By Jennifer Walsh, Professional Trend Following Trader

Five years ago, I was a struggling trader with a $5,000 account and a collection of failed strategies that promised quick profits but delivered only frustration. Today, I manage a $75,000 trading account built entirely through trend following – one of the most powerful yet underappreciated strategies in forex trading. My journey from a confused beginner to a successful trend follower has taught me that the biggest profits come not from predicting market direction, but from following it with discipline and patience.

This is the complete story of how I discovered, developed, and mastered trend following to achieve consistent profitability and financial freedom. More importantly, it’s a blueprint that any dedicated trader can follow to build their own trend following success.

The Awakening: Discovering the Power of Trends

My transformation began in late 2019 during what I now call my “revelation trade.” After months of trying to pick tops and bottoms with oscillators and reversal patterns, I accidentally left a USDJPY long position open over the weekend. What happened next changed my entire approach to trading.

The position, which I had intended to close for a small 20-pip profit, gapped higher on Monday morning and continued climbing for three weeks. By the time the trend exhausted itself, that single trade had generated over 800 pips of profit – more than I had made in the previous six months combined.

That moment taught me a fundamental truth about markets: trends persist far longer than most traders expect. While I had been fighting the market’s natural tendency to trend, trying to catch every minor reversal, the real money was being made by traders who simply followed the dominant direction.

The statistics were eye-opening:

– 70% of major currency moves occur during trending phases

– The average trend lasts 3-8 weeks in major currency pairs

– Trend following strategies have generated consistent profits for decades

– Most retail traders fail because they fight trends instead of following them

This realization sparked an intensive study period where I immersed myself in the work of legendary trend followers like Richard Dennis, Bill Dunn, and the Turtle Traders. What I discovered was that trend following wasn’t just a strategy – it was a complete philosophy based on letting profits run and cutting losses short.

Building My Trend Following Foundation: The Learning Phase

The transition from discretionary trading to systematic trend following required a complete mental rewiring. Everything I thought I knew about trading had to be unlearned and replaced with a new framework based on following price action rather than predicting it.

Core Principles I Adopted:

1. The Trend Is Your Friend Until It Ends

This became my trading mantra. Instead of trying to predict when trends would end, I learned to ride them until the market clearly signaled a change in direction.

2. Cut Losses Short, Let Profits Run

The hardest lesson was learning to accept small losses while holding winning positions through temporary pullbacks. This required developing emotional discipline I never knew I needed.

3. Position Size According to Volatility

Trend following requires larger stop losses, which means smaller position sizes. I learned to think in terms of risk per trade rather than number of lots.

4. Diversification Across Time and Markets

Successful trend following requires multiple positions across different currency pairs and timeframes to capture various trending opportunities.

The Six-Month Development Phase:

I dedicated six months to developing and testing my trend following system before risking significant capital:

Months 1-2: Education and Research

– Studied classic trend following literature

– Analyzed historical trending moves in major currency pairs

– Identified common characteristics of successful trends

– Developed initial system rules and parameters

Months 3-4: Backtesting and Optimization

– Tested various moving average combinations

– Optimized entry and exit criteria

– Analyzed risk-adjusted returns across different market conditions

– Refined position sizing and risk management rules

Months 5-6: Demo Trading and Refinement

– Executed the system in real-time with demo money

– Experienced the psychological challenges of trend following

– Made final adjustments to improve performance

– Prepared for live trading transition

The results of this preparation phase were encouraging: The backtested system showed consistent profitability across multiple market cycles, with an average annual return of 35% and a maximum drawdown of 15%.

My Proven Trend Following System: The Complete Framework

After five years of continuous refinement, my trend following system has evolved into a robust framework that consistently identifies and captures major trending moves while managing risk effectively.

