Wouldn’t it be nice if we could measure the sentiment of investors? Knowing when they’re willing to buy in the stock market or when they want to protect their capital by investing in bonds, gold, or safe haven currencies could be a real game-changer for many traders.

Guess what, there is a way we can achieve exactly that! Let’s see how to measure and trade with risk sentiment in the markets.

Risk Sentiment Explained

-

What is risk sentiment?

In essence, risk sentiment refers to the mood of investors in the markets. Risk sentiment is always real-time and can change from minute to minute, depending on the news and events in the world and the markets themselves. However, risk sentiment is mostly stable throughout the day, at least if there are no important and unexpected events (like a terrorist attack or virus outbreak, for example.)

Unlike macro fundamentals, no one can tell for sure how long a particular risk sentiment will last in the markets. The sentiment is often in line with fundamentals, but it can also move in the opposite direction of fundamentals for hours, or even days.

-

How does market sentiment affect price fluctuations?

In the big picture, sentiment is what drives prices up or down. If the market has a positive sentiment about a particular currency, this will drive demand for the currency and push its price higher. Similarly, if the market has a negative sentiment about a currency, this will increase the selling of the currency (supply) and push the currency lower.

In other words, market sentiment wraps fundamental analysis and is often the main driver of price moves in the markets. As mentioned earlier, fundamentals can point in one direction, while market sentiment can move the market in the completely opposite direction of fundamentals. This is the reason why understanding risk sentiment is so important for day traders who want to succeed in the markets.

-

Types of risk sentiment

There are two types of risk sentiment, and some of you may have heard about them. They are called risk-on and risk-off (RORO).

When markets are in risk-on, investors prefer asset classes that are generally considered riskier and that have a better return over asset classes that are generally considered safe.

When markets are in risk-off, investors prefer safer asset classes over riskier asset classes in order to protect their capital.

Examples of riskier asset classes and financial instruments include the stock market, crypto-currencies, and some fiat currencies like the Australian dollar and New Zealand dollar. On the other hand, examples of safer asset classes and instruments (also known as safe-havens) include the bond market, gold, the Japanese yen, Swiss franc, and the US dollar.

How Does Risk Sentiment Impact Markets?

Stock markets are considered riskier and with a higher rate of return than bond markets. The risky part of stock markets is their volatility. When a company announces lower earnings than expected, the price of the company’s stock may fall significantly in a matter of minutes (depending on how bad the release actually was.) This works for entire stock market sectors during times of economic recessions for example. That’s why we often see a strong sell-off in the stock markets when the economy enters a recession, as investors move their capital from riskier asset classes into safe-havens.

Similar to stock markets, crypto-currencies are also considered a risky asset class due to their extreme volatility and high returns. However, when risk sentiment turns sour, crypto-currencies will often enter into a very powerful and abrupt downtrend. Again, investors are taking their money out of crypto-currencies and putting it into safer investments in order to protect their capital.

In general, investors always seek the highest rates of return when market conditions are normal. That’s why the Australian dollar and New Zealand dollar will often see a strong spike in their prices as those currencies offer one of the highest interest rates among the major currencies.

-

Carry trades

Investors can therefore buy Australian and New Zealand dollars by shorting a low-yielding currency (like the Japanese yen, for example), which will allow them to collect the differential in interest rates between the currency they bought (AUD or NZD) and the currency they shorted (JPY or CHF). Those trades, where investors invest in the highest-yielding currencies, are also popularly known as carry trades.

-

Risk sentiment turns into risk-off

However, when market conditions are not normal and risk sentiment turns into risk-off, having a high-yielding currency isn’t attractive anymore. What investors look for during times of risk-off is to protect their capital, not to make outstanding returns in the markets. That’s when the markets will see an unwinding of carry trades, which in turn increases selling pressure in high-yielding currencies and increases demand for safe-haven currencies.

The next time you see the stock markets falling, the JPY, CHF, or USD getting stronger against all other currencies, while the AUD and NZD are falling like a stone, there is a high chance that markets have just entered risk-off mode (especially if there is no change in market fundamentals.) Take a look at the charts for March 2020 during the coronavirus outbreak, and you’ll see a typical risk-off mode in the markets.

Another popular safe haven is gold. Gold shines when markets enter risk-off mode as investors like to park their money in the yellow metal. Another popular use of gold is to hedge against inflation. When expectations about future inflation rates are high, gold tends to rise in value. However, since gold is denominated in US dollars, it’s important to understand that when the US dollar rises in value, the price of gold usually falls, even when markets are in risk-off. But, as investors start to increase the demand for gold over the coming days, gold picks up and enters a strong uptrend.

