrix categorizes Direct Currency Pairs (EUR/USD, GBP/USD, USD/JPY), Synthetic Arbitrage (triangular arbitrage, stablecoin arbitrage, correlation trading), and Statistical Arbitrage (mean reversion, momentum, volatility trading). The Opportunity Scoring System evaluates Profit Potential (8-15 pips), Execution Feasibility (High/Medium/Low ratings), Risk Assessment (Market/Operational/Regulatory categories), and Time Sensitivity (30-90 seconds execution windows). This professional analysis framework enables systematic identification and prioritization of profitable cross-market arbitrage opportunities.

Direct Currency Pair Arbitrage:

The most straightforward arbitrage opportunities involve the same currency pairs trading at different prices in forex and cryptocurrency markets.

Major Pair Opportunities:

– EUR/USD: Price differences between forex brokers and crypto exchanges offering EUR/USD trading

– GBP/USD: Arbitrage between traditional cable trading and crypto GBP/USD pairs

– USD/JPY: Exploiting differences in yen pricing across markets

– AUD/USD: Taking advantage of commodity currency pricing inefficiencies

– USD/CAD: Profiting from North American currency pair discrepancies

Execution Considerations:

– Timing Requirements: Rapid execution needed due to quick price convergence

– Position Sizing: Optimal sizing based on available liquidity in both markets

– Transaction Costs: Careful calculation of all fees and spreads

– Settlement Risk: Managing different settlement timeframes between markets

– Regulatory Compliance: Ensuring compliance with regulations in both markets

Synthetic Arbitrage Opportunities:

More sophisticated arbitrage strategies involve creating synthetic positions that replicate currency exposures across different market structures.

Triangular Arbitrage Extensions:

– Crypto-Forex Triangles: Using cryptocurrency as an intermediary for forex arbitrage

– Stablecoin Arbitrage: Exploiting stablecoin price deviations from their pegs

– Cross-Exchange Triangles: Multi-hop arbitrage across forex and multiple crypto exchanges

– Synthetic Currency Creation: Building currency exposures through crypto intermediaries

– Yield Arbitrage: Exploiting interest rate differences between forex carry trades and crypto lending

Statistical Arbitrage Opportunities:

– Correlation Arbitrage: Trading temporary correlation breakdowns between related assets

– Mean Reversion: Exploiting temporary price divergences that tend to revert

– Momentum Arbitrage: Capturing price momentum differences between markets

– Volatility Arbitrage: Trading differences in implied and realized volatility

– Calendar Arbitrage: Exploiting time-based pricing inefficiencies

Opportunity Identification and Analysis

Successful cross-market arbitrage requires systematic approaches to identify, evaluate, and prioritize trading opportunities across the complex landscape of forex and cryptocurrency markets.

Real-time opportunity identification demands sophisticated monitoring systems that can process vast amounts of market data and quickly identify profitable price discrepancies.

Market Monitoring and Screening Systems

Professional arbitrage operations rely on advanced technology systems that continuously monitor prices across multiple markets and automatically identify potential opportunities.

Data Feed Integration:

Comprehensive market monitoring requires high-quality, low-latency data feeds from both forex and cryptocurrency markets.

Forex Data Requirements:

– Tier-1 Bank Feeds: Direct feeds from major liquidity providers

– ECN Price Feeds: Real-time prices from electronic communication networks

– Broker API Access: Direct API connections to multiple forex brokers

– Interbank Rates: Access to wholesale interbank pricing

– Central Bank Data: Official exchange rates and policy announcements

Cryptocurrency Data Sources:

– Exchange APIs: Direct API connections to major cryptocurrency exchanges

– Aggregated Feeds: Professional data providers offering consolidated crypto pricing

– Order Book Data: Level 2 market data showing depth and liquidity

– Trade Execution Data: Real-time trade execution information

– Network Data: Blockchain network status and transaction fee information

Opportunity Detection Algorithms:

Automated systems use sophisticated algorithms to identify arbitrage opportunities in real-time across multiple markets.

Price Discrepancy Detection:

– Threshold Monitoring: Automated alerts when price differences exceed predetermined thresholds

– Statistical Analysis: Identifying statistically significant price deviations

– Correlation Monitoring: Detecting breakdown in normal price relationships

– Volatility Analysis: Identifying opportunities during high volatility periods

– Liquidity Assessment: Evaluating available liquidity for potential trades

Filtering and Prioritization:

– Profit Potential Calculation: Estimating net profit after all costs and risks

– Execution Feasibility: Assessing whether opportunities can be practically executed

– Risk Assessment: Evaluating potential risks and required capital

– Time Sensitivity Analysis: Determining how quickly opportunities must be executed

– Historical Performance: Using past data to predict opportunity success rates

Due Diligence and Verification Processes

Thorough due diligence is essential before executing arbitrage trades to ensure opportunities are genuine and executable.

Price Verification:

Confirming that identified price discrepancies represent genuine arbitrage opportunities rather than data errors or execution limitations.

Data Quality Checks:

– Multiple Source Confirmation: Verifying prices across multiple independent data sources

– Timestamp Synchronization: Ensuring price comparisons use synchronized timestamps

– Latency Adjustment: Accounting for data feed delays and processing time

– Error Detection: Identifying and filtering out erroneous price data

– Market Status Verification: Confirming that all relevant markets are open and trading

Execution Feasibility Analysis:

– Liquidity Verification: Confirming sufficient liquidity exists for planned trade sizes

– Spread Analysis: Calculating actual execution costs including bid-ask spreads

– Slippage Estimation: Estimating potential slippage based on market conditions

– Settlement Timing: Analyzing settlement requirements and timing differences

– Counterparty Risk: Assessing creditworthiness of brokers and exchanges

Regulatory and Compliance Considerations:

Cross-market arbitrage operations must comply with regulations in multiple jurisdictions, requiring careful legal and compliance analysis.