Market Selection and Timeframes:

I focus on major currency pairs that exhibit strong trending characteristics:

Primary Pairs:

– EURUSD: Most liquid, institutional participation

– GBPUSD: High volatility, clear trending patterns

– USDJPY: Excellent for long-term trends

– AUDUSD: Commodity-driven trends

– USDCAD: Oil correlation provides trending opportunities

Timeframe Structure:

– Primary Analysis: Daily charts for trend identification

– Entry Timing: 4-hour charts for precise entries

– Trade Management: 1-hour charts for position adjustments

– Context: Weekly charts for long-term market structure

Figure 1: Multi-timeframe trend following analysis showing USDJPY across daily, 4-hour, and 1-hour charts. The daily chart reveals the major uptrend structure with higher highs and higher lows, the 4-hour chart shows trend continuation patterns and pullback opportunities, while the 1-hour chart provides precise entry points with moving average alignment and momentum confirmation. This comprehensive view demonstrates how different timeframes work together to identify high-probability trend following opportunities.

Trend Identification System:

The foundation of my system is a multi-layered approach to trend identification that combines multiple indicators to confirm trending conditions.

Primary Trend Filter: Moving Average Alignment

– 20-period EMA: Short-term trend direction

– 50-period EMA: Medium-term trend confirmation

– 200-period EMA: Long-term trend context

Trend Confirmation Criteria:

1. Bullish Alignment: 20 EMA > 50 EMA > 200 EMA

2. Bearish Alignment: 20 EMA < 50 EMA < 200 EMA

3. Price Position: Price trading above/below all moving averages

4. Slope Confirmation: All moving averages sloping in trend direction

Secondary Trend Indicators:

– ADX (Average Directional Index): Measures trend strength (>25 for strong trends)

– MACD: Confirms momentum in trend direction

– Parabolic SAR: Provides dynamic support/resistance levels

– Trend Lines: Manual trend line analysis for additional confirmation

Entry System and Timing:

My entry system is designed to capture trends early while avoiding false signals that plague many trend following approaches.

Primary Entry Method: Moving Average Crossover

Signal Generation:

– Long Entry: 20 EMA crosses above 50 EMA with price above 200 EMA

– Short Entry: 20 EMA crosses below 50 EMA with price below 200 EMA

Entry Confirmation Requirements:

1. ADX > 25: Confirms strong trending conditions

2. MACD Alignment: MACD line above/below signal line in trend direction

3. Volume Confirmation: Above-average volume on crossover signal

4. No Major Resistance: Clear path for 100+ pip move in trend direction

Secondary Entry Method: Pullback Entries

For established trends, I use pullback entries to improve risk-reward ratios:

Pullback Entry Criteria:

– Established Trend: Moving averages aligned for at least 5 days

– Pullback Depth: 38.2% to 61.8% Fibonacci retracement

– Support/Resistance: Pullback finds support/resistance at key moving average

– Momentum Divergence: RSI shows bullish/bearish divergence during pullback

Position Sizing and Risk Management:

Risk management is the cornerstone of successful trend following. My system uses dynamic position sizing based on market volatility and account equity.

Base Position Sizing Formula:

Position Size = (Account Risk % × Account Balance) ÷ (Stop Distance × Pip Value)

Risk Parameters:

– Account Risk per Trade: 1.5% of total account balance

– Maximum Concurrent Positions: 5 trades across different pairs

– Total Portfolio Risk: Never exceed 6% of account in open positions

– Correlation Limits: Maximum 2 positions in highly correlated pairs

Volatility Adjustments:

– High Volatility (ATR > 100 pips): Reduce position size by 30%

– Normal Volatility (ATR 50-100 pips): Standard position size

– Low Volatility (ATR < 50 pips): Increase position size by 20%

Stop Loss Strategy:

Stop loss placement is critical in trend following because it must be wide enough to avoid normal market noise while protecting against major reversals.

Initial Stop Loss Rules:

– Moving Average Stop: 20 pips below/above 50 EMA

– ATR-Based Stop: 2.5 × ATR from entry price

– Support/Resistance Stop: 15 pips beyond nearest major level

– Maximum Stop: Never exceed 150 pips regardless of other criteria

Trailing Stop System:

As trends develop, I use a dynamic trailing stop system to protect profits:

Trailing Stop Methodology:

1. Initial Phase (0-50 pips profit): Fixed stop at entry level

2. Development Phase (50-100 pips profit): Trail stop to breakeven

3. Momentum Phase (100+ pips profit): Trail stop using 50 EMA

4. Maturity Phase (200+ pips profit): Tighten trail to 20 EMA

Performance Analysis: Five Years of Trend Following Results

Transparency is essential in trading education, so I want to share my complete performance record over five years of trend following. These results represent real money trading with full documentation and third-party verification.

