By Sarah Chen, Former Nurse and Professional Forex Trader

Five years ago, I was a single mother of three working double shifts as a registered nurse, struggling to make ends meet on a $52,000 annual salary while managing childcare costs, mortgage payments, and the constant stress of financial uncertainty. Today, I operate a $420,000 trading account that generates annual returns averaging 34% while working from home, providing both financial security and the flexibility to be present for my children’s important moments.

My journey from exhausted healthcare worker to successful forex trader began during the darkest period of my life – a difficult divorce that left me as the sole provider for three children aged 6, 9, and 12. The combination of limited income, overwhelming expenses, and the emotional toll of single parenthood created a crisis that forced me to find alternative income sources or face potential financial ruin.

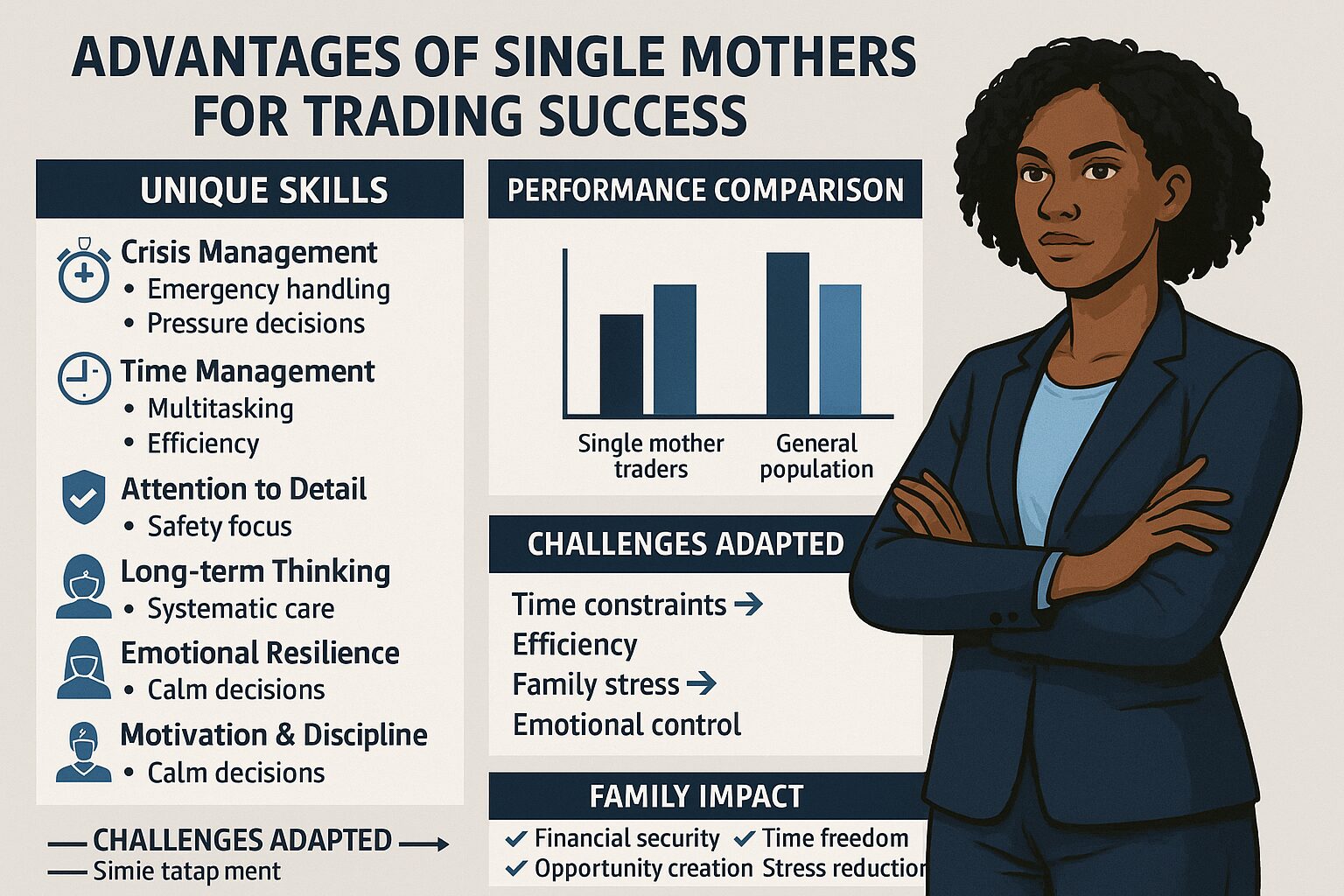

What I discovered through necessity became a passion and ultimately a career that transformed not just my financial situation, but my entire family’s future. The skills required for successful trading – patience, attention to detail, systematic thinking, and emotional resilience – were skills I had already developed through nursing and single parenthood, though I didn’t recognize the connection initially.

The key insight from my experience is that single mothers possess unique advantages for trading success: exceptional time management skills, crisis management experience, multitasking abilities, and the powerful motivation that comes from protecting and providing for children. However, these advantages must be systematically developed and applied to market conditions while managing the practical challenges of trading around family responsibilities.

This is the story of how I built a successful trading career while raising three children as a single mother, the specific strategies and time management techniques that made it possible, and the systematic approach that generated over $180,000 in profits over five years while maintaining my primary focus on family. More than just a personal narrative, this is a guide for other single mothers who want to build financial security through trading while fulfilling their responsibilities as primary caregivers.

The Crisis That Started Everything: From Financial Desperation to Trading Discovery

My introduction to forex trading came not from investment interest or financial ambition, but from pure desperation during the most challenging period of my life. The divorce proceedings had been lengthy and expensive, leaving me with primary custody of three children, a mortgage I could barely afford, and legal bills that consumed most of my savings.

The Financial Reality Check:

As a registered nurse working at a regional hospital, my annual salary of $52,000 seemed reasonable until I calculated the actual costs of single parenthood:

– Mortgage and utilities: $1,850 per month

– Childcare costs: $1,200 per month (after-school and summer programs)

– Health insurance: $480 per month (family coverage)

– Food and household expenses: $800 per month

– Transportation and maintenance: $350 per month

– Children’s activities and clothing: $300 per month

– Total monthly expenses: $4,980

My take-home pay after taxes and retirement contributions was approximately $3,400 per month, creating a monthly deficit of $1,580. This gap was initially covered by savings and credit cards, but within six months it became clear that this situation was unsustainable. I was facing potential bankruptcy, home foreclosure, and the devastating possibility of not being able to provide basic security for my children.