Most Popular Risk Sentiment Indicators

-

VIX

The VIX index, also known as the Cboe Volatility Index or Fear Index, is a real-time index that represents the market’s expectations for volatility in the S&P 500 over the next 30 days. The VIX uses the implied volatility of S&P 500 put and call options to measure investor sentiment for the next month. Generally, when the VIX index is rising, this means that investors expect higher volatility (typically to the downside) which can also turn into a risk-off market sentiment. When the VIX trades around 20, this is usually considered a normal market condition.

-

Gold

As mentioned earlier, gold is a safe haven used by investors and big market players to park their capital during times of economic or political turmoil. Gold has been used as money for thousands of years and has seen a steady rise in its value over time. Gold is also considered a great hedge against inflation, which is why its value rises during times of high inflation in the world.

-

NZD/JPY

Since NZD is a high-yielding risk currency and JPY a safe haven, the NZD/JPY pair is often used by traders to gauge the current risk sentiment in the markets. When the NZD/JPY pair is rising, this can reflect a risk-on mood in the markets. Similarly, when the NZD/JPY pair is falling, this can reflect a risk-off market sentiment.

However, it’s always a good idea to take a look at other risk currencies (such as AUD, for example) and other safe havens (such as USD and CHF) instead of assessing the current sentiment based only on one currency pair.

-

DXY

The US dollar is still the king currency in the forex market. It’s a world reserve currency, and given the economic strength of the United States, this likely won’t change any time soon. When markets are in turmoil, investors tend to sell their stock and other risky holdings, which in turn increases demand for US dollars in the world.

This leads to an appreciation of the currency during times of risk-off market sentiment. Always have a look at the US dollar index early in the morning before placing your trades. However, bear in mind that other fundamental factors can also lead to weakness or strength in the US dollar index, and not just risk sentiment.

-

Corporate Bond Yields

When investors are risk-averse, they tend to sell riskier assets and park their capital in safer assets. Among bonds, corporate bonds are usually considered riskier than sovereign bonds, which is why investors tend to sell corporate bonds during recessions and times of risk-off sentiment. Since bonds and yields are inversely correlated, a sell-off in corporate bonds will lead to an increase in their yields, which is a good barometer for the current market sentiment.

-

The Swiss franc

The CHF is a great safe haven due to the global status of Switzerland, which is considered a stable country with low debt rates and good trade balances. This is why the CHF tends to increase in value during times of risk-off, especially if there are problems in the euro area. The EUR/CHF pair is an interesting pair to watch when there is bad news surrounding the eurozone and the euro.

How to Trade with Risk Sentiment in the Markets?

Trading with risk sentiment involves analyzing various markets and asset classes to measure the current investor sentiment. For example, if a trader trades exclusively forex, he or she could get valuable insights from the stock and bond markets regarding the current risk sentiment.

-

Nikkei 225

A popular indicator is to use the Nikkei 225 when trading with the Japanese yen. The Nikkei 225 is a major stock index in Japan, and the JPY is considered a safe haven because of the large holdings of foreign debt that the Japanese government holds.

An interesting relationship is that when the Nikkei 225 falls, which means falling stock prices in Japan, the Japanese yen tends to strengthen. The reason behind this is fairly simple. When the Japanese stock market is in turmoil, Japanese investors who have large foreign holdings tend to sell them for JPY, which in turn increases demand for the currency.

This chart shows how the USD/JPY pair reacts to changes in the Nikkei 225. Note that the pair tends to rise when Nikkei 225 is rising (meaning a weaker JPY) and falling when the Nikkei is falling. Just recently, the pair broke below a longer-term trendline, and the Nikkei suggests further weakness in the pair.

-

USD/JPY pair

The next chart shows how the Coronavirus outbreak affected the NZD/JPY pair. Remember, the NZD/JPY pair is a popular proxy for risk sentiment as it consists of the New Zealand dollar, which is considered a high-yielding currency, and the Japanese yen, which is considered a safe haven. When risk sentiment turns negative, investors tend to unwind carry trades (carry trades refer to buying high-yielding currencies and shorting low-yielding ones), which creates selling pressure on the high-yielding currencies that make up those portfolios.

The NZDJPY pair made a 1000+ pips move after countries around the world introduced lockdowns to help the healthcare system fight against the pandemic.

-

US dollar & gold

The next chart shows the relationship between the US dollar, gold, and risk sentiment. Since gold is denominated in the US dollar on the global markets, it tends to fall immediately after the US dollar enters a bull, because gold sellers around the world are willing to sell gold for a lower price when the US dollar is strong. However, as markets enter risk-off and investors start to park their money in safe havens (including gold), the price of the yellow metal starts to rise.

