The Vegas Tunnel Trading System was developed by a famous Forex trader named Barry Haigh. Barry worked at the Mid America Commodity Exchange as a newbie trader where he thought about how the markets operate and what trading systems would generate the best results.

Do complex systems really generate better returns than simple ones? What if a simple system could provide a rule-based methodology to enter and exit the markets, and lock in profits as a position goes in the trader’s favor? He included all this in his well-known Vegas Tunnel Trading System.

What is Vegas Tunnel Trading?

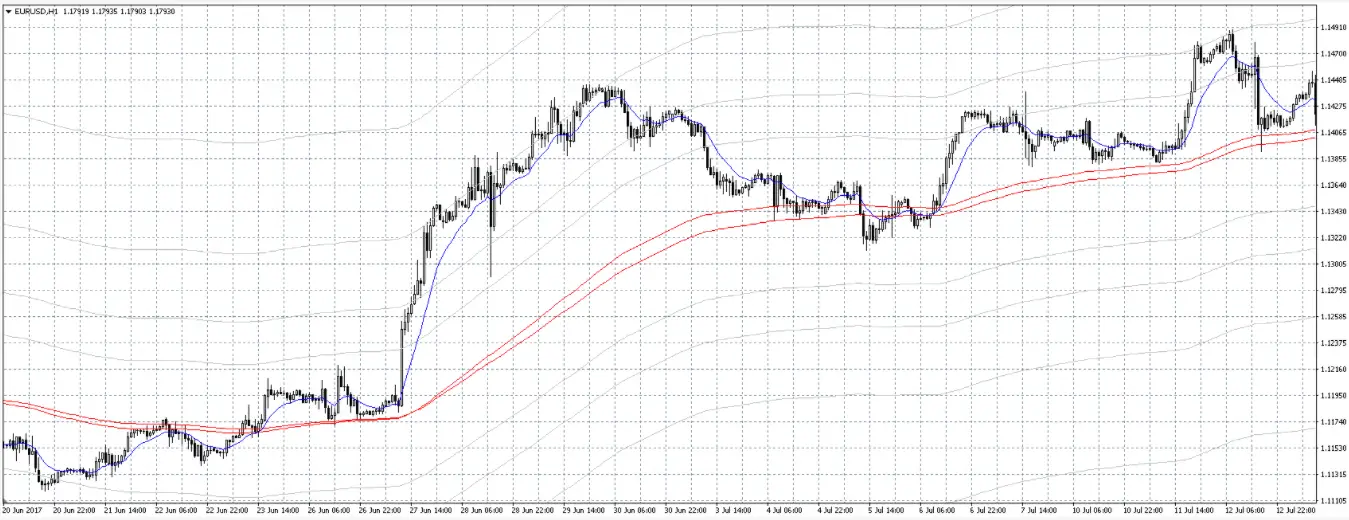

Vegas Tunnel Trading is a trading system developed to trade the Forex market on the 1-hour charts. Later, Barry also adjusted the system to work on the 4-hour chart and daily charts for traders who don’t have the time to follow the 1-hour chart.

The system is partly based on Fibonacci numbers and Gann squares. Barry tried to include tested methodologies in the Vegas system to make it as robust as possible.

However, the backbone of the system is two exponential moving averages (the 144 EMA and the 169 EMA), and the 12 EMA that acts as a filter for trades. Profit-taking levels are also based on the Fibonacci sequence, with the 55, 89, 144, 233, and 377 numbers used to take partial profits. We’ll soon show you how this works.

The basic principle behind Vegas trading is that markets like to trend on momentum. When the price crosses the upper boundary of the 144 EMA and the 169 EMA tunnel (this is why this system is called Vegas Tunnel Trading), a buying signal is generated.

Similarly, when the price crosses below the lower boundary of the tunnel, a selling signal is generated. When the price reaches the first Fib level (55 pips away from the tunnel), you should take the first profits and let the remainder run. When the next Fib level is reached (89 pips away from the tunnel), you lock in profits again, and so on.

This is how the Vegan Tunnel System works in a nutshell. Now, let’s take a deeper look into the construction of the system, and how filters can increase your profitability while simultaneously reducing your losses.

The Vegas Tunnel and Fibonacci

As you may have noticed, the Vegas Tunnel System takes extensive use of Fibonacci numbers. The Fibonacci sequence is created by starting at 1 and adding the previous two numbers to generate a new number in the sequence.

