What is the VWAP Indicator?

The VWAP indicator, or Volume-Weighted Average Price, is the average price of a stock over a number of periods divided by the total trading volume for the current day. The indicator starts to calculate with the opening of the trading session, and ends its calculation with the closing of the session.

The calculation of the VWAP goes as follows:

- Calculating the typical price for the period (H + L + C) / 3

- Multiplying the typical price by the period’s volume

- Creating a cumulative total (running total of typical prices)

- Creating a cumulative volume (running total of volume data)

- And finally, dividing the cumulative total with the cumulative volume

Main Differences to Moving Averages

Unlike traditional moving averages which simply sum up the closing price of a stock and divide it by a number of predetermined periods, the VWAP gives you the true average price of a stock by additionally considering the transaction volume at a specific price.

By factoring in the volume of transactions, the VWAP indicator gives valuable clues to traders before entering the market. A price rally accompanied with a low volume needs to be approached fundamentally different than a surge in price accompanied with a high volume. You need to take this information into account in order to successfully trade the stock market.

VWAP uses tick data for its calculations. The tick data is very valuable, and actively traded stocks can have as much as 30 ticks per minute, which sums up to around 5000 ticks per day.

Just like moving averages, the VWAP indicator lags the price as it’s based on previous data. The traditional VWAP is restarted with each start of the trading day, which means that as times goes by, the lag of the VWAP will increase. Still, technical traders use the VWAP to analyze intraday price-action. Generally, supply exceeds demand when the price falls below the VWAP, and demand exceeds supply when the price rises above the VWAP.

The VWAP Uses Intraday Data

By the end of the trading day, the VWAP indicator will be very close to a moving average based on the same period-settings. On the other hand, the opening of the VWAP will be quite different than the opening of a moving average. The reason for this is because moving averages use any available historic periods as a basis for their calculation, i.e. a 6-hour moving average at the beginning of a day will take into account the closing prices of the last six hours of the previous trading day. The VWAP, on the other hand, is an intraday cumulative indictor and its data volume progressively increases throughout the day.

However, today there are also new interpretations of the VWAP indicator which use the previous day’s data for its calculation.

The VWAP can also be used to determine trade efficiency. Entering a trade below the VWAP line means that investors paid less for the stock than its average price with volume factored in.

In addition, the VWAP indicator is very popular among institutional investors, as it reflects price levels weighted by volume. This helps not to disturb the market price when opening large buy or sell orders. Institutional investors can simply identify which price points are liquid and which are not, by taking a look at the values of the VWAP indicator.

VWAP Trading Strategies

There are two ways to enter a trade based on the VWAP: the pullback, and the breakout.

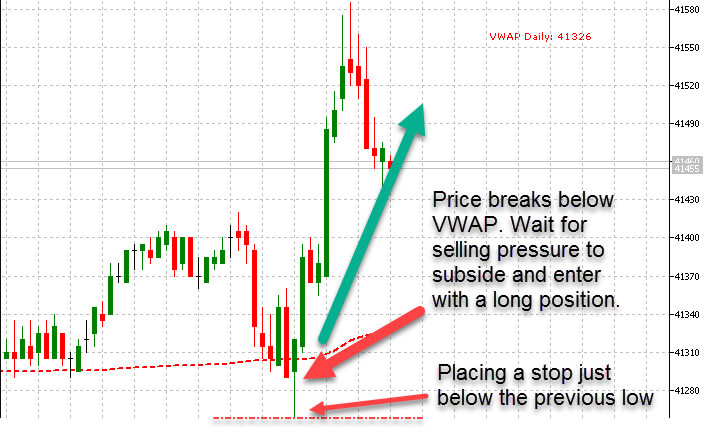

The VWAP pullback is a riskier approach to trading the VWAP, and you need to closely watch the tape as the price approaches the VWAP. Essentially, you want to identify when the selling pressure loses its strength around the VWAP to pull the trigger.

However, novice traders usually find it difficult to simultaneously follow the price action and the order book to find an appropriate price level to enter the market. This strategy is more suitable for the advanced traders, as you need to have experience in identifying when the selling pressure calms down according to the tape.

Placing the Stop with a VWAP Pullback

Although it’s possible to place a stop based on the daily range of the stock, the safer bet would be to use the previous swing low or swing high as a stop point. Previous lows and highs act as support and resistance levels, and in case the price breaks those levels you will be on the safe side by using a stop level.

NOTE: Don’t use a stop at the same level as the previous low or high. Instead, place it a few cents above the high or below the low, so the price has enough room to breath in case it decides just to touch the support/resistance level.

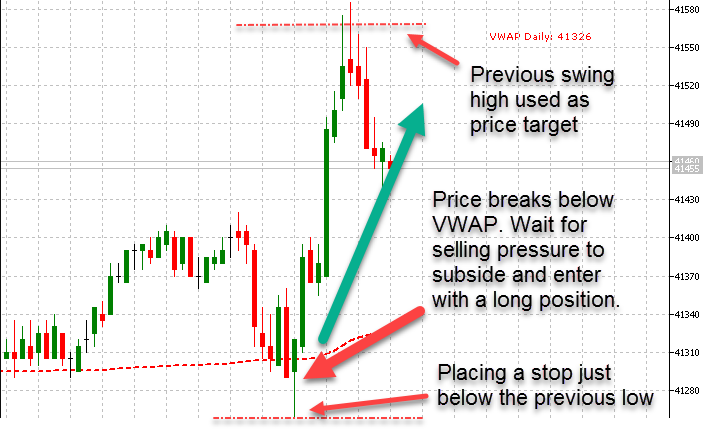

Identifying the Target Level to Exit the Trade

Before you enter the trade, you need to mentally set both your stop and target price levels for the trade. The safest way to do so, just like in the case of placing stops, is to use previous swing lows and highs. Place your take-profit order just below the previous swing high, or just above the previous swing low. Similar to your stop levels, you don’t want to place your target at the same level as the previous highs or lows. The reason for this is that the price might miss the previous high or low for just a few cents, and you could end up with a lower profit when the price reverses after missing your take-profit level.