-

Currency strength chart

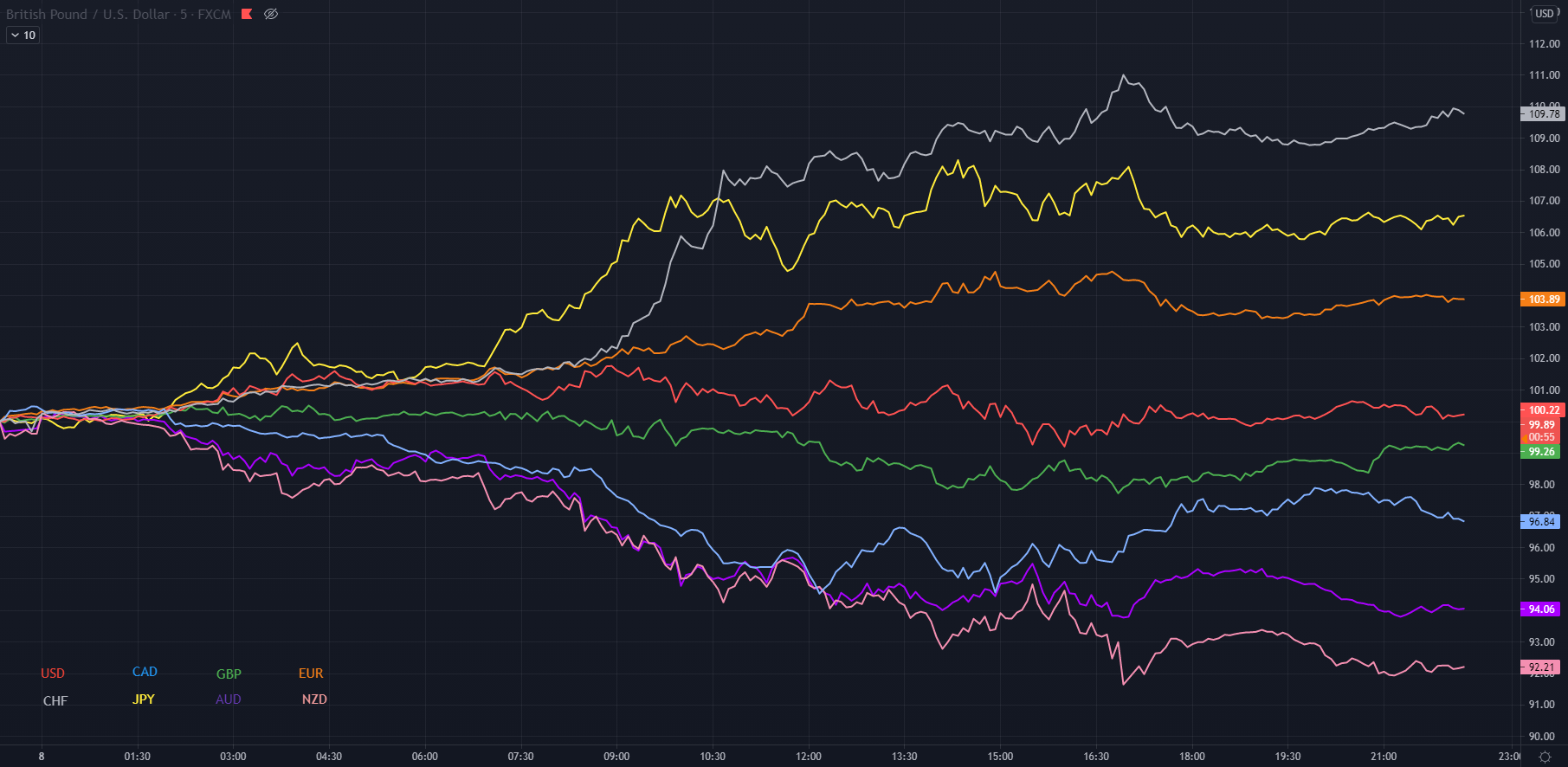

Finally, traders can analyze a currency strength chart, like the one shown below, to analyze whether markets are in risk-off or risk-on. Remember, risk-off is characterized by strengthening safe havens and weakening risk currencies.

This chart shows exactly this situation: the CHF and JPY are the strongest currencies for the day, while NZD and AUD are the weakest. This signals that investors aren’t willing to take on risks during the day, which also signals lower stock prices, higher bond prices, and potentially higher gold prices.

Bear in mind that the risk sentiment in the forex market can often change between different forex trading sessions. For example, we could have risk-off during the Asian and European session, but risk-on when the US markets open later in the day. It’s also beneficial to know that risk sentiment tends to remain steady during a single trading session.

Final Words

Trading with risk sentiment opens many new doors for forex traders. Risk sentiment refers to the general mood of market participants in real-time and can change from minute to minute.

In essence, when investors have a low-risk appetite (risk-off) they tend to sell riskier asset classes and move their capital to safer asset classes, like bonds or precious metals. When risk appetite is high, investors tend to buy riskier assets like stocks and prefer high-yielding currencies like the Australian dollar or New Zealand dollar.