If we start with 1, then the sequence goes like this: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377. As you can notice, each number represents the sum of the previous two numbers (1 + 1 = 2, 2 + 3 = 5, 5 + 3 = 8, 13 + 8 = 21, etc.)

The Fibonacci sequence can be found in nature, in seashells, in the ratios of the human body, in mathematics, so why not in the markets? In fact, the Fibonacci tool is a major technical tool in Forex trading (the 38.2% and 61.8% Fib levels are actually the result of the division of two and three consecutive Fibonacci numbers. 55/89=0.618, while 55/144=0.382… this works for any number in the sequence.)

The tunnel in the Vegas Tunnel Trading system is made up of two moving averages, the 144-period EMA and the 169-EMA. The first EMA, 144, is a natural Fibonacci number, while the second EMA, 169, is based on Gann squares. The square root of 169 is 13, which is a natural Fibonacci number.

Besides the tunnel, all profit-taking levels are also based on Fibonaccis. A trader would take profits when the price reaches 55 pips away from the tunnel, 89 pips away from the tunnel, 144 pips away from the tunnel, and so on. If you take a look at your charts and scroll back a few weeks or months in history, you’ll notice that the Fibonacci numbers often acted as natural support or resistance in the markets where a new retracement started.

The 1-Hour Chart

So far, we’ve explained why the system uses Fibonacci numbers in its construction. Buy, you may have also noticed that the system uses exclusively the 1-hour chart. The reason behind this lies in the fact that very short-term timeframes, like the 5-minute ones, create many false signals that can lead to whipsaws and losses.

On the other hand, longer-term timeframes, like the daily or weekly, take a lot of time for the tunnel (the two EMAs) to react to recent price-changes, which makes them inappropriate for short-term traders. For example, it may take days (or even weeks on the weekly chart) after the trend has already started until you get a trading signal, which leaves you without a huge chunk of profits.

Applying the Vegas Tunnel to a Chart

Now, let’s explain how to add the Vegas Tunnel Trading System to your charts. It’s pretty straightforward, as the underlying tools of the system are very common in every trading platform.

Step 1: In the first step, you need to apply the exponential moving averages to the chart that form the tunnel of the trading system. Add the 144-period EMA and the 169-period EMA to the currency pair you want to trade.

Barry recommends trading on GBP/USD, USD/CHF, or the S&P 500, as these instruments offer plenty of volatility and large profit potentials, but you can use any currency pair that you like. If you want to trade on some pairs that are less volatile, consider adding the 34 Fib level as your first profit-taking level to avoid missing profits.

Step 2: In the second step, add the 12-period EMA that will act as a filter for your trades. You’ll have the 12-period EMA always on your chart. Consider having one color for the tunnel (for example, red) and another color for the filter EMA (for example, blue). This will make it easier to distinguish between the tunnel and the filter when all three lines converge in a narrow range.

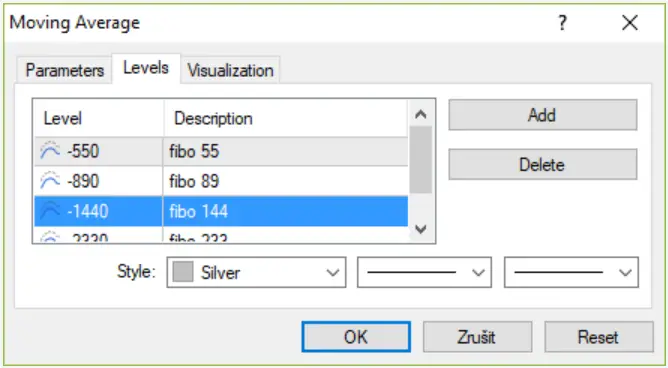

Step 3: In the third step, add the corresponding Fib levels to your tunnel EMAs that will act as your partial profit-taking levels. This is pretty simple to do on MetaTrader, simply right-click on the EMA and select properties -> Levels. Add the 55, 89, 144, 233, and 377 levels and the platform will automatically draw them on your chart.

Note: If your broker uses a 5-digit convention to quote currency pairs (for example, GBP/USD is quoted as 1.35572 instead of 1.3557), then you need to add another zero to the levels (55 will become 550, and so on.)