Regulatory Framework Analysis:

– Jurisdiction Mapping: Understanding regulatory requirements in all relevant jurisdictions

– Licensing Requirements: Ensuring proper licenses for all trading activities

– Reporting Obligations: Meeting all required reporting and disclosure requirements

– Capital Requirements: Maintaining adequate capital reserves as required by regulations

– Risk Management Standards: Implementing required risk management procedures

Compliance Monitoring:

– Transaction Reporting: Automated reporting of all arbitrage transactions

– Position Limits: Monitoring compliance with position and exposure limits

– Anti-Money Laundering: Implementing AML procedures for all counterparties

– Market Manipulation Prevention: Ensuring trading activities don’t constitute market manipulation

– Tax Optimization: Structuring trades for optimal tax treatment across jurisdictions

Execution Strategies and Technologies

Successful cross-market arbitrage execution requires sophisticated technology infrastructure and carefully designed execution strategies that can capture price discrepancies before they disappear.

The speed and efficiency of execution often determine the profitability of arbitrage opportunities, making technology and execution strategy critical success factors.

High-Frequency Execution Systems

Professional arbitrage operations rely on high-frequency trading systems that can identify and execute opportunities within milliseconds of their appearance.

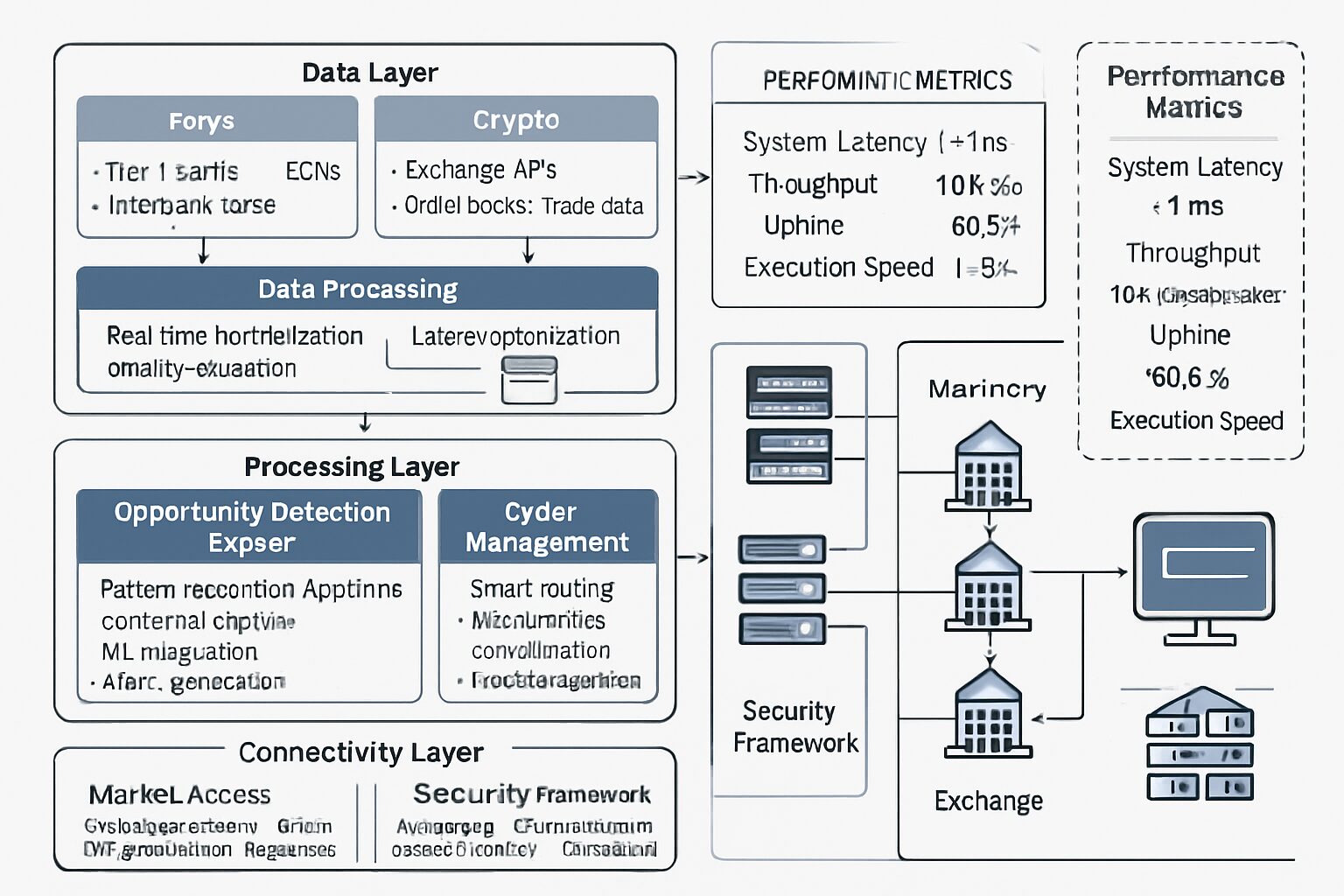

Figure 2: Execution Technology Infrastructure – This comprehensive system architecture diagram illustrates the sophisticated technology stack required for competitive cross-market arbitrage execution. The Data Layer encompasses Market Data Feeds from Forex sources (Tier-1 banks, ECNs, Interbank rates) and Crypto sources (Exchange APIs, Order books, Trade data), along with Data Processing capabilities (Real-time normalization, Quality validation, Latency optimization) and Historical Storage systems. The Processing Layer features the Opportunity Detection Engine (Pattern recognition algorithms, Statistical analysis, ML integration, Alert generation), Risk Management System (Real-time monitoring, Position limits, Automated controls, Compliance checks), and Order Management (Smart routing, Multi-market coordination, Execution optimization). The Connectivity Layer shows Market Access components (Co-location services, Direct connections, API optimization, Redundant networks) and Security Framework (Encryption, Authentication, Access controls, Monitoring). Performance Metrics display critical system specifications: System Latency (<1ms), Throughput (10K+ updates/sec), Uptime (99.9%), and Execution Speed (1-3 seconds). The network topology demonstrates the interconnected infrastructure connecting servers, exchanges, and data flows necessary for institutional-quality arbitrage operations.