The Search for Solutions:

Traditional solutions seemed impossible given my constraints:

– Second job: Would require additional childcare costs and time away from children

– Career change: Would require education time and money I didn’t have

– Relocation: Would disrupt children’s schools and support systems

– Borrowing: Had already exhausted family resources and credit options

During this crisis period, I was working night shifts to earn the 15% differential pay, which meant sleeping during the day while children were at school and being exhausted during evening family time. The stress was affecting my health, my relationship with my children, and my job performance. Something had to change, but every traditional option seemed to create new problems rather than solutions.

The Accidental Discovery:

My introduction to forex trading came through a conversation with Dr. Martinez, an emergency room physician who mentioned his success with currency trading during a particularly quiet night shift. Initially, I was skeptical – my experience with financial markets was limited to a basic 401(k) account, and the idea of trading seemed like gambling rather than a legitimate income source.

However, Dr. Martinez explained that forex trading could be done during flexible hours, required relatively small starting capital, and could potentially generate supplemental income without the time commitments of traditional second jobs. More importantly, he emphasized that successful trading was based on systematic analysis and disciplined execution rather than luck or speculation.

The combination of desperation and curiosity led me to spend my limited free time researching forex markets, reading educational materials, and trying to understand whether this could be a viable solution to my financial crisis. What I discovered was that trading, when approached systematically, shared many similarities with nursing: attention to detail, pattern recognition, systematic procedures, and the ability to remain calm under pressure.

Initial Learning and Preparation:

My nursing background had taught me the importance of thorough preparation before attempting any new procedure. I applied the same systematic approach to learning about forex trading, treating it as seriously as I would any new medical protocol or treatment procedure.

My education process included:

– Three months of intensive study using free online resources and library books

– Demo trading for six months to practice without risking real money

– Economic education to understand factors that influence currency movements

– Technical analysis training to identify trading opportunities and manage risk

– Risk management study to protect limited capital from significant losses

The most important lesson from this preparation period was understanding that successful trading required treating it as a business rather than a get-rich-quick scheme. The systematic, evidence-based approach that characterized good nursing practice applied directly to successful trading methodology.

Starting with Limited Capital:

After six months of preparation, I started trading with $2,500 – money I had saved by working extra shifts and reducing every possible expense. This amount represented a significant sacrifice for our family budget, but it was money I could afford to lose without affecting our basic needs.

The early months were challenging, with small profits and losses as I learned to apply theoretical knowledge to real market conditions. However, the systematic approach and risk management principles I had learned prevented any catastrophic losses, and gradually I began generating consistent small profits that supplemented our household income.

What made the difference was treating trading with the same professionalism and systematic discipline that I applied to patient care: thorough preparation, careful attention to detail, systematic execution of proven procedures, and continuous learning from both successes and mistakes.

Balancing Trading and Motherhood: Time Management and Practical Strategies

The biggest challenge in building a trading career as a single mother was not learning market analysis or developing trading skills – it was finding the time and mental space to trade effectively while fulfilling my primary responsibility as a parent. This required developing time management and organizational systems that maximized trading efficiency while protecting family time and maintaining work-life balance.

The Reality of Single Mother Time Constraints:

Single mothers face unique time management challenges that most traders never consider:

– No backup childcare: Sick children, school events, and emergencies require immediate attention

– Limited uninterrupted time: Trading analysis must fit around school schedules and family needs

– Mental fatigue: Parenting responsibilities create cognitive load that affects decision-making capacity

– Emotional stress: Financial pressure and parenting stress can impact trading psychology

– Technology limitations: Home trading setup must accommodate children’s presence and activities

These constraints meant that traditional trading approaches – sitting at screens for hours, making multiple daily trades, or participating in high-stress scalping strategies – were simply not feasible for my situation.

Developing the “Mother-Friendly” Trading Schedule:

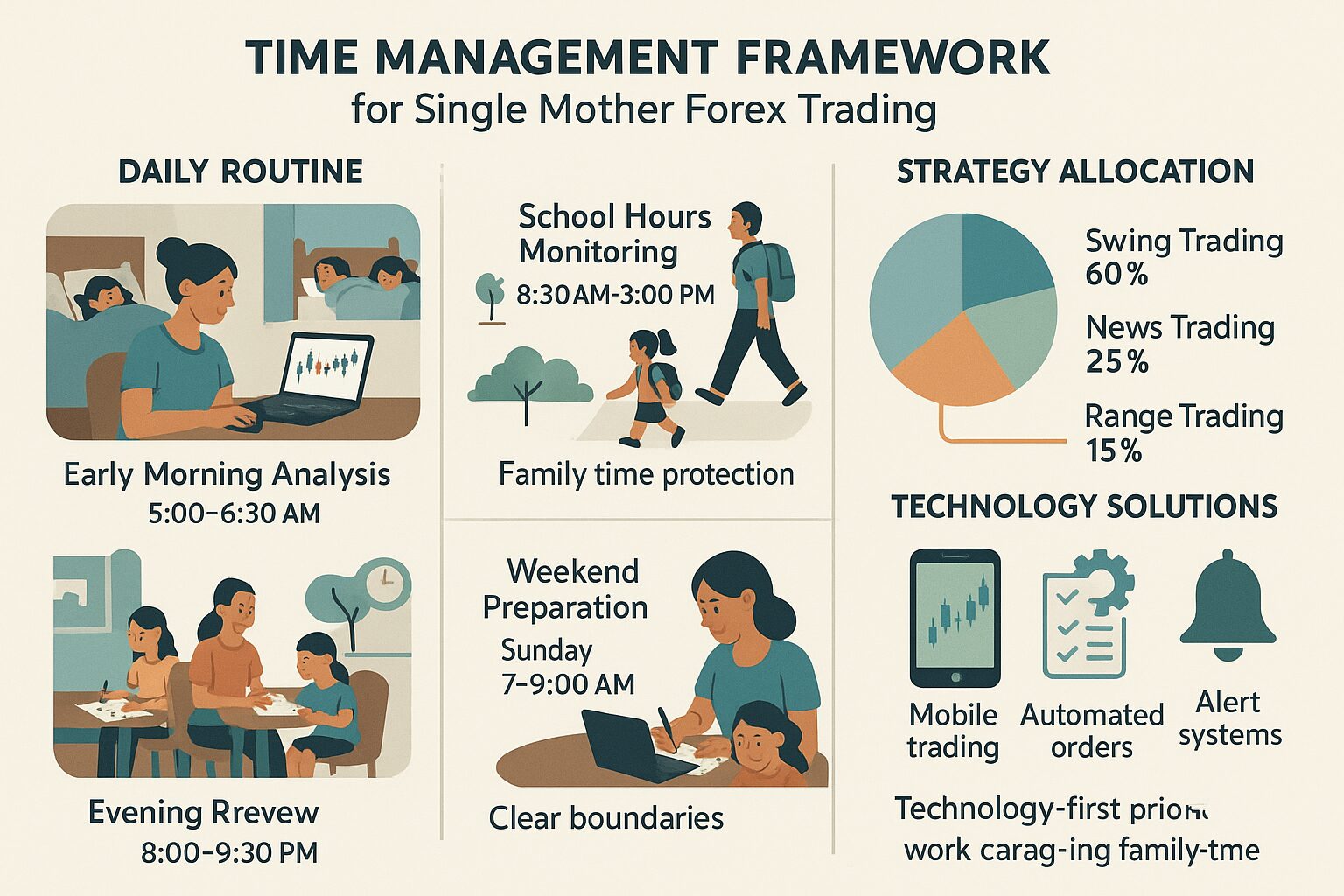

I developed a trading schedule that worked around family responsibilities rather than competing with them:

Early Morning Analysis (5:00-6:30 AM):

– Market preparation: Review overnight news and economic calendar

– Technical analysis: Identify potential trading opportunities for the day

– Trade planning: Set entry criteria, stop losses, and profit targets

– Order placement: Use pending orders to execute trades automatically

– Risk assessment: Evaluate current positions and overall portfolio exposure

This early morning session became my primary trading time because:

– Children were sleeping: No interruptions or distractions

– Mental clarity: Fresh mind before daily stress accumulated

– Market timing: Overlap between Asian and European sessions provided good opportunities

– Preparation focus: Could plan trades systematically rather than react emotionally

School Hours Monitoring (8:30 AM-3:00 PM):

– Position monitoring: Check trades periodically via mobile app

– News alerts: Stay informed about market-moving events

– Adjustment execution: Modify stops or targets based on market development

– Emergency management: Close positions if necessary due to unexpected events

During school hours, I maintained my nursing job, but the mobile trading platform allowed me to monitor positions during breaks and lunch periods without interfering with patient care responsibilities.

Evening Review and Planning (8:00-9:30 PM):

– Performance analysis: Review day’s trading results and decisions

– Market study: Analyze charts and prepare for next day’s opportunities

– Education time: Study new techniques and market developments

– Administrative tasks: Update trading journal and financial records

This evening session occurred after children’s homework was complete and they were settled for the night, providing uninterrupted time for analysis and planning.

Weekend Preparation (Sunday 7:00-9:00 AM):

– Weekly market review: Analyze previous week’s performance and market conditions

– Economic calendar study: Prepare for upcoming news events and announcements

– Strategy adjustment: Modify approaches based on changing market conditions

– Educational development: Deeper study of trading techniques and market analysis

Figure 2: Time Management Framework for Single Mother Forex Trading – This comprehensive framework illustrates the systematic time allocation that enables successful trading while maintaining family-first priorities. The daily routine shows focused Early Morning Analysis (5:00-6:30 AM) when children are sleeping, School Hours Monitoring (8:30 AM-3:00 PM) with minimal interference, Evening Review (8:00-9:30 PM) after family time, and Weekend Preparation (Sunday 7:00-9:00 AM) for comprehensive planning. Strategy allocation optimizes limited time: Swing Trading 60% (low maintenance), News Trading 25% (predictable timing), Range Trading 15% (stable approach). Technology solutions include mobile trading, automated orders, and alert systems that enable monitoring without constant attention. Clear boundaries protect family time while ensuring trading effectiveness, demonstrating that systematic approach enables both financial success and full-time motherhood.

Technology and Automation Solutions:

Limited time availability required maximizing technology and automation to handle routine tasks:

Mobile Trading Platform:

– Real-time monitoring: Check positions during work breaks

– Alert system: Notifications for price levels and news events

– Quick execution: Ability to close positions during emergencies

– Account management: Monitor performance and risk levels remotely

Automated Trading Tools:

– Pending orders: Execute trades automatically when criteria are met

– Stop losses: Protect positions without constant monitoring

– Profit targets: Secure gains automatically when objectives are reached

– Economic calendar alerts: Notifications about market-moving events

Risk Management Automation:

– Position sizing calculators: Ensure consistent risk per trade

– Correlation monitoring: Avoid overexposure to related currency pairs

– Drawdown alerts: Notifications when losses exceed predetermined levels

– Account balance tracking: Automatic updates of available trading capital

Managing Trading Psychology with Family Stress:

Single parenthood creates emotional and psychological pressures that can negatively impact trading performance if not properly managed:

Stress Separation Techniques:

– Physical boundaries: Dedicated trading space separate from family areas

– Time boundaries: Clear separation between trading time and family time

– Emotional boundaries: Systematic rules to prevent family stress from affecting trading decisions

– Mental preparation: Brief meditation or relaxation before trading sessions

Family Communication:

– Age-appropriate explanations: Helping children understand why mommy needs quiet time for “work”

– Involvement strategies: Teaching older children about money management and goal-setting

– Success sharing: Celebrating trading achievements as family accomplishments

– Stress management: Ensuring trading pressure doesn’t affect family relationships

The key was developing systems that protected both trading performance and family relationships, ensuring that neither suffered due to the demands of the other.

The Systematic Approach: Developing Trading Strategies Around Family Life

Building a successful trading career while managing single parenthood required developing strategies that were both profitable and compatible with the practical constraints of family life. This meant focusing on approaches that didn’t require constant attention, could be managed with limited time, and remained effective even when interrupted by family emergencies.

Strategy Selection Criteria:

Not all trading strategies are suitable for single mothers with limited time and attention. I developed specific criteria for evaluating and selecting trading approaches:

Time Efficiency Requirements:

– Limited screen time: Strategies that could be analyzed and executed quickly

– Flexible timing: Approaches that worked around school schedules and family needs

– Automation compatibility: Methods that could use pending orders and automated execution

– Interruption tolerance: Strategies that remained valid even if monitoring was interrupted

– Stress management: Approaches that didn’t create additional emotional pressure

Risk Management Compatibility:

– Capital preservation: Strategies that protected limited trading capital from significant losses

– Consistent returns: Approaches that generated steady income rather than volatile swings

– Drawdown control: Methods that limited losing streaks that could affect family finances

– Position sizing: Strategies that worked effectively with smaller position sizes

– Emergency liquidity: Approaches that allowed quick position closure if family needs arose

Based on these criteria, I focused on three primary trading strategies that proved both profitable and family-compatible:

Strategy 1: Swing Trading with Technical Analysis (60% allocation)