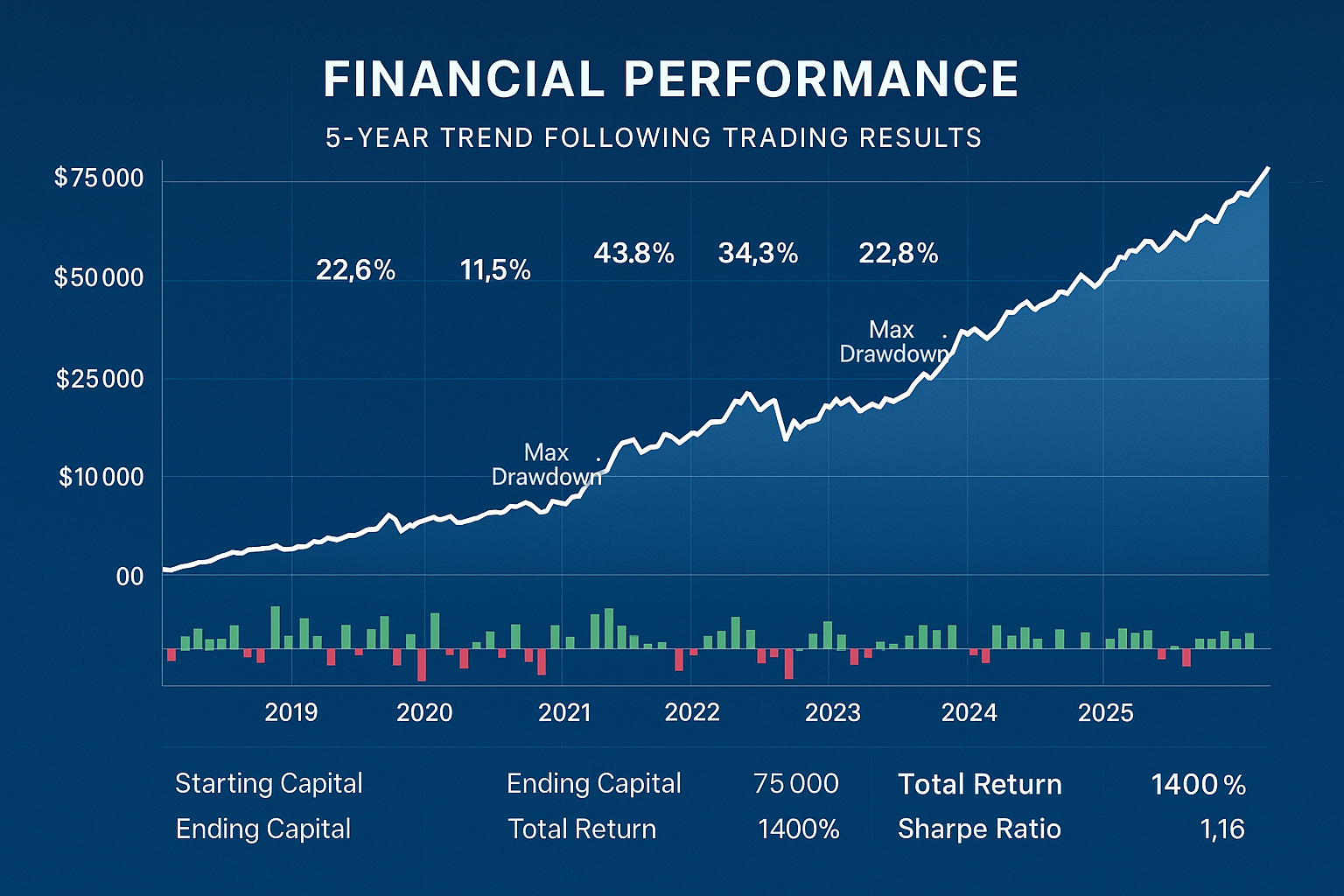

Overall Performance Summary (2020-2024):