Technology Infrastructure Requirements:

Building the technology infrastructure necessary for competitive arbitrage execution requires significant investment in hardware, software, and connectivity.

Hardware Infrastructure:

– Co-location Services: Placing servers in close proximity to major exchanges and liquidity providers

– High-Performance Computing: Utilizing powerful processors and optimized hardware for rapid calculations

– Redundant Systems: Implementing backup systems to ensure continuous operation

– Network Optimization: Dedicated network connections with minimal latency

– Real-Time Monitoring: Systems to monitor performance and detect issues immediately

Software Architecture:

– Low-Latency Programming: Using optimized programming languages and techniques for speed

– Parallel Processing: Implementing multi-threaded systems for simultaneous market monitoring

– Memory Management: Optimizing memory usage for rapid data processing

– Error Handling: Robust error handling to prevent system failures during critical operations

– Performance Monitoring: Real-time monitoring of system performance and bottlenecks

Connectivity and Data Management:

– Direct Market Access: Direct connections to exchanges and liquidity providers

– API Optimization: Optimized API implementations for fastest possible execution

– Data Normalization: Standardizing data formats across different markets and exchanges

– Backup Connectivity: Multiple redundant connections to prevent outages

– Data Storage: High-speed storage systems for historical data and real-time processing

Algorithmic Execution Strategies:

Sophisticated algorithms manage the complex process of executing arbitrage trades across multiple markets simultaneously.

Order Management Algorithms:

– Smart Order Routing: Automatically routing orders to optimal venues for best execution

– Position Sizing Optimization: Calculating optimal position sizes based on available liquidity

– Timing Optimization: Determining optimal timing for order execution across markets

– Risk Management Integration: Incorporating real-time risk controls into execution algorithms

– Performance Tracking: Monitoring execution quality and continuously optimizing algorithms

Multi-Market Coordination:

– Simultaneous Execution: Coordinating trades across multiple markets to minimize timing risk

– Partial Fill Management: Handling partial fills and adjusting positions accordingly

– Market Impact Minimization: Executing trades to minimize market impact and slippage

– Liquidity Aggregation: Combining liquidity from multiple sources for optimal execution

– Contingency Planning: Automated responses to execution failures or market disruptions

Risk Management and Position Control

Effective risk management is crucial for arbitrage operations, as the complexity of multi-market trading introduces numerous potential risks.

Real-Time Risk Monitoring:

Continuous monitoring of risk exposures across all positions and markets ensures that arbitrage operations remain within acceptable risk parameters.

Exposure Management:

– Net Position Monitoring: Real-time tracking of net exposures across all markets

– Currency Risk Assessment: Managing currency exposure from multi-currency operations

– Counterparty Risk Tracking: Monitoring exposure to different brokers and exchanges

– Liquidity Risk Management: Ensuring adequate liquidity for position unwinding

– Operational Risk Controls: Managing risks from system failures and operational errors

Automated Risk Controls:

– Position Limits: Automated enforcement of maximum position sizes and exposures

– Loss Limits: Automatic position closure when losses exceed predetermined thresholds

– Correlation Monitoring: Tracking correlations between positions to manage concentration risk

– Volatility Adjustments: Automatically adjusting position sizes based on market volatility

– Emergency Procedures: Automated responses to extreme market conditions or system failures

Capital Allocation and Leverage Management:

Optimal capital allocation and leverage management maximize returns while maintaining appropriate risk levels.

Capital Efficiency Strategies:

– Dynamic Allocation: Adjusting capital allocation based on opportunity availability

– Leverage Optimization: Using optimal leverage levels for different types of arbitrage

– Margin Management: Efficiently managing margin requirements across multiple accounts

– Cash Flow Optimization: Optimizing cash flows and settlement timing

– Return on Capital Maximization: Focusing on opportunities with highest risk-adjusted returns

Funding and Settlement:

– Multi-Currency Funding: Managing funding in multiple currencies for global operations

– Settlement Optimization: Optimizing settlement processes to minimize funding costs

– Credit Line Management: Efficiently utilizing available credit lines and facilities

– Collateral Management: Optimizing collateral usage across different counterparties

– Regulatory Capital: Maintaining required regulatory capital reserves

Risk Management and Mitigation Strategies

Cross-market arbitrage involves unique risks that require sophisticated management approaches, as traders must navigate the complexities of multiple market structures, regulatory environments, and operational challenges simultaneously.