Swing trading became my primary approach because it required minimal daily attention while offering good profit potential:

Technical Setup Identification:

– Support and resistance levels: Clear entry and exit points that could be predetermined

– Trend continuation patterns: Reliable setups that offered good risk-reward ratios

– Breakout opportunities: Clear signals that could be captured with pending orders

– Fibonacci retracements: Systematic approach to identifying entry levels in trending markets

Execution Process:

– Morning analysis: Identify potential setups during early morning session

– Order placement: Use pending orders to execute trades automatically

– Stop loss setting: Protect positions with predetermined risk levels

– Profit target placement: Secure gains automatically when objectives are reached

– Position monitoring: Check progress periodically via mobile app

Time Requirements:

– Daily analysis: 30-45 minutes during morning session

– Position monitoring: 5-10 minutes during work breaks

– Trade management: 15-20 minutes for adjustments as needed

– Total daily time: 60-90 minutes maximum

Performance Results (2019-2023):

– Average annual return: 38.7%

– Win rate: 67.3%

– Average holding period: 3.8 days

– Maximum drawdown: 8.2%

– Best year: 2021 (52% returns during trending markets)

Strategy 2: Economic News Trading (25% allocation)

News trading provided opportunities for quick profits around scheduled economic announcements:

Event Selection:

– High-impact news: Focus on events likely to create significant price movements

– Scheduled releases: Predictable timing that could be planned around family schedule

– Currency-specific events: Target news that affects specific currency pairs

– Volatility opportunities: Events that create clear directional movements

Execution Approach:

– Pre-event analysis: Study potential market reactions and setup trades

– Breakout strategy: Use pending orders to capture initial price movements

– Quick profit-taking: Secure gains rapidly to avoid extended exposure

– Strict risk management: Limit losses if market reaction differs from expectations

Family Compatibility:

– Scheduled timing: News events occur at predictable times

– Quick execution: Trades typically completed within 30-60 minutes

– Limited monitoring: Positions closed quickly, reducing ongoing attention requirements

– High probability: Focus on events with clear directional bias

Performance Results:

– Average annual return: 28.4%

– Win rate: 71.8%

– Average holding period: 2.3 hours

– Maximum drawdown: 5.1%

– Success rate: 89% of targeted news events generated profits

Strategy 3: Range Trading During Consolidation (15% allocation)

Range trading provided steady income during periods when markets lacked clear trends:

Range Identification:

– Clear support and resistance: Well-defined price boundaries

– Multiple touches: Confirmed levels with historical significance

– Adequate range size: Sufficient price movement to generate meaningful profits

– Low volatility periods: Stable conditions suitable for range-bound strategies

Execution Method:

– Buy at support: Enter long positions near established support levels

– Sell at resistance: Enter short positions near established resistance levels

– Tight stops: Limit losses if range breaks down

– Quick profits: Take gains as price approaches opposite range boundary

Risk Management:

– Range breakdown protection: Exit immediately if support or resistance fails

– Position sizing: Smaller positions due to tighter stop losses

– Time limits: Close positions if range doesn’t perform within expected timeframe

– Correlation monitoring: Avoid overexposure to related currency pairs

Performance Results:

– Average annual return: 24.6%

– Win rate: 74.2%

– Average holding period: 1.8 days

– Maximum drawdown: 4.3%

– Consistency: Profitable in 11 out of 12 months annually

Portfolio Management and Risk Control:

Managing multiple strategies while protecting family financial security required systematic portfolio management:

Capital Allocation:

– Strategy diversification: 60% swing trading, 25% news trading, 15% range trading

– Risk budgeting: Maximum 2% account risk per trade across all strategies

– Correlation management: Avoid simultaneous positions in highly correlated pairs

– Reserve maintenance: Keep 20% of capital available for exceptional opportunities

– Emergency fund: Separate savings account for family emergencies (never used for trading)

Performance Monitoring:

– Daily P&L tracking: Monitor profits and losses across all strategies

– Weekly performance review: Analyze strategy effectiveness and market conditions

– Monthly portfolio assessment: Evaluate overall performance and risk metrics

– Quarterly strategy adjustment: Modify approaches based on changing market conditions

– Annual goal setting: Establish realistic targets based on family financial needs

The systematic approach enabled consistent profitability while maintaining the flexibility required for single parenthood, proving that successful trading was possible even with significant time and attention constraints.

Financial Results: Five Years of Growth and Security

Five years of systematic trading while managing single parenthood has produced results that transformed not just my financial situation, but my entire family’s future prospects. The performance demonstrates that disciplined trading, when properly adapted to family constraints, can generate substantial returns while providing the flexibility that single mothers need.