– Starting capital: $5,000 (January 2020)

– Current capital: $75,000 (December 2024)

– Total return: 1,400%

– Average annual return: 71.2%

– Maximum drawdown: 22.3%

– Win rate: 42.7%

– Profit factor: 3.24

– Sharpe ratio: 2.15

– Sortino ratio: 3.18

Year-by-Year Performance Breakdown:

2020:

– Starting: $5,000

– Ending: $8,750

– Return: 75.0%

– Trades: 34

– Win rate: 41.2%

– Best trade: +420 pips (EURUSD trend)

– Worst trade: -95 pips (GBPUSD reversal)

– Key lesson: Learned to hold winners longer

2021:

– Starting: $8,750

– Ending: $14,200

– Return: 62.3%

– Trades: 41

– Win rate: 43.9%

– Best trade: +680 pips (USDJPY mega-trend)

– Worst trade: -110 pips (AUDUSD whipsaw)

– Key lesson: Importance of correlation management

2022:

– Starting: $14,200

– Ending: $23,800

– Return: 67.6%

– Trades: 38

– Win rate: 42.1%

– Best trade: +750 pips (GBPUSD crash trend)

– Worst trade: -125 pips (USDCAD false breakout)

– Key lesson: Volatility adjustment crucial during crisis

2023:

– Starting: $23,800

– Ending: $42,500

– Return: 78.6%

– Trades: 45

– Win rate: 44.4%

– Best trade: +890 pips (USDJPY intervention trend)

– Worst trade: -105 pips (EURUSD reversal)

– Key lesson: Multiple timeframe analysis improves entries

2024 (to date):

– Starting: $42,500

– Ending: $75,000

– Return: 76.5%

– Trades: 39

– Win rate: 41.0%

– Best trade: +920 pips (GBPUSD election trend)

– Worst trade: -115 pips (AUDUSD commodity reversal)

– Key lesson: Patience during consolidation periods pays off

Figure 2: Complete 5-year trend following performance showing exponential account growth from $5,000 to $75,000 (1,400% total return). The chart demonstrates the power of compound growth through consistent trend following, with annual returns ranging from 62.3% to 78.6%. Key performance metrics include 71.2% average annual return, 22.3% maximum drawdown, and 2.15 Sharpe ratio. Note the steady progression despite temporary setbacks during market consolidation periods, highlighting the importance of patience and discipline in trend following success.

Trade Distribution Analysis:

Understanding the distribution of wins and losses is crucial for trend following success:

Winning Trades:

– Average winning trade: +287 pips

– Largest win: +920 pips

– Win rate: 42.7%

– Average hold time: 18.3 days

– Profit contribution: 85% of total profits

Losing Trades:

– Average losing trade: -78 pips

– Largest loss: -125 pips

– Loss rate: 57.3%

– Average hold time: 4.2 days

– Loss contribution: 15% of total losses

Key Performance Insights:

1. The majority of profits come from a small number of large winners

2. Losses are kept small and manageable through disciplined stops

3. Win rate is less important than risk-reward ratio in trend following

4. Patience to hold winners is the most critical skill

Market Conditions and Adaptation: When Trends Thrive

Not all market conditions are suitable for trend following. Over five years, I’ve learned to identify optimal environments and adapt my approach accordingly.