That’s it! Your Vegas Trading System is now applied to your 1-hour chart! Now, let’s take a look at the various filters you can use in combination with the system to improve your trading performance.

Applying Filters to the Vegas Tunnel

Filters are tools that are designed to increase your profits while simultaneously reducing your losses. They are used to filter through the trading signals generated by the Vegas Trading System, allowing traders to only trade those signals that have the highest probability of success. Here are a few filters recommended by Barry to use in combination with the Vegas Tunnel Trading System.

- a. The 12-period EMA – This EMA is the main filter used in the Vegas system. It acts as a short-term EMA that quickly reacts to price-changes and confirms a buy or sell signal provided by the tunnel. You should be ready to trade when the price-action, the tunnel, and the 12-period EMA all converge to a narrow range, as this is often the period when we can expect huge moves in the market.

When the price crosses above the upper boundary of the tunnel and the 12-period EMA, we have a strong buying signal. For selling signals, just wait for the price to cross below the lower boundary of the tunnel and below the 12-period EMA.

- b. Active trading hours – Barry recommends that the best trading hours for the Vegas tunnel system are the open hours of the US market.

However, since the system is highly customizable, you can also trade during the very liquid London market, or during the London-New York overlap. The only period that isn’t recommended for trading is the Asian market, as markets can move unpredictably and create false signals during those hours.

- c. News events – The Vegas trading system isn’t a news strategy, so Barry recommends to avoid trading ahead of very important market reports. The exception is the NFP report that is released on the first Friday of every month.

- d. Narrow tunnel – As explained with the 12-period EMA, when the tunnel starts trading in a very tight range, we can expect large market movements. This is often described as the calm before the storm. While narrow tunnels offer excellent trading opportunities, the best opportunities are formed when the tunnel converges together with the price and the 12-period EMA.

e. Trend-following – In essence, the Vegas Tunnel Trading System is a trend-following strategy that takes advantage of momentum when the price crosses above or below long-term moving averages. This is why the best trades are done when the signals align with the underlying trend of the market.

Barry recommends avoiding taking signals that go in the opposite direction of the underlying trend. For example, if GBPUSD trades in a strong uptrend but the price crosses below the tunnel (in a correction, for example), you shouldn’t take the trade. Instead, wait for the price to move back above the tunnel to enter in a long position, in the direction of the overall trend of GBPUSD.

- f. Clean breakouts – Clean breakouts happen when the price forms a strong bullish or bearish candlestick right after it crosses the tunnel. We want clean breakouts because our position would almost immediately be in profit. The best trades are those that are instantly in profit shortly after we initiate the trade.

Money Management

Money management is an important point to consider when trading with any trading strategy, not only with the Vegas Tunnel Trading system. The system is designed to lock in partial profits as the price moves in our direction, at the 55-pips Fib level, 89-pips Fib level, and so on. If you’re trading with a smaller account, you could take 1/3 of your position off at the 55 Fib level, another 1/3 off at the 89 Fib level, and the final 1/3 off at the 144 Fib level.

However, with a larger trading account, a viable approach would be to lock in 1/5 of your position at the first Fib level, another 1/5 at the second Fib level, and so on until you close the final 1/5 of your position at the 377 Fib level. Remember, those Fib levels simply represent the distance of the price from the tunnel, measured in pips.

When talking about money management, your approach to trading the system could also be either aggressive or conservative.

If you’re an aggressive trader, you could open a trade in the opposite direction when the price reaches the 144, 233, or 377 Fib levels. This approach takes advantage of the mean-reverting nature of markets, and the price often reverses after it hits the 377 Fib level. You can take a look at the historical charts and see for yourself how this approach played out very nicely in the past.

If you’re more of a conservative trader, then wait for most of the filters to confirm a signal before opening a trade. Also, you may want to close most of your position at the 55 Fib level and the 89 Fib level to avoid the market turning against you.

Final Words

The Vegas Trading System is a simple yet very effective trading system that takes advantage of the surge in momentum when new trends begin. The backbone of the system is a couple of EMAs: the 144-hour EMA and the 169-hour EMA on the 1-hour chart.

The system is very powerful in catching trends and growing your trading account as it incorporates effective money management rules that allow you to lock in part of your profits as your trade goes in your favor. The system is also flexible in many regards, so you can move your SL to breakeven once the price reaches one of the Fib levels.