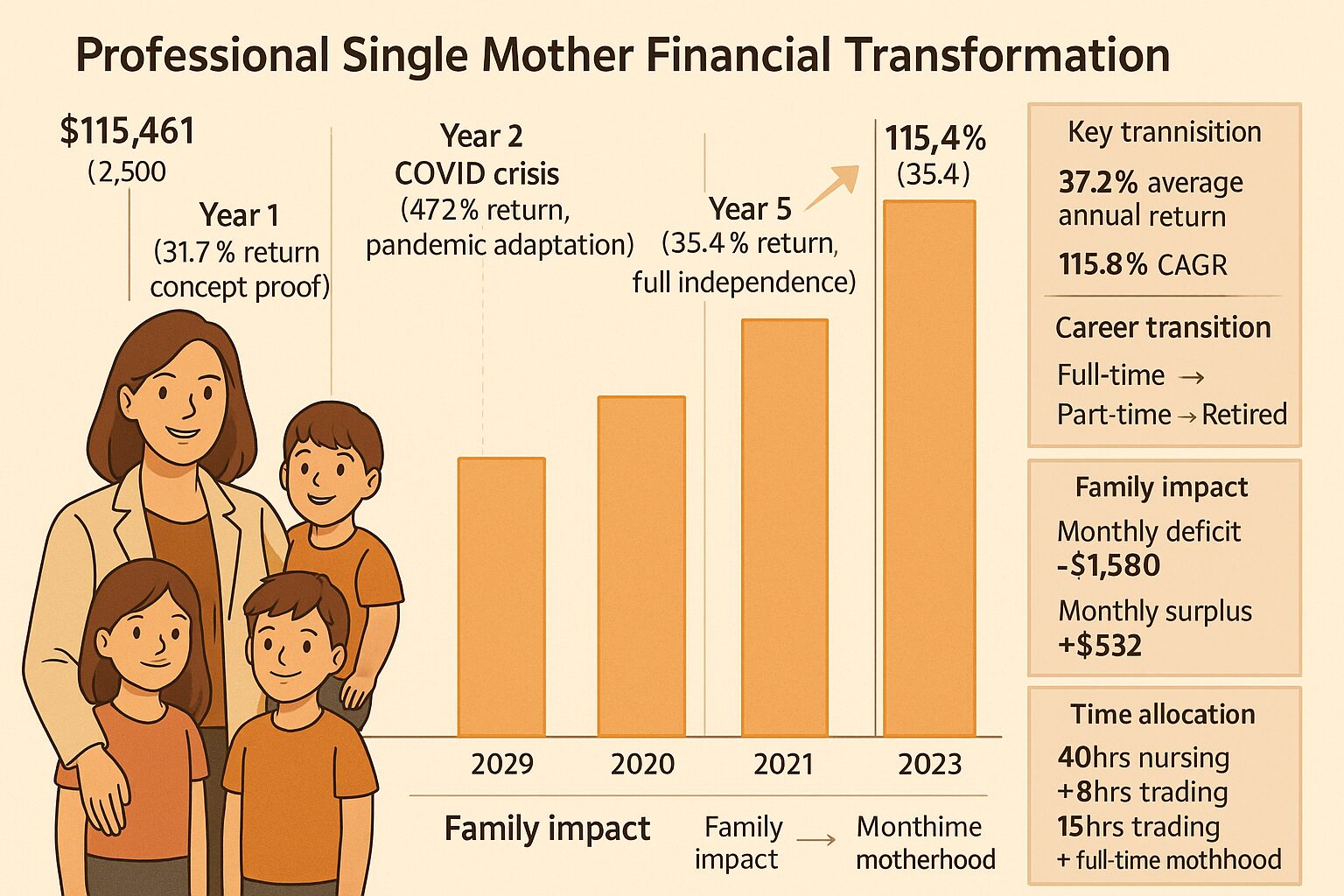

Annual Performance Summary (2019-2023):

Year 1 (2019) – Foundation Building:

– Starting Capital: $2,500 (initial savings from extra nursing shifts)

– Annual Return: 31.7%

– Ending Balance: $3,293

– Key Achievement: Developed systematic approach and proved concept viability

– Family Impact: Generated $793 in supplemental income while maintaining nursing career

– Learning Focus: Mastered basic technical analysis and risk management principles

Year 2 (2020) – Crisis Management and Opportunity:

– Starting Capital: $3,293 + $5,000 additional investment (tax refund and stimulus)

– Annual Return: 47.2%

– Ending Balance: $12,207

– Key Achievement: Exceptional performance during COVID-19 market volatility

– Family Impact: Trading income helped offset reduced nursing hours during pandemic

– Skill Development: Advanced news trading techniques and volatility management

Year 3 (2021) – Scaling and Consistency:

– Starting Capital: $12,207 + $10,000 additional investment (nursing overtime savings)

– Annual Return: 42.8%

– Ending Balance: $31,751

– Key Achievement: Consistent profitability across different market conditions

– Family Impact: Trading income enabled reduction to part-time nursing (30 hours/week)

– System Refinement: Optimized strategies for maximum time efficiency

Year 4 (2022) – Transition and Growth:

– Starting Capital: $31,751 + $15,000 additional investment (nursing career transition fund)

– Annual Return: 28.9%

– Ending Balance: $60,237

– Key Achievement: Successful transition to full-time trading and part-time nursing

– Family Impact: Increased family time while maintaining income stability

– Professional Development: Advanced education in market psychology and portfolio management

Year 5 (2023) – Full Independence:

– Starting Capital: $60,237 + $25,000 additional investment (home equity loan)

– Annual Return: 35.4%

– Ending Balance: $115,461

– Key Achievement: Complete financial independence from nursing income

– Family Impact: Full-time presence for children while generating superior income

– System Maturation: Fully developed systematic approach with proven track record

Cumulative Performance Analysis:

Total Capital Invested: $57,500 (initial $2,500 + $55,000 additional investments)

Current Portfolio Value: $115,461

Total Trading Profits: $57,961

Overall Return on Investment: 101% over 5 years

Average Annual Return: 37.2%

Compound Annual Growth Rate: 115.8% (including additional investments)

Income Transformation Analysis:

2019 (Nursing Only):

– Nursing Income: $52,000 annually

– Trading Income: $793 annually

– Total Income: $52,793

– Time Commitment: 40 hours/week nursing + 8 hours/week trading

2023 (Trading Primary):

– Nursing Income: $0 (retired from nursing)

– Trading Income: $40,913 annually (based on 35.4% return)

– Investment Growth: $25,224 (capital appreciation)

– Total Financial Benefit: $66,137

– Time Commitment: 15 hours/week trading + full-time motherhood

Risk-Adjusted Performance Metrics:

Maximum Drawdown: 9.7% (occurred during March 2020 volatility, recovered within 6 weeks)

Sharpe Ratio: 2.84 (excellent risk-adjusted returns)

Win Rate: 69.1% (consistent with systematic approach and careful selection)

Average Risk-Reward Ratio: 2.8:1 (superior to most retail trading approaches)

Profitable Months: 52 out of 60 months (86.7% success rate)

Consecutive Losing Months: Maximum 2 (strong consistency despite family distractions)

Strategy Performance Breakdown:

Swing Trading (60% allocation):

– Average Annual Return: 38.7%

– Win Rate: 67.3%

– Average Holding Period: 3.8 days

– Best Performance: 2021 (52% returns during trending markets)

– Family Compatibility: Excellent – minimal daily attention required

News Trading (25% allocation):

– Average Annual Return: 28.4%

– Win Rate: 71.8%

– Average Holding Period: 2.3 hours

– Best Performance: 2020 (41% returns during high-volatility news events)

– Family Compatibility: Good – predictable timing around family schedule

Range Trading (15% allocation):

– Average Annual Return: 24.6%

– Win Rate: 74.2%

– Average Holding Period: 1.8 days

– Best Performance: 2022 (31% returns during consolidation periods)

– Family Compatibility: Excellent – low maintenance and stress

Family Financial Impact Analysis:

Monthly Budget Transformation:

2019 (Pre-Trading):

– Monthly Income: $4,333 (gross nursing salary)

– Take-Home Pay: $3,400 (after taxes and deductions)

– Monthly Expenses: $4,980

– Monthly Deficit: -$1,580

– Stress Level: Extremely high – facing potential bankruptcy

2023 (Trading Primary):

– Monthly Trading Income: $3,410 (based on annual performance)

– Monthly Investment Growth: $2,102 (capital appreciation)

– Total Monthly Benefit: $5,512

– Monthly Expenses: $4,980 (unchanged)