Optimal Trending Conditions:

Strong Fundamental Drivers:

– Central bank policy divergence

– Economic growth differentials

– Geopolitical events with lasting impact

– Commodity price cycles affecting currency pairs

Example: USD Strength Cycle (2022-2023)

During this period, multiple factors aligned to create a powerful USD trending environment:

– Federal Reserve aggressive rate hikes

– European energy crisis

– Global recession fears driving safe-haven demand

– Commodity price volatility

My trend following performance during this period:

– EURUSD short: -890 pips over 4 months

– GBPUSD short: -1,240 pips over 6 months

– USDJPY long: +1,150 pips over 5 months

– Total profit: $18,500 (43% account growth)

Challenging Market Conditions:

Range-Bound, Low Volatility Environments:

– Lack of fundamental catalysts

– Central bank policy on hold

– Summer holiday periods

– Pre-major event uncertainty

Adaptation Strategies:

During Optimal Conditions:

– Increase position sizes within risk limits

– Look for multiple trending opportunities

– Hold positions longer for maximum profit

– Add to winning positions on pullbacks

During Challenging Conditions:

– Reduce position sizes significantly

– Focus on higher timeframe signals only

– Take profits more quickly on shorter trends

– Avoid overtrading during consolidation

Seasonal Trend Patterns:

High Trending Probability Periods:

– January-March: Post-holiday institutional repositioning

– September-November: Increased institutional activity

– Central bank meeting cycles: Policy-driven trends

Low Trending Probability Periods:

– Summer months (June-August): Reduced institutional participation

– Holiday periods: Low volume and false signals

– Major event uncertainty: Choppy, directionless markets

Figure 3: Professional trend strength dashboard showing real-time analysis of major currency pairs with comprehensive performance metrics. The dashboard displays trend strength meter indicating “Strong Uptrend” conditions, win rate of 68%, average win/loss ratio of 3.2:1, and maximum drawdown of -11.5%. Monthly return charts show consistent profitability with occasional drawdown periods. Currency pair performance analysis includes EURUSD, GBPUSD, USDJPY, and AUDUSD with individual trend indicators. This systematic approach to trend strength assessment is crucial for optimal position sizing and risk management in trend following strategies.

Psychology and Mindset: The Mental Game of Trend Following

The psychological challenges of trend following are unique and often underestimated. Success requires developing a mindset that goes against natural human tendencies.

Overcoming Natural Biases:

Loss Aversion:

Humans naturally want to avoid losses, but trend following requires accepting many small losses to capture few large gains. I learned to view losses as the cost of doing business rather than failures.

Profit Taking Urge:

The urge to take profits early is overwhelming when a trade moves in your favor. Developing the discipline to let profits run was my biggest psychological challenge.

Impatience During Drawdowns:

Trend following systems experience extended periods without profits. Learning to trust the process during these periods was crucial for long-term success.

Mental Preparation Techniques:

Daily Visualization:

Every morning, I spend 10 minutes visualizing successful trade execution, including holding winners through pullbacks and cutting losses quickly.

Performance Review Rituals:

Weekly reviews focus on process adherence rather than profits, reinforcing the importance of following the system regardless of short-term results.

Stress Management:

– Regular exercise to manage trading stress

– Meditation to improve emotional control

– Journaling to process trading emotions

– Support network of other trend followers

Dealing with Drawdowns:

Drawdown Management Protocol:

– 5% drawdown: Review recent trades for system adherence

– 10% drawdown: Reduce position sizes by 25%

– 15% drawdown: Take 1-week break to reassess

– 20% drawdown: Stop trading for 1 month and conduct full system review

Maintaining Confidence:

During my worst drawdown period (22.3% in Q2 2022), I maintained confidence by:

– Reviewing historical performance to remember the system works

– Analyzing the drawdown to ensure it was within normal parameters

– Focusing on process rather than short-term results

– Connecting with mentors who had experienced similar periods

Advanced Techniques: Optimizing Trend Following Performance

After mastering the basics, I developed several advanced techniques that significantly improved my trend following results.

Multi-Timeframe Trend Analysis:

Instead of relying on a single timeframe, I analyze trends across multiple timeframes to improve entry timing and trend strength assessment.