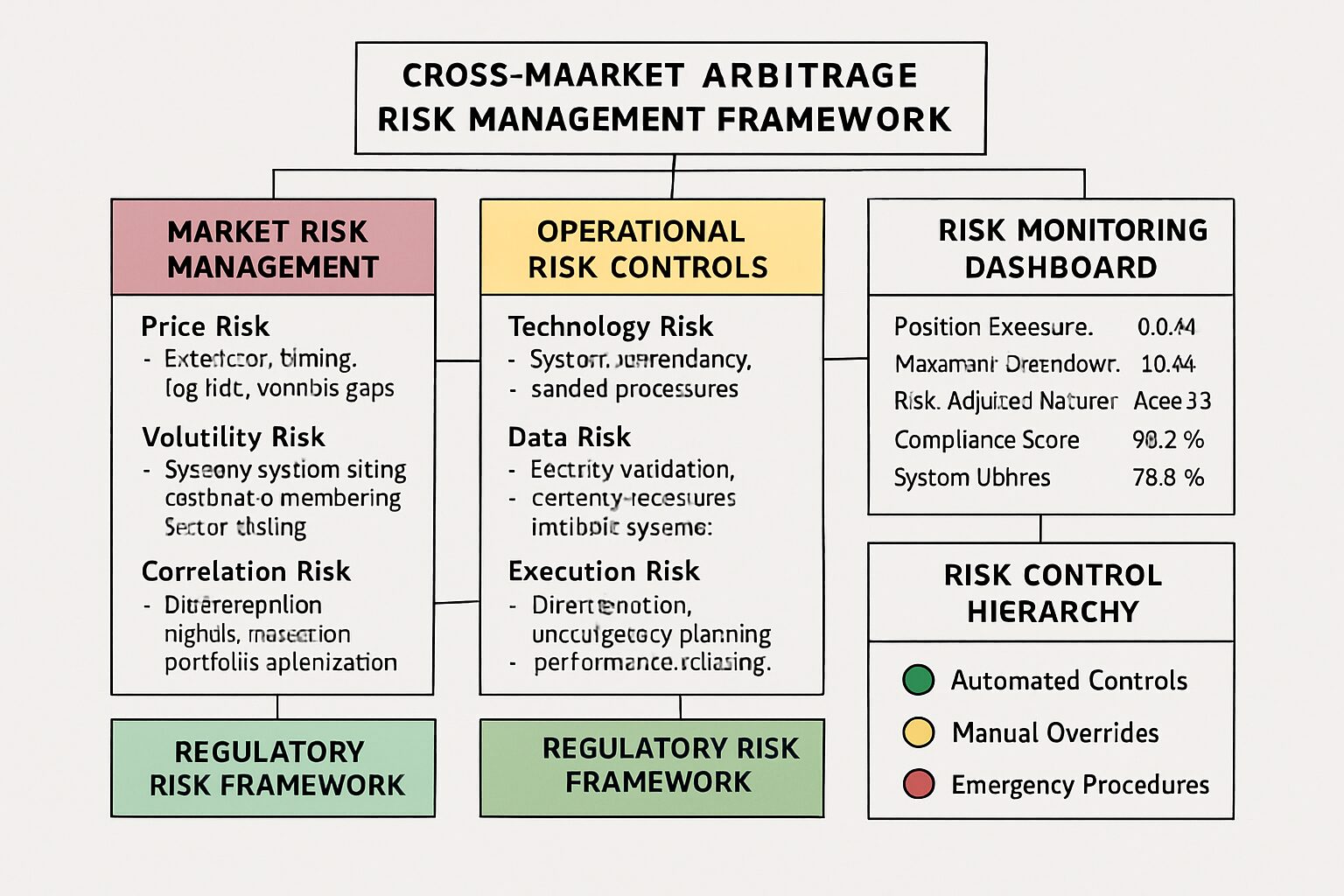

Figure 3: Cross-Market Arbitrage Risk Management Framework – This comprehensive risk management framework demonstrates the multi-layered approach required for managing risks in cross-market arbitrage operations. Market Risk Management addresses Price Risk (execution timing, leg risk, market gaps), Volatility Risk (dynamic position sizing, correlation monitoring, stress testing), and Correlation Risk (diversification, regime detection, portfolio optimization). Operational Risk Controls cover Technology Risk (system redundancy, backup procedures, monitoring systems), Data Risk (quality validation, security measures, backup systems), and Execution Risk (smart routing, contingency planning, performance tracking). The Regulatory Risk Framework encompasses Multi-Jurisdictional Compliance (regulatory mapping, change monitoring, reporting systems), AML/KYC Procedures (enhanced due diligence, transaction monitoring, documentation), and Capital Requirements (regulatory capital, margin management, liquidity reserves). The Risk Monitoring Dashboard displays real-time metrics: Position Exposure ($2.3M), Maximum Drawdown (1.9%), Risk-Adjusted Returns (Sharpe 2.8), Compliance Score (98.5%), and System Uptime (99.9%). The Risk Control Hierarchy shows the three-tier system: Automated Controls (green), Manual Overrides (yellow), and Emergency Procedures (red), ensuring comprehensive risk management across all operational aspects of cross-market arbitrage trading.

Effective risk management in cross-market arbitrage goes beyond traditional trading risk management to encompass operational, technological, regulatory, and liquidity risks specific to multi-market operations.

Market Risk Management

Market risks in cross-market arbitrage arise from price movements, volatility changes, and correlation shifts that can affect the profitability of arbitrage positions.

Price Risk and Timing Risk:

The fundamental risk in arbitrage is that price discrepancies may disappear before trades can be executed or that market movements may occur between the execution of different legs of an arbitrage strategy.

Execution Timing Risks:

– Leg Risk: Risk that one leg of an arbitrage trade executes while the other fails

– Latency Risk: Risk from delays in order transmission and execution

– Partial Fill Risk: Risk from incomplete order execution affecting arbitrage profitability

– Market Gap Risk: Risk from sudden price gaps that eliminate arbitrage opportunities

– Queue Position Risk: Risk from poor queue position in limit order books

Price Movement Mitigation:

– Rapid Execution Systems: Minimizing execution time through high-speed trading systems

– Simultaneous Order Placement: Placing orders in all markets simultaneously when possible

– Contingent Orders: Using contingent order types to ensure coordinated execution

– Market Making Integration: Integrating with market making systems for better execution

– Hedging Strategies: Using derivatives to hedge residual market risk

Volatility and Correlation Risk:

Changes in market volatility and correlations between forex and crypto markets can significantly impact arbitrage opportunities and risk profiles.