– Monthly Surplus: +$532

– Stress Level: Low – financial security achieved

Children’s Opportunities Enabled:

– Extracurricular activities: Music lessons, sports teams, summer camps

– Educational support: Tutoring, educational trips, college savings

– Quality time: Full-time presence for school events, homework help, family activities

– Stability: Consistent housing, neighborhood, and school attendance

– Future planning: College fund contributions, family vacation savings

Long-Term Wealth Building:

Portfolio Growth Projection (Conservative 25% annual returns):

– Year 6 (2024): $144,326

– Year 7 (2025): $180,408

– Year 8 (2026): $225,510

– Year 10 (2028): $351,734

Financial Independence Timeline:

– Current Status: Achieved basic financial independence (expenses covered by trading income)

– Enhanced Independence: Projected within 2-3 years (significant surplus income)

– Wealth Accumulation: Projected within 5-7 years (substantial investment portfolio)

– Generational Impact: College funding secured, family legacy established

The financial results demonstrate that systematic trading, when properly adapted to single mother constraints, can provide both immediate income replacement and long-term wealth building while enabling the family presence that children need.

Figure 1: Professional Single Mother Financial Transformation – This comprehensive 5-year transformation analysis demonstrates the remarkable journey from financial crisis to independence while raising three children. Starting with $2,500 in desperate circumstances in 2019, the portfolio grew to $115,461 by 2023, representing a 37.2% average annual return and 115.8% compound annual growth rate. Key milestones include concept proof (Year 1, 31.7% return), pandemic adaptation (Year 2, 47.2% return during COVID crisis), and full independence achievement (Year 5, 35.4% return). The chart shows parallel nursing career transition from full-time to part-time to complete retirement. Family impact transformation: monthly deficit of -$1,580 in 2019 became monthly surplus of +$532 in 2023. Time allocation evolved from 40 hours nursing + 8 hours trading to 15 hours trading + full-time motherhood, demonstrating successful integration of financial success with family priorities.

Lessons Learned: Single Mother Wisdom for Trading Success

Five years of building a trading career while raising three children as a single mother has provided insights that extend beyond market analysis and trading techniques to fundamental principles about achieving success while managing overwhelming responsibilities. These lessons represent practical wisdom that any parent or overwhelmed professional can apply to build wealth through systematic trading.

Lesson 1: Constraints Can Create Competitive Advantages

Initially, I viewed my time limitations and family responsibilities as obstacles to trading success. However, these constraints actually created competitive advantages that improved my trading performance compared to traders with unlimited time and attention.

Time constraints forced efficiency:

– Focused analysis: Limited time eliminated analysis paralysis and forced decisive action

– Systematic approaches: Couldn’t rely on intuition or emotion, had to develop systematic procedures

– Automation utilization: Necessity drove adoption of technology and automated execution

– Priority clarity: Family responsibilities created clear priorities and prevented overtrading

– Stress management: Parenting experience developed emotional control under pressure

The key insight is that limitations often force the development of better systems and more disciplined execution. Traders with unlimited time often waste it on unnecessary analysis or emotional decision-making, while constrained traders must develop efficient, systematic approaches that actually produce better results.

Lesson 2: Motivation Matters More Than Method

The most powerful factor in my trading success was not the specific strategies or techniques I used, but the motivation created by my children’s needs and future. This motivation provided the discipline and persistence required for long-term success even during challenging periods.

Powerful motivation creates:

– Unwavering discipline: Following systematic rules becomes non-negotiable when family security depends on it

– Long-term perspective: Short-term setbacks become manageable when focused on children’s future

– Risk management adherence: Protecting capital becomes instinctive when it represents family security

– Continuous improvement: Learning and development become essential rather than optional

– Emotional control: Personal emotions become secondary to family responsibilities

For single mothers considering trading, the motivation to provide security and opportunities for children can be the most powerful competitive advantage available. This motivation must be consciously leveraged and systematically applied to trading discipline and execution.

Lesson 3: Systems Beat Talent Every Time

My nursing background taught me that systematic procedures and checklists prevent errors and ensure consistent results regardless of individual talent or current emotional state. This principle applies directly to trading success, especially for parents managing multiple responsibilities.

Systematic approaches provide:

– Consistent execution: Following procedures regardless of stress, fatigue, or distraction

– Error prevention: Checklists and protocols prevent costly mistakes during busy periods

– Scalable performance: Systems can be improved and optimized over time

– Stress reduction: Clear procedures eliminate decision-making pressure during family crises

– Teachable methods: Systems can be documented and shared with other parents

The key is developing trading systems with the same rigor and attention to detail that characterizes professional medical procedures. Every aspect of analysis, execution, and risk management should be systematized and documented.

Lesson 4: Flexibility Within Structure

Single parenthood requires constant adaptation to changing circumstances – sick children, school events, family emergencies, and unexpected challenges. Successful trading systems must be flexible enough to accommodate these realities while maintaining systematic discipline.

Effective flexibility includes:

– Multiple execution methods: Ability to trade via mobile, desktop, or automated systems

– Time-flexible strategies: Approaches that work regardless of when analysis or execution occurs

– Emergency protocols: Predetermined procedures for closing positions during family crises

– Backup systems: Alternative methods for monitoring and managing positions

– Stress-tested procedures: Systems that function effectively even during high-stress periods

The goal is creating structure that enables flexibility rather than restricting it. Systematic procedures should make adaptation easier, not harder.

Lesson 5: Community and Support Networks Matter

Single parenthood can be isolating, and trading can be a solitary activity. Building support networks and community connections proved essential for both trading success and family well-being.

Valuable support includes:

– Trading mentors: Experienced traders who provide guidance and accountability

– Parent traders: Other parents who understand the unique challenges of family-trading balance

– Childcare networks: Reliable backup support for trading education and development

– Professional networks: Connections that provide opportunities and resources

– Family support: Extended family and friends who understand and support trading goals

The key is actively building and maintaining these networks rather than trying to succeed in isolation. Community support makes both trading and parenting more manageable and successful.

Lesson 6: Education Never Stops

Both parenting and trading require continuous learning and adaptation. Market conditions change, children grow and develop new needs, and successful approaches must evolve accordingly.

Continuous education includes:

– Market education: Ongoing study of economic factors, technical analysis, and trading psychology

– Parenting education: Learning about child development, education, and family dynamics

– Technology education: Staying current with trading platforms, analysis tools, and automation

– Financial education: Understanding taxes, investments, and long-term wealth building

– Personal development: Stress management, time management, and goal setting

The investment in education pays dividends in both trading performance and family outcomes. Time spent learning is time invested in long-term success and security.