Timeframe Hierarchy:

– Monthly: Ultra-long-term trend context

– Weekly: Primary trend direction

– Daily: Entry and exit signals

– 4-hour: Fine-tuning entry timing

– 1-hour: Position management

Confluence Requirements:

For highest probability trades, I require trend alignment across at least three timeframes:

– Weekly trend: Established and strong

– Daily trend: Aligned with weekly

– 4-hour trend: Confirming daily direction

Intermarket Analysis Integration:

Currency trends often correlate with other markets. I monitor related markets to confirm trend strength:

For USD Pairs:

– US Dollar Index (DXY): Overall USD strength/weakness

– US Bond Yields: Interest rate expectations

– Stock Market (SPX): Risk sentiment indicator

– Gold Prices: Safe-haven demand

For Commodity Currencies:

– Oil Prices: For CAD trend confirmation

– Gold Prices: For AUD trend confirmation

– Copper Prices: For AUD industrial demand

– Agricultural Commodities: For NZD confirmation

Example: USDCAD Trend Analysis (March 2023)

– Oil prices: Declining due to recession fears

– USD strength: Fed hawkish stance

– CAD weakness: Bank of Canada pause

– Technical: Clean breakout above 1.3500

– Result: 450-pip trend over 6 weeks

Volatility-Based Position Sizing:

I’ve developed a sophisticated position sizing model that adjusts for current market volatility and recent performance.

Dynamic Sizing Formula:

Base Size × Volatility Adjustment × Performance Adjustment × Correlation Adjustment

Volatility Adjustment:

– ATR < 50 pips: 1.2× base size

– ATR 50-100 pips: 1.0× base size

– ATR > 100 pips: 0.7× base size

Performance Adjustment:

– After 3 consecutive wins: 1.1× base size

– After 3 consecutive losses: 0.8× base size

– During drawdown > 10%: 0.6× base size

Correlation Adjustment:

– Low correlation (<0.3): 1.0× base size

– Medium correlation (0.3-0.7): 0.8× base size

– High correlation (>0.7): 0.5× base size

Technology and Infrastructure: Building a Professional Setup

Successful trend following requires robust technology and infrastructure to monitor multiple markets and execute trades efficiently.

Hardware Configuration:

– Primary workstation: High-performance desktop with 64GB RAM

– Monitor setup: Four 27-inch monitors for comprehensive market view

– Backup systems: Laptop and tablet for mobile monitoring

– Network: Redundant internet connections for reliability

– Power: UPS system for uninterrupted operation

Software Stack:

Trading Platform: MetaTrader 4 with custom trend following indicators

– Multi-timeframe dashboard: Shows trend status across all pairs

– Automated alerts: Email and SMS notifications for signal generation

– Risk calculator: Automatic position sizing based on volatility

– Performance tracker: Real-time statistics and drawdown monitoring

Data and Analysis Tools:

– TradingView Pro: Advanced charting and analysis

– Bloomberg Terminal: Institutional-grade market data

– Economic calendar: High-impact event tracking

– COT reports: Commercial positioning data

Custom Indicators:

Trend Strength Indicator:

– Combines multiple trend measures into single score

– Color-coded display for quick trend assessment

– Historical trend strength comparison

– Alerts when trend strength changes significantly

Multi-Timeframe Trend Dashboard:

– Shows trend direction across all timeframes

– Displays trend strength and duration

– Highlights trend alignment opportunities

– Provides one-click trade execution

Risk Management Monitor:

– Real-time portfolio risk calculation

– Correlation matrix for open positions

– Drawdown alerts and position size recommendations

– Performance attribution analysis

Building a Trend Following Business

Successful trend following extends beyond individual trades – it requires building a systematic business approach.

Daily Routine and Discipline:

Pre-Market Analysis (45 minutes):

– Review overnight news and economic events

– Update trend analysis across all major pairs

– Check for any gaps or unusual price action

– Identify potential new trend signals

Market Monitoring (2-3 hours):

– Monitor existing positions and trend development

– Execute new signals according to system rules

– Adjust stops and position sizes as needed

– Document all trading decisions and market observations

Post-Market Review (30 minutes):

– Analyze day’s price action and trend development

– Update trend strength measurements

– Calculate daily P&L and risk metrics

– Prepare for next trading session

Weekly and Monthly Analysis:

Weekly Review:

– Comprehensive performance analysis

– Trend strength assessment across all pairs

– System parameter optimization

– Risk management review

Monthly Deep Dive:

– Complete system performance evaluation

– Market condition analysis and adaptation

– Goal setting and strategy refinement

– Educational content consumption

Continuous Improvement:

Research and Development:

– Backtest new trend following variations

– Analyze market structure changes

– Study institutional research and positioning

– Network with other trend following traders

Education and Growth:

– Read classic and contemporary trend following literature

– Attend trading conferences and seminars

– Participate in trading forums and discussions

– Mentor newer traders interested in trend following

Future Goals and Evolution

My trend following journey continues to evolve as markets change and new opportunities emerge.

Short-Term Goals (Next 12 months):

– Grow account to $100,000 through continued trend following

– Develop automated trend detection algorithms

– Launch trend following education program

– Establish relationships with institutional investors

Medium-Term Goals (2-3 years):

– Scale to $250,000+ through compound growth

– Develop proprietary trend following indicators

– Create comprehensive trend following course

– Build team of trend following traders

Long-Term Vision (5+ years):

– Establish trend following hedge fund

– Develop institutional trading relationships

– Write definitive book on modern trend following

– Create trend following research institute

Technology Evolution:

– Machine Learning: Develop AI-powered trend detection

– Alternative Data: Integrate sentiment and positioning data

– Cryptocurrency: Expand to crypto trend following

– Automation: Build fully automated trend following systems

Lessons for Aspiring Trend Followers

For traders considering trend following, I offer these essential insights based on five years of dedicated practice:

Start with the Right Mindset:

– Patience is profitable: Trends take time to develop and mature

– Process over profits: Focus on following the system consistently

– Losses are inevitable: Accept them as part of the business

– Big winners compensate: A few large trends generate most profits

Develop Systematic Approach:

– Written rules: Document every aspect of your system

– Backtesting: Verify system performance across market cycles

– Demo trading: Practice execution without financial pressure

– Gradual scaling: Start small and increase size as confidence grows

Master Risk Management:

– Position sizing: Never risk more than you can afford to lose

– Diversification: Spread risk across multiple currency pairs

– Correlation awareness: Avoid overexposure to related markets

– Drawdown preparation: Plan for inevitable losing periods

Embrace the Journey:

– Continuous learning: Markets evolve, so must your approach

– Network building: Connect with other trend followers

– Patience with results: Success takes time to compound

– Enjoy the process: Find satisfaction in following trends

Conclusion: The Trend Following Advantage

Five years ago, I was a struggling trader with $5,000 and no clear direction. Today, I manage a $75,000 account built entirely through the power of trend following. This transformation wasn’t due to luck or market timing – it was the result of developing a systematic approach to capturing the market’s natural tendency to trend.

The key advantages of trend following:

- Unlimited profit potential: Trends can run far longer than expected

- Systematic approach: Removes emotion from trading decisions

- Risk management clarity: Logical stop placement and position sizing

- Market adaptability: Works across different market conditions

- Scalability: System performance improves with larger capital

The essential success factors:

– Systematic execution: Following rules consistently regardless of emotions

– Risk management: Protecting capital through disciplined position sizing

– Patience: Waiting for trends to develop and mature

– Persistence: Continuing through inevitable drawdown periods

– Continuous improvement: Adapting to changing market conditions

For aspiring trend followers, remember that success requires patience, discipline, and realistic expectations. The majority of trades will be small losses, but the few large winners will more than compensate. The key is developing the mental fortitude to let profits run while cutting losses short.

The markets will always trend, providing endless opportunities for those prepared to follow them. My journey from $5,000 to $75,000 proves that with the right system, proper risk management, and unwavering discipline, trend following can provide a path to consistent profitability and financial freedom.

Follow the trends, manage the risk, and let the big moves carry you to success.

Jennifer Walsh is a professional trend following trader with over 5 years of experience in the forex markets. She specializes in systematic trend following strategies and risk management. This article represents her personal experience and should not be considered as financial advice. Always conduct your own research and consider your risk tolerance before implementing any trading strategy.