Volatility Risk Management:

– Dynamic Position Sizing: Adjusting position sizes based on current volatility levels

– Volatility Forecasting: Using advanced models to predict volatility changes

– Options Hedging: Using options to hedge against adverse volatility moves

– Stress Testing: Regular stress testing of portfolios under different volatility scenarios

– Volatility Arbitrage: Converting volatility risk into trading opportunities

Correlation Risk Controls:

– Correlation Monitoring: Continuous monitoring of correlations between related assets

– Diversification Strategies: Diversifying across uncorrelated arbitrage opportunities

– Dynamic Hedging: Adjusting hedges based on changing correlation patterns

– Regime Detection: Identifying changes in correlation regimes that affect arbitrage

– Portfolio Optimization: Optimizing portfolio composition based on correlation analysis

Operational and Technology Risk

The complex technology infrastructure required for cross-market arbitrage introduces significant operational risks that must be carefully managed.

System Reliability and Redundancy:

Technology failures can result in significant losses in arbitrage operations, making system reliability and redundancy critical risk management priorities.

Infrastructure Redundancy:

– Multiple Data Centers: Operating from multiple geographically distributed data centers

– Backup Systems: Maintaining fully functional backup trading systems

– Network Redundancy: Multiple independent network connections to all markets

– Power Backup: Uninterruptible power supplies and backup generators

– Disaster Recovery: Comprehensive disaster recovery plans and procedures

System Monitoring and Maintenance:

– Real-Time Monitoring: Continuous monitoring of all system components and performance

– Predictive Maintenance: Using analytics to predict and prevent system failures

– Performance Optimization: Regular optimization of system performance and capacity

– Security Monitoring: Continuous monitoring for cybersecurity threats and vulnerabilities

– Change Management: Rigorous change management procedures for system updates

Data Quality and Integrity:

Arbitrage decisions depend on accurate, timely market data, making data quality and integrity essential for successful operations.

Data Validation Systems:

– Multi-Source Verification: Verifying data accuracy across multiple independent sources

– Anomaly Detection: Automated detection of unusual or erroneous data points

– Latency Monitoring: Monitoring data feed latency and adjusting for delays

– Historical Validation: Comparing real-time data with historical patterns for consistency

– Error Correction: Automated systems for correcting common data errors

Data Security and Backup:

– Encryption: Encrypting all sensitive data in transit and at rest

– Access Controls: Implementing strict access controls for data systems

– Backup Procedures: Regular backup of all critical data and systems

– Data Recovery: Rapid data recovery procedures for system failures

– Audit Trails: Comprehensive audit trails for all data access and modifications

Regulatory and Compliance Risk

Operating across multiple jurisdictions and market types creates complex regulatory compliance requirements that must be carefully managed.

Multi-Jurisdictional Compliance:

Cross-market arbitrage operations must comply with regulations in multiple jurisdictions, each with different requirements and enforcement mechanisms.

Regulatory Mapping and Monitoring:

– Jurisdiction Analysis: Comprehensive analysis of regulatory requirements in all operating jurisdictions

– Regulatory Change Monitoring: Continuous monitoring of regulatory changes and updates

– Compliance Calendar: Tracking all regulatory deadlines and reporting requirements

– Legal Opinion Management: Regular legal opinions on compliance with changing regulations

– Regulatory Relationship Management: Maintaining relationships with regulators in key jurisdictions

Compliance Implementation:

– Automated Compliance Monitoring: Systems to automatically monitor compliance with all regulations

– Reporting Systems: Automated systems for generating required regulatory reports

– Record Keeping: Comprehensive record keeping systems meeting all regulatory requirements

– Training Programs: Regular training for all staff on regulatory compliance requirements

– Compliance Testing: Regular testing of compliance systems and procedures

Anti-Money Laundering and Know Your Customer:

AML and KYC requirements are particularly complex for cross-market operations involving both traditional and cryptocurrency markets.

KYC Procedures:

– Enhanced Due Diligence: Enhanced KYC procedures for all counterparties and clients

– Ongoing Monitoring: Continuous monitoring of client activities and transactions

– Risk Assessment: Regular risk assessment of all business relationships

– Documentation Management: Comprehensive documentation of all KYC procedures

– Regulatory Reporting: Timely reporting of suspicious activities to relevant authorities

Transaction Monitoring:

– Automated Monitoring: Automated systems for monitoring all transactions for suspicious patterns

– Pattern Recognition: Advanced analytics for identifying unusual transaction patterns

– Alert Management: Efficient systems for managing and investigating compliance alerts

– Reporting Procedures: Clear procedures for reporting suspicious activities

– Record Retention: Appropriate record retention policies for all compliance documentation

Technology Infrastructure and Implementation

Building and maintaining the technology infrastructure necessary for successful cross-market arbitrage requires significant investment in hardware, software, and human resources, but forms the foundation for competitive advantage in this highly technical field.

The complexity of simultaneously monitoring and trading across forex and cryptocurrency markets demands sophisticated technology solutions that can process vast amounts of data and execute trades with minimal latency.

System Architecture and Design

Professional arbitrage operations require carefully designed system architectures that can handle the demanding requirements of real-time multi-market trading.

Core System Components:

The foundation of any arbitrage system consists of several critical components that must work together seamlessly to identify and execute opportunities.

Market Data Management:

– Data Ingestion Layer: High-performance systems for ingesting market data from multiple sources

– Data Normalization: Converting data from different markets into standardized formats

– Real-Time Processing: Stream processing systems for real-time data analysis

– Historical Storage: Efficient storage and retrieval systems for historical market data

– Data Quality Monitoring: Continuous monitoring and validation of data quality

Opportunity Detection Engine:

– Pattern Recognition: Advanced algorithms for identifying arbitrage patterns

– Statistical Analysis: Real-time statistical analysis of price relationships

– Machine Learning Integration: ML models for improving opportunity detection accuracy

– Alert Generation: Automated alert systems for notifying traders of opportunities

– Backtesting Framework: Systems for testing and validating arbitrage strategies

Order Management System:

– Multi-Market Connectivity: Connections to all relevant forex and crypto markets

– Smart Order Routing: Intelligent routing of orders for optimal execution

– Risk Controls: Real-time risk management and position monitoring

– Execution Analytics: Analysis and optimization of execution performance

– Audit Trail: Comprehensive logging of all trading activities

Scalability and Performance Optimization:

Arbitrage systems must be designed to handle high volumes of data and transactions while maintaining low latency and high reliability.