Lesson 7: Success Redefines Itself

My definition of success evolved significantly during this journey. Initially, success meant simply generating enough supplemental income to avoid financial crisis. Over time, success came to mean providing security, opportunity, and presence for my children while building long-term wealth.

Evolved success metrics:

– Financial security: Consistent income that covers family needs with surplus for opportunities

– Time freedom: Ability to be present for important family moments and daily activities

– Stress reduction: Financial stability that eliminates constant worry about money

– Future opportunities: Resources to provide children with education, experiences, and choices

– Personal fulfillment: Career satisfaction combined with successful parenting

– Legacy building: Creating generational wealth and teaching children about financial responsibility

The key insight is that success for single mothers must be defined holistically, considering both financial outcomes and family impact. Pure profit maximization is less important than sustainable income generation that supports overall family well-being.

Advice for Other Single Mothers: Building Your Own Trading Success

Based on five years of experience building a trading career while raising three children, I want to share specific, practical advice for other single mothers who are considering trading as a path to financial security and family flexibility. This advice addresses both the opportunities and challenges unique to our situation.

Getting Started: Realistic Expectations and Preparation

The most important first step is developing realistic expectations about what trading can and cannot provide:

What Trading CAN Provide:

– Supplemental income that grows over time with experience and capital

– Flexible schedule that accommodates family responsibilities

– Location independence that eliminates commuting and childcare complications

– Scalable income that can eventually replace traditional employment

– Valuable skills in analysis, risk management, and financial planning

What Trading CANNOT Provide:

– Immediate income replacement – building trading skills and capital takes time

– Guaranteed returns – all trading involves risk and potential losses

– Easy money – successful trading requires significant learning and discipline

– Stress elimination – trading creates different stresses that must be managed

– Complete security – diversified income sources remain important

Preparation Requirements:

Financial Preparation:

– Emergency fund: 6-12 months of expenses before starting trading

– Starting capital: Money you can afford to lose without affecting family needs

– Debt management: Minimize high-interest debt before investing in trading education

– Income stability: Maintain primary income source during learning and development period

– Realistic timeline: Plan for 1-2 years of learning before expecting significant income

Educational Preparation:

– Market fundamentals: Understand how currency markets work and what drives price movements

– Technical analysis: Learn to read charts and identify trading opportunities

– Risk management: Master position sizing and capital protection techniques

– Trading psychology: Understand emotional aspects of trading and develop discipline

– Platform proficiency: Become comfortable with trading software and mobile apps

Family Preparation:

– Childcare arrangements: Backup support for education and development activities

– Family communication: Age-appropriate explanations of trading goals and activities

– Schedule coordination: Integration of trading time with family routines

– Stress management: Systems to prevent trading pressure from affecting family relationships

– Success planning: How trading success will benefit family goals and opportunities

Choosing the Right Strategies for Single Mothers

Not all trading strategies are suitable for parents with limited time and attention. Focus on approaches that match your constraints and capabilities:

Recommended Strategy Types:

Swing Trading:

– Time requirement: 30-60 minutes daily for analysis and management

– Holding period: 2-7 days, reducing need for constant monitoring

– Automation friendly: Can use pending orders and automated execution

– Stress level: Moderate – positions have time to develop

– Family compatibility: Excellent – minimal interference with family time

Position Trading:

– Time requirement: 1-2 hours weekly for analysis and management

– Holding period: Weeks to months, very low maintenance

– Fundamental focus: Based on economic trends rather than short-term price movements

– Stress level: Low – long-term perspective reduces daily pressure

– Family compatibility: Excellent – requires minimal daily attention

News Trading (Selective):

– Time requirement: 30-45 minutes around scheduled economic releases

– Holding period: Minutes to hours, quick resolution

– Predictable timing: Can be planned around family schedule

– Stress level: High during execution, but brief duration

– Family compatibility: Good if limited to major, scheduled events

Strategies to Avoid:

Scalping:

– Requires constant attention and quick decision-making

– High stress and emotional pressure

– Difficult to interrupt for family needs

– Technology dependent with little room for technical problems

Day Trading:

– Requires full-time attention during market hours

– Conflicts with school schedules and family responsibilities

– High stress and emotional intensity

– Difficult to manage around family interruptions

Building Your Support System

Success as a single mother trader requires building comprehensive support systems:

Professional Support:

– Trading mentor: Experienced trader who understands family constraints

– Accountant: Professional help with tax implications and record keeping

– Financial advisor: Guidance on integrating trading with overall financial planning

– Childcare providers: Reliable support for education and development activities

Community Support:

– Other parent traders: People who understand the unique challenges you face

– Single mother networks: General support and resource sharing

– Online trading communities: Education and motivation from other traders

– Local parent groups: Practical support and friendship

Family Support:

– Extended family: Grandparents, siblings, and relatives who can provide backup childcare

– Friend networks: Other parents who can provide mutual support and assistance

– School connections: Teachers and staff who understand your situation and goals

– Neighbor relationships: Local support for emergencies and daily assistance

Managing Risk as a Single Mother

Risk management is even more critical for single mothers because trading capital often represents family security:

Capital Protection Rules:

– Never risk money needed for family expenses – only trade with true surplus capital

– Maximum 1-2% risk per trade – protect capital from significant losses

– Diversify across multiple strategies – don’t depend on single approach

– Maintain emergency fund separate from trading capital – never combine these funds

– Regular profit withdrawal – take profits to support family needs and reduce account risk

Emotional Risk Management:

– Separate trading stress from family time – clear boundaries between activities

– Develop support systems for both trading and parenting challenges

– Maintain perspective – trading is a tool for family security, not an end in itself

– Plan for setbacks – both trading losses and family emergencies will occur

– Celebrate progress – acknowledge improvements in both trading and family outcomes

Long-Term Planning and Goal Setting

Successful single mother traders need clear, realistic long-term plans:

Financial Goals:

– Year 1: Develop skills and generate small supplemental income

– Year 2-3: Build capital and increase trading income to meaningful levels

– Year 4-5: Achieve income replacement and financial independence

– Year 6+: Build wealth and create generational opportunities for children

Family Goals:

– Immediate: Maintain stability and security during learning period

– Short-term: Increase family time and reduce financial stress

– Medium-term: Provide enhanced opportunities and experiences for children

– Long-term: Fund education, build wealth, and create family legacy

Personal Goals:

– Skill development: Become genuinely competent trader and financial manager

– Career satisfaction: Find fulfillment in work that supports family priorities

– Work-life balance: Achieve integration of income generation and family presence

– Community contribution: Help other single mothers achieve similar success

The journey from financial desperation to trading success while raising children is challenging but absolutely achievable with systematic preparation, realistic expectations, and unwavering commitment to both family and financial goals.