NOTE: Another way to exit a trade based on the VWAP indicator is to look for Fibonacci extension levels. However, have in mind that the price might have difficulties to reach those levels on a consistent basis, which increases the risk of the trade reversing against you. Just like with all other aspects of trading, increased risk carries an increased potential for profit, and you need to decide if it is worth the payoff.

The VWAP Breakout

This approach is better suited for risk-averse traders, and is essentially based on the same principles as any other breakout strategy – taking the order after the price breaks above or below the VWAP indicator. If the price breaks above the VWAP with relatively high trade volumes, you should open a buy order. And if the price breaks below the VWAP with higher than usual volumes, you should place a sell order.

VWAP Confluence Zones

An especially important concept when trading with any indicator are confluence zones. Simply said, a confluence zone is when two or more support (or resistance) lines hit on the same level, therefore adding to the importance of that level. If you find a confluence zone of supports, that consists for example from a horizontal support line and a Fibonacci retracement level, there is a high probability that the market will respect that confluence zone.

That being said, indicators can also act as support and resistance levels, and the VWAP indicator is no exception. Take a look at the following chart, and notice how the VWAP acted as an important support zone in at least two instances.

A VWAP confluence zone forms when the indicator is on the same price level as another support or resistance level. Those other support levels can be all kinds of technical tools, such as horizontal support lines, trendlines, channels, Fibonacci extensions and retracements, Fan lines etc. If you identify a VWAP confluence zone, you can enter a trade just after the price rejects the zone, by putting a stop order just above or below the confluence zone. Confluence zones are one of the most profitable price-actions that can be difficult to spot in the beginning, but will pay off in the long-term.

VWAP Acts as a Price Equilibrium

The VWAP can be interpreted as an equilibrium price of a stock. The indicator is especially useful to identify where the current market price stands in relation to the volume weighted average price. You don’t want to buy a stock if the price diverges too much from the average price, as there is a high probability that the price will reverse to its mean. Furthermore, by knowing if the stock is overvalued or undervalued in regard to the VWAP indicator, you are able to buy below and sell above the VWAP for day trading purposes.

VWAP Can be Used to Anticipate Changes in Momentum

The VWAP indicator is the average price over a number of periods with trade volume factored in, which means that it takes into account all closing prices and their volumes. By knowing this information, you can trade based on the VWAP breakout.

You simply wait for the price to cross below the VWAP for a sell signal, or cross above the VWAP for a buy signal. These crosses between the price and VWAP are especially important if they are accompanied by surge in trading volume, which can reflect a change in trading momentum. Momentum traders can find this very useful, as the price diverges increasingly from the VWAP. Although the price should theoretically reverse to its VWAP, but if the fundamentals of a stock change strong enough, the price might just continue to diverge, and momentum traders could benefit from it.

Being essentially a moving average in its nature, the VWAP can act as a dynamic support or resistance line. Under the assumption of self-fulfilling prophecies, if enough traders follow and act upon the VWAP indicator, and base their trades on similar strategies, the price might start see the VWAP as a support or resistance line.

This is important in case when the price trades close to the VWAP. Take a look and see if the VWAP has previously acted as a support or resistance for the price – in case it has, anticipate the possibility that the price might bounce off the indicator again – and in case it hasn’t, wait for the price-action to complete and see how the price reacts around the VWAP, will it break through or make a pullback.

Using the VWAP as an Oversold/Overbought Indicator

The VWAP indicator is very versatile, and can also be used to identify overbought or oversold areas. Basically, day traders look at the slope of the VWAP line when the price is diverging from it. If the VWAP line is flat but the price is diverging upwards, this could be a good signal that the stock is overbought. And on the contrary, if the price continues to fall below the VWAP, but the indicator line is flat, a possible oversold market condition may be ahead. It’s important to note that the VWAP line needs to be flat to use it as an overbought and oversold indicator. If the line is sloping upwards or downwards, this strategy can create many false signals.

Conclusion

The VWAP indicator, just like the other technical indicators in a technician’s toolbox, has no special powers. It’s basically calculating the average price with trading volumes factored in. But if you use it under the right conditions and the right way, it can create profitable trading signals.

The VWAP is a very versatile indicator, and be used by day traders, breakout traders or momentum traders. Day traders find it especially helpful to know where the current market price stand in relation to the volume weighted average price, in order not to buy stocks that diverge a lot from the VWAP. Breakout traders usually base their entry strategies on the VWAP breakout – a cross of the price below or above the VWAP which generates sell and buy signals, respectively. And momentum traders benefit from identifying early shifts in momentum if the price diverges is a large degree from the VWAP, accompanied with changes in underlying stock fundamentals.

However, be sure to apply strict money management rules when trading based on the VWAP indicator, and always look for additional confirmation signals such as candlestick patterns, chart patterns, confluence zones or others. Just like with any other indicator, confirming the VWAP’s signals is a key measure to avoid false signals.