Performance Requirements:

– Latency Minimization: Sub-millisecond response times for critical operations

– Throughput Optimization: Handling thousands of market updates per second

– Concurrent Processing: Simultaneous processing of multiple arbitrage opportunities

– Memory Management: Efficient memory usage for high-performance computing

– CPU Optimization: Optimized algorithms and code for maximum processing speed

Scalability Design:

– Horizontal Scaling: Ability to add computing resources as volumes increase

– Load Balancing: Distributing processing load across multiple systems

– Microservices Architecture: Modular design allowing independent scaling of components

– Cloud Integration: Hybrid cloud architectures for flexible resource allocation

– Capacity Planning: Proactive planning for future capacity requirements

Connectivity and Market Access

Reliable, low-latency connectivity to all relevant markets is essential for competitive arbitrage execution.

Market Connectivity Solutions:

Different markets require different connectivity approaches, from traditional FIX protocols for forex to REST and WebSocket APIs for cryptocurrency exchanges.

Forex Market Connectivity:

– Prime Brokerage Connections: Direct connections to prime brokers and liquidity providers

– ECN Access: Connectivity to electronic communication networks

– FIX Protocol Implementation: Industry-standard FIX protocol for order management

– Liquidity Aggregation: Aggregating liquidity from multiple forex sources

– Backup Connectivity: Redundant connections for business continuity

Cryptocurrency Exchange Integration:

– REST API Integration: Efficient implementation of exchange REST APIs

– WebSocket Connections: Real-time market data via WebSocket connections

– Rate Limit Management: Managing API rate limits across multiple exchanges

– Authentication Security: Secure implementation of exchange authentication

– Error Handling: Robust error handling for exchange connectivity issues

Network Infrastructure:

– Co-location Services: Strategic placement of servers near major exchanges

– Dedicated Circuits: Private network connections for critical market access

– Internet Redundancy: Multiple internet service providers for redundancy

– Network Monitoring: Continuous monitoring of network performance and latency

– Bandwidth Management: Optimizing bandwidth usage for different data types

Security and Risk Controls:

Security is paramount in arbitrage operations, as systems handle significant financial transactions and sensitive market data.

Cybersecurity Framework:

– Multi-Factor Authentication: Strong authentication for all system access

– Encryption: End-to-end encryption for all sensitive data and communications

– Network Security: Firewalls, intrusion detection, and network segmentation

– Access Controls: Role-based access controls for all system components

– Security Monitoring: Continuous monitoring for security threats and vulnerabilities

Operational Security:

– Key Management: Secure management of API keys and trading credentials

– Audit Logging: Comprehensive logging of all system access and activities

– Incident Response: Procedures for responding to security incidents

– Regular Testing: Regular penetration testing and security assessments

– Staff Training: Security awareness training for all personnel

Case Studies and Real-World Applications

Examining real-world implementations of cross-market arbitrage strategies provides valuable insights into the practical challenges and opportunities that exist in live trading environments.

These case studies are based on actual arbitrage operations conducted across forex and cryptocurrency markets, demonstrating both successful strategies and lessons learned from challenging market conditions.

Successful Arbitrage Implementations

Professional arbitrage operations have successfully exploited various types of price discrepancies between forex and cryptocurrency markets, generating consistent profits while managing associated risks.

Case Study 1: EUR/USD Arbitrage During Market Volatility

During the March 2020 market volatility, significant price discrepancies emerged between EUR/USD pricing in traditional forex markets and cryptocurrency exchanges offering EUR/USD trading pairs.

Opportunity Identification:

– Price Divergence: EUR/USD trading 15-25 pips higher on crypto exchanges during peak volatility

– Volume Analysis: Sufficient liquidity available on both sides for meaningful position sizes

– Timing Factors: Discrepancies lasting 30-90 seconds during high volatility periods

– Risk Assessment: Manageable execution risk with proper technology infrastructure

– Profit Potential: Net profit margins of 8-12 pips after all transaction costs

Execution Strategy:

– Simultaneous Orders: Placing buy orders on forex and sell orders on crypto exchanges simultaneously

– Position Sizing: $2-5 million position sizes based on available liquidity

– Risk Management: Maximum 30-second exposure window with automatic position closure

– Technology Utilization: High-frequency trading systems for rapid execution

– Performance Monitoring: Real-time monitoring of execution quality and slippage

Results and Analysis:

– Success Rate: 78% of identified opportunities successfully executed

– Average Profit: 9.3 pips average profit per successful trade

– Risk Metrics: Maximum drawdown of 2.1% during the strategy implementation period

– Execution Quality: Average execution time of 1.2 seconds for complete arbitrage cycle

– Total Returns: Generated 23.7% returns over 6-week implementation period

Lessons Learned:

– Technology Importance: Superior technology infrastructure was critical for success

– Risk Management: Strict risk controls prevented significant losses during failed executions

– Market Timing: Opportunities were most frequent during high volatility periods

– Liquidity Management: Careful liquidity analysis was essential for position sizing

– Regulatory Compliance: Proper regulatory compliance was crucial for sustainable operations

Case Study 2: Bitcoin-USD Triangular Arbitrage

A sophisticated triangular arbitrage strategy exploiting price differences between BTC/USD, EUR/USD, and BTC/EUR across forex and cryptocurrency markets.