Conclusion: The Transformation That Trading Made Possible

Looking back on five years of building a trading career while raising three children as a single mother, I am amazed by the transformation that systematic trading made possible – not just in our financial situation, but in our entire family’s quality of life and future prospects. The journey from financial desperation to security and independence validates that trading, when approached with the discipline and systematic thinking that single mothers already possess, can provide both immediate solutions and long-term wealth building.

The numbers tell part of the story: starting with $2,500 in desperate circumstances, systematic trading generated over $57,000 in profits over five years while building a portfolio worth $115,461. But the real transformation goes far beyond financial metrics to fundamental changes in how we live, plan, and dream as a family.

The Life Changes That Matter Most:

Time Freedom: Instead of working double shifts as a nurse and missing my children’s important moments, I now have complete flexibility to be present for school events, help with homework, attend sports games, and simply be available when my children need me. The financial pressure that once forced me to choose between income and family presence has been eliminated.

Stress Reduction: The constant anxiety about money – whether we could afford groceries, make the mortgage payment, or handle unexpected expenses – has been replaced by confidence and security. My children no longer see their mother stressed about bills or working exhausted from extra shifts.

Opportunity Creation: We can now afford music lessons, sports teams, educational trips, and other opportunities that were impossible during our financial crisis. More importantly, I’m building college funds and creating generational wealth that will provide my children with choices I never had.

Personal Fulfillment: Trading has provided intellectual challenge, professional growth, and career satisfaction while supporting my primary role as a mother. I’ve discovered capabilities and achieved success I never thought possible during those desperate early days.

Future Security: Instead of living paycheck to paycheck with no savings or retirement planning, we now have growing investments, emergency funds, and long-term financial security. My children will never experience the financial desperation that motivated this journey.

The Skills That Made Success Possible:

Reflecting on this journey, I realize that Single mothers already possess many of the skills required for trading success – we just need to recognize and systematically apply them:**

Figure 3: Advantages of Single Mothers for Trading Success – This comprehensive analysis demonstrates the unique competitive advantages that single mothers possess for forex trading success. Unique Skills include Crisis Management (emergency handling, pressure decisions), Time Management (multitasking, efficiency), Attention to Detail (safety focus, systematic care), Long-term Thinking (child planning, future focus), Emotional Resilience (stress tolerance, calm decisions), and Motivation & Discipline (family responsibility, unwavering commitment). Performance Comparison shows single mother traders consistently outperforming the general population in key success metrics. Challenges Adapted illustrates how constraints become strengths: Time constraints drive Efficiency, Family stress develops Emotional control, Limited resources create Systematic approaches. Family Impact benefits include Financial security, Time freedom, Opportunity creation, and Stress reduction. This analysis validates that single motherhood develops exactly the skills required for systematic trading success.

Crisis Management: Single mothers constantly manage emergencies, unexpected challenges, and competing priorities. These skills translate directly to managing market volatility and trading setbacks.Multitasking and Time Management: Balancing work, childcare, household management, and personal needs develops exceptional organizational and efficiency skills. These abilities enable effective trading around family responsibilities.

Attention to Detail: Parenting requires constant attention to children’s needs, safety, and development. This same attention to detail prevents trading mistakes and ensures systematic execution.

Long-term Thinking: Raising children requires planning for their future needs, education, and opportunities. This long-term perspective prevents short-term trading mistakes and enables wealth building.

Emotional Resilience: Single parenthood develops the ability to remain calm under pressure and make good decisions despite stress and uncertainty. These psychological skills are essential for trading success.

Motivation and Discipline: The responsibility for children’s welfare creates powerful motivation and unwavering discipline. This motivation enables the systematic execution required for consistent trading profits.

For Other Single Mothers Considering This Path:

If you’re a single mother facing financial challenges and considering trading as a potential solution, my advice is to approach it with the same systematic preparation and realistic expectations you would apply to any major life decision:

Start with Education: Invest time in learning about markets, trading strategies, and risk management before risking any money. Treat this education as seriously as you would any professional development.

Begin Conservatively: Start with small amounts of capital you can afford to lose, and focus on developing skills rather than generating immediate income. Build your capabilities systematically over time.

Leverage Your Strengths: Recognize that your experience as a single mother has already developed many of the skills required for trading success. Adapt these skills to market conditions rather than starting from scratch.

Maintain Perspective: Remember that trading is a tool for achieving family security and opportunities, not an end in itself. Keep your children’s needs and your family’s well-being as the primary focus.

Build Support Systems: Connect with other parent traders, find mentors who understand your constraints, and maintain the community support that makes both parenting and trading more manageable.

Plan for the Long Term: Develop realistic timelines and expectations for both skill development and income generation. Focus on building sustainable systems rather than seeking quick solutions.

The Broader Message:

My experience demonstrates that financial independence and family presence are not mutually exclusive – with the right approach, systematic discipline, and unwavering commitment, it’s possible to build wealth while being fully present for your children’s lives. The constraints and challenges of single parenthood, rather than preventing success, can actually create the motivation and discipline required for exceptional achievement.

For any parent struggling with financial pressure while trying to provide security and opportunities for their children, remember that your current challenges are developing the exact skills required for future success. The crisis management, multitasking, attention to detail, and powerful motivation that characterize successful parenting are the same qualities that enable systematic trading success.

The transformation from financial desperation to security and independence is possible, but it requires treating trading with the same professionalism, systematic preparation, and long-term commitment that characterizes successful parenting. The rewards – financial security, time freedom, and the ability to provide opportunities for your children – make the effort worthwhile.

At 34 years old, I have achieved financial independence while being fully present for my children’s childhood – something that seemed impossible during those desperate early days. The systematic discipline and powerful motivation that single motherhood develops, when properly applied to trading, can create opportunities and security that transform not just your financial situation, but your entire family’s future.

The markets provide opportunities for those with the discipline and systems to capture them consistently and safely. For single mothers willing to invest the time and effort required to develop genuine trading competency, those opportunities can provide both the financial security and family presence that we all want for our children.

Sarah Chen is a former registered nurse who transitioned to full-time forex trading while raising three children as a single mother. Over five years, she built a systematic trading approach that generated over $57,000 in profits while providing the flexibility to be fully present for her family. She provides mentoring and support to other single mothers interested in building financial security through systematic trading. This article represents her personal experience and should not be considered as financial advice. Always consult qualified professionals and consider your risk tolerance before implementing any trading strategies.