Strategy Framework:

– Triangle Construction: BTC/USD (crypto) → EUR/USD (forex) → BTC/EUR (crypto)

– Opportunity Detection: Automated detection of profitable triangular arbitrage opportunities

– Execution Coordination: Simultaneous execution across three different markets

– Risk Management: Comprehensive hedging of all currency and cryptocurrency exposures

– Performance Optimization: Continuous optimization of execution algorithms

Implementation Details:

– Market Selection: Binance (BTC/USD, BTC/EUR), Interactive Brokers (EUR/USD)

– Position Sizing: $1-3 million equivalent positions based on liquidity analysis

– Execution Speed: Average execution time of 2.8 seconds for complete triangle

– Risk Controls: Maximum exposure of $500,000 at any point during execution

– Monitoring Systems: Real-time monitoring of all positions and market conditions

Performance Results:

– Opportunity Frequency: 15-25 profitable opportunities per day during active periods

– Success Rate: 82% successful execution rate for identified opportunities

– Average Profit: 0.15% average profit per successful arbitrage cycle

– Risk-Adjusted Returns: Sharpe ratio of 2.8 over 12-month implementation period

– Maximum Drawdown: 1.9% maximum drawdown during strategy implementation

Operational Challenges and Solutions:

Real-world arbitrage operations face numerous challenges that require innovative solutions and continuous adaptation.

Challenge 1: Regulatory Compliance Across Jurisdictions

Operating across multiple jurisdictions with different regulatory requirements creates complex compliance challenges.

Regulatory Complexity:

– Multiple Jurisdictions: Operations spanning US, EU, UK, and Asian regulatory frameworks

– Changing Regulations: Rapidly evolving cryptocurrency regulations affecting operations

– Reporting Requirements: Complex reporting requirements across different jurisdictions

– Capital Requirements: Varying capital requirements for different types of trading activities

– Licensing Obligations: Multiple licenses required for comprehensive market access

Solution Implementation:

– Legal Framework: Comprehensive legal structure designed for multi-jurisdictional operations

– Compliance Systems: Automated compliance monitoring and reporting systems

– Regulatory Relationships: Proactive engagement with regulators in key jurisdictions

– Documentation Standards: Standardized documentation meeting all regulatory requirements

– Regular Reviews: Quarterly reviews of regulatory compliance across all jurisdictions

Challenge 2: Technology Infrastructure Scaling

Scaling technology infrastructure to handle increasing volumes while maintaining performance presents significant challenges.

Scaling Challenges:

– Volume Growth: 10x increase in trading volumes over 18-month period

– Latency Requirements: Maintaining sub-millisecond latency as volumes increased

– System Complexity: Managing increasing complexity of multi-market operations

– Cost Management: Controlling infrastructure costs while scaling operations

– Reliability Maintenance: Maintaining 99.9% uptime as system complexity increased

Solution Approach:

– Cloud Integration: Hybrid cloud architecture for flexible scaling

– Microservices Migration: Migration to microservices architecture for better scalability

– Performance Optimization: Continuous optimization of critical system components

– Monitoring Enhancement: Enhanced monitoring and alerting systems

– Capacity Planning: Proactive capacity planning and resource allocation

Challenge 3: Market Structure Evolution

Continuous evolution of both forex and cryptocurrency market structures requires constant adaptation of arbitrage strategies.

Market Changes:

– Increased Competition: Growing number of arbitrage participants reducing opportunities

– Technology Advancement: Faster execution systems reducing arbitrage windows

– Regulatory Changes: New regulations affecting market access and operations

– Market Maturation: Cryptocurrency markets becoming more efficient over time

– Liquidity Shifts: Changes in liquidity patterns affecting arbitrage opportunities

Adaptation Strategies:

– Strategy Evolution: Continuous development of new arbitrage strategies

– Technology Investment: Ongoing investment in faster, more sophisticated technology

– Market Expansion: Expansion into new markets and asset classes

– Partnership Development: Strategic partnerships for enhanced market access

– Research and Development: Dedicated R&D for next-generation arbitrage strategies

Future Trends and Opportunities

The landscape of cross-market arbitrage between forex and cryptocurrency markets continues to evolve rapidly, driven by technological advancement, regulatory development, and market maturation.

Understanding emerging trends and future opportunities is essential for maintaining competitive advantage in this dynamic field.

Emerging Market Developments

Several key developments are reshaping the arbitrage landscape and creating new opportunities for sophisticated traders.

Central Bank Digital Currencies (CBDCs):

The development and implementation of central bank digital currencies will create new arbitrage opportunities and challenges.

CBDC Impact Analysis:

– New Trading Pairs: CBDCs will create new currency pairs for arbitrage opportunities

– Market Structure Changes: Different settlement mechanisms and trading hours for CBDCs

– Regulatory Implications: New regulatory frameworks for CBDC trading and arbitrage

– Technology Requirements: Updated technology infrastructure for CBDC connectivity

– Risk Considerations: New risk factors associated with government-issued digital currencies

Opportunity Development:

– CBDC-Fiat Arbitrage: Arbitrage opportunities between CBDCs and traditional fiat currencies

– Cross-CBDC Trading: Arbitrage between different countries’ CBDCs

– CBDC-Crypto Arbitrage: Price differences between CBDCs and private cryptocurrencies

– Settlement Arbitrage: Exploiting different settlement speeds and mechanisms

– Yield Arbitrage: Interest rate differences between CBDC holdings and traditional deposits

Decentralized Finance (DeFi) Integration:

The growth of decentralized finance creates new arbitrage opportunities and execution mechanisms.

DeFi Arbitrage Opportunities:

– DEX-CEX Arbitrage: Price differences between decentralized and centralized exchanges

– Yield Farming Arbitrage: Exploiting yield differences across DeFi protocols

– Liquidity Pool Arbitrage: Arbitrage opportunities in automated market makers

– Cross-Chain Arbitrage: Price differences across different blockchain networks

– Synthetic Asset Arbitrage: Price differences between synthetic and underlying assets

Implementation Considerations:

– Smart Contract Risk: Managing risks associated with smart contract interactions

– Gas Fee Optimization: Optimizing transaction costs on blockchain networks

– Liquidity Analysis: Understanding liquidity mechanics in DeFi protocols

– Regulatory Compliance: Navigating regulatory uncertainty around DeFi activities

– Technology Integration: Integrating DeFi protocols with existing arbitrage systems

Technological Advancement Impact

Rapid technological advancement continues to reshape the arbitrage landscape, creating both opportunities and challenges.

Artificial Intelligence and Machine Learning:

AI and ML technologies are revolutionizing arbitrage opportunity detection and execution.

AI Application Areas:

– Pattern Recognition: Advanced pattern recognition for opportunity identification

– Predictive Analytics: Predicting arbitrage opportunity emergence and duration

– Execution Optimization: AI-driven optimization of execution strategies

– Risk Management: Machine learning models for dynamic risk assessment

– Market Microstructure Analysis: Deep learning analysis of market microstructure changes

Implementation Strategies:

– Data Science Teams: Building dedicated data science capabilities

– Model Development: Developing proprietary ML models for arbitrage applications

– Real-Time Integration: Integrating AI models into real-time trading systems

– Performance Monitoring: Continuous monitoring and optimization of AI model performance

– Competitive Advantage: Using AI for sustainable competitive advantage

Quantum Computing Implications:

The eventual development of practical quantum computing will have significant implications for arbitrage operations.

Quantum Impact Analysis:

– Computational Speed: Quantum computers could dramatically increase computation speed

– Optimization Problems: Better solutions to complex optimization problems in arbitrage

– Cryptographic Security: Implications for cryptocurrency security and market structure

– Competitive Dynamics: First-mover advantages for quantum computing adoption

– Risk Considerations: New risks from quantum computing capabilities

Preparation Strategies:

– Research Investment: Investing in quantum computing research and development

– Partnership Development: Partnerships with quantum computing companies

– Security Planning: Planning for quantum-resistant security measures

– Talent Acquisition: Recruiting quantum computing expertise

– Strategic Planning: Long-term strategic planning for quantum computing impact

Regulatory Evolution and Compliance

The regulatory landscape for both forex and cryptocurrency markets continues to evolve, creating new compliance requirements and opportunities.

Global Regulatory Harmonization:

Increasing coordination between international regulators is creating more standardized regulatory frameworks.

Harmonization Trends:

– International Standards: Development of international standards for cryptocurrency regulation

– Cross-Border Cooperation: Increased cooperation between regulatory authorities

– Standardized Reporting: Harmonized reporting requirements across jurisdictions

– Market Access Rules: Standardized rules for cross-border market access

– Compliance Frameworks: Common compliance frameworks for international operations

Strategic Implications:

– Compliance Efficiency: More efficient compliance with harmonized regulations

– Market Access: Improved access to global markets through standardized rules

– Operational Simplification: Simplified operations across multiple jurisdictions

– Competitive Advantage: Advantages for firms with strong compliance capabilities

– Risk Reduction: Reduced regulatory risk through standardized frameworks

Institutional Adoption Impact:

Increasing institutional adoption of cryptocurrency markets is changing market dynamics and creating new opportunities.

Institutional Market Changes:

– Increased Liquidity: Higher liquidity from institutional participation

– Market Efficiency: More efficient price discovery and reduced arbitrage opportunities

– Professional Standards: Higher professional standards and best practices

– Technology Investment: Increased investment in market infrastructure and technology

– Regulatory Clarity: Greater regulatory clarity from institutional involvement

Adaptation Strategies:

– Institutional Partnerships: Developing partnerships with institutional market participants

– Technology Upgrades: Upgrading technology to institutional standards

– Compliance Enhancement: Enhancing compliance capabilities for institutional requirements

– Service Development: Developing services for institutional arbitrage clients

– Market Making: Expanding into institutional market making activities

Conclusion: Mastering Cross-Market Arbitrage Excellence

Cross-market arbitrage between forex and cryptocurrency markets represents one of the most sophisticated and potentially rewarding trading strategies available to modern financial professionals. Success in this field requires a unique combination of technical expertise, technological infrastructure, risk management discipline, and regulatory compliance knowledge.

The opportunities in cross-market arbitrage continue to evolve as both forex and cryptocurrency markets mature and integrate with each other. While increasing market efficiency reduces some traditional arbitrage opportunities, new technologies, market structures, and regulatory frameworks create fresh opportunities for those prepared to adapt and innovate.

Technology infrastructure remains the foundation of successful arbitrage operations, but human expertise in strategy development, risk management, and market analysis continues to be the key differentiator. The most successful arbitrage operations combine cutting-edge technology with deep market knowledge and disciplined execution.

Risk management in cross-market arbitrage requires a comprehensive approach that addresses market, operational, technological, and regulatory risks simultaneously. The complexity of operating across multiple markets and jurisdictions demands sophisticated risk management frameworks and continuous monitoring systems.

Regulatory compliance is not just a requirement but a competitive advantage for arbitrage operations. Firms with strong compliance capabilities can access more markets, build better relationships with counterparties, and operate with greater confidence in changing regulatory environments.

The future of cross-market arbitrage will be shaped by technological advancement, regulatory evolution, and market structure changes. Successful arbitrage operations must continuously invest in research and development, maintain flexibility to adapt to changing conditions, and build sustainable competitive advantages through superior execution and risk management.

Remember that cross-market arbitrage is a highly competitive field where success depends on continuous improvement and adaptation. Focus on building robust systems, maintaining strict risk controls, and developing deep expertise in both forex and cryptocurrency markets.

The integration of traditional and digital financial markets will continue to create opportunities for sophisticated arbitrage strategies. Position yourself to capitalize on these opportunities by investing in technology, building expertise, and maintaining the highest standards of professional operation.

This comprehensive guide provides the foundation for understanding and implementing cross-market arbitrage strategies between forex and cryptocurrency markets. The techniques and principles outlined here represent current best practices, but remember that markets evolve continuously, requiring ongoing learning and adaptation for